North Dakota Assignment of Partnership Interest with Consent of Remaining Partners

Description

How to fill out Assignment Of Partnership Interest With Consent Of Remaining Partners?

Have you ever been in a situation where you require documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of template forms, such as the North Dakota Assignment of Partnership Interest with Consent of Remaining Partners, which are created to comply with federal and state requirements.

Once you locate the appropriate document, click Acquire now.

Select the pricing plan you desire, complete the required information to create your account, and pay for the transaction using either your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the North Dakota Assignment of Partnership Interest with Consent of Remaining Partners template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is suitable for your specific city/region.

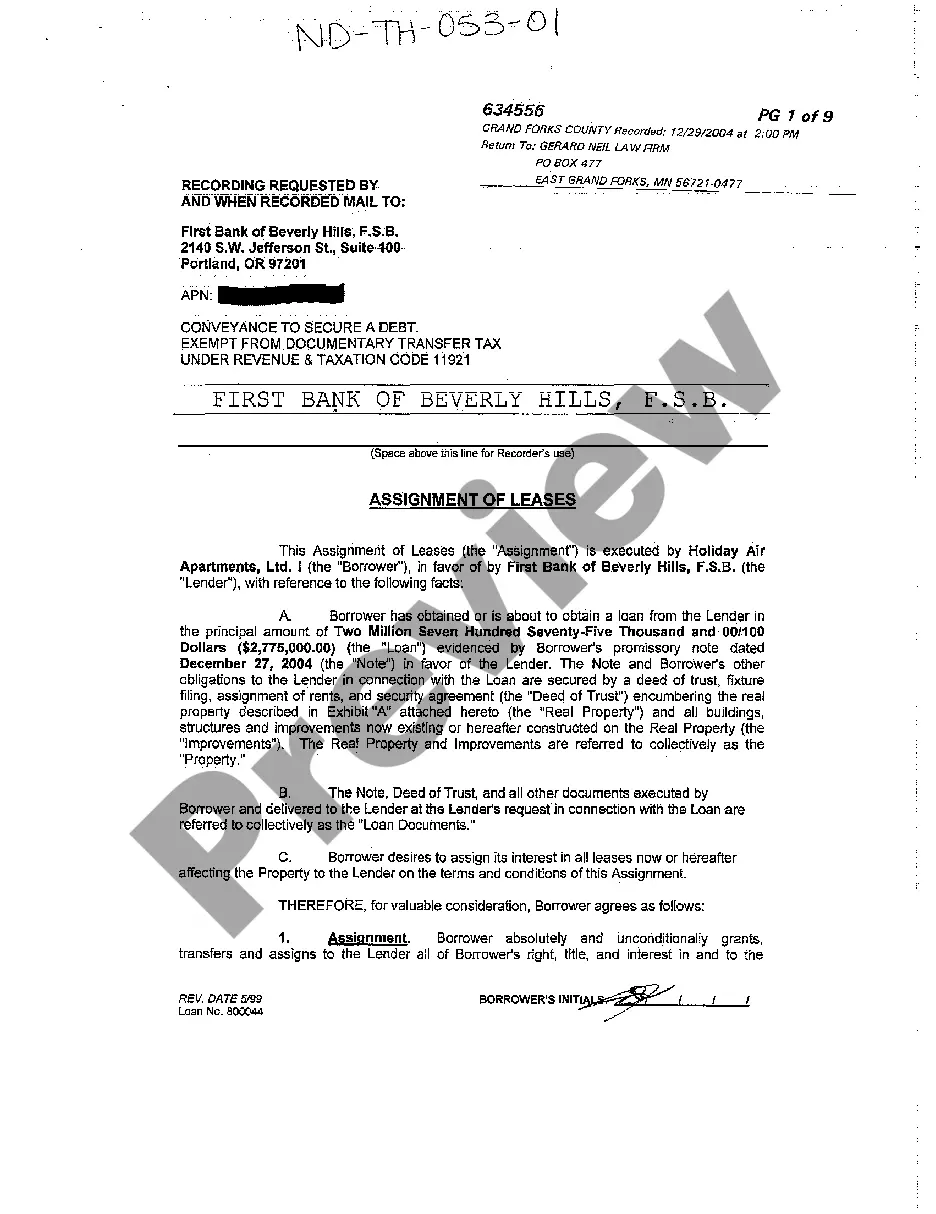

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the document that meets your needs.

Form popularity

FAQ

To report the transfer of partnership interest, partners must document the assignment and notify relevant parties, such as the Internal Revenue Service and any state authorities. For the North Dakota Assignment of Partnership Interest with Consent of Remaining Partners, proper documentation is essential to ensure compliance and avoid legal issues. Utilizing platforms like UsLegalForms can streamline this process, helping you fill out necessary forms and maintain accurate records.

North Dakota does not recognize domestic partnerships established within the state but only those contracted in other jurisdictions. Therefore, domestic partners who established such unions within the state are not entitled to rights that formally married couples enjoy.

Transferable interest means the right, as initially owned by a person in the person's capacity as a partner, to receive distributions from a partnership, whether or not the person remains a partner or continues to own any part of the right. The term applies to any fraction of the interest, by whomever owned.

The North Dakota Legislature voted Thursday to repeal a centuries old law that bans men and women from living together without being married. Under the provision, which has passed the both the state House and state Senate, living together "openly and notoriously" while unwed would no longer be considered a sex crime.

Withdrawing from PartnershipA limited partner has the right to withdraw from the limited partnership in the manner that the partnership agreement provides. If the partnership agreement does not address the withdrawal of limited partners, the state's limited partnership law applies.

Partnership Agreements and the Exit of One Partner A partnership does not necessarily end when a partner exits. The remaining partners may continue with the partnership. Therefore, your partnership agreement covers what happens when a partner wants to leave, becomes incapacitated, or dies.

Legally, UpCounsel says, one partner leaving may dissolve the partnership but not in the sense that it ends the business. If A, B and C buy out D, or D sells their interest to E, the action dissolves the original partnership and launches a new one. The partnership's business, however, remains operational.

When a partner leaves a partnership, the present partnership ends, but the business can still continue to operate. Assets invested by a partner into a partnership remain the property of the individual partner.

In a General Partnership, all partners are financially obligated to any debts incurred by the partnership. When a partner leaves, the partnership dissolves and the partners equally split debts and assets.

Dissolving a partnership firm means discontinuing the business under the name of the said partnership firm. In this case, all liabilities are finally settled by selling off assets or transferring them to a particular partner, settling all accounts that existed with the partnership firm.