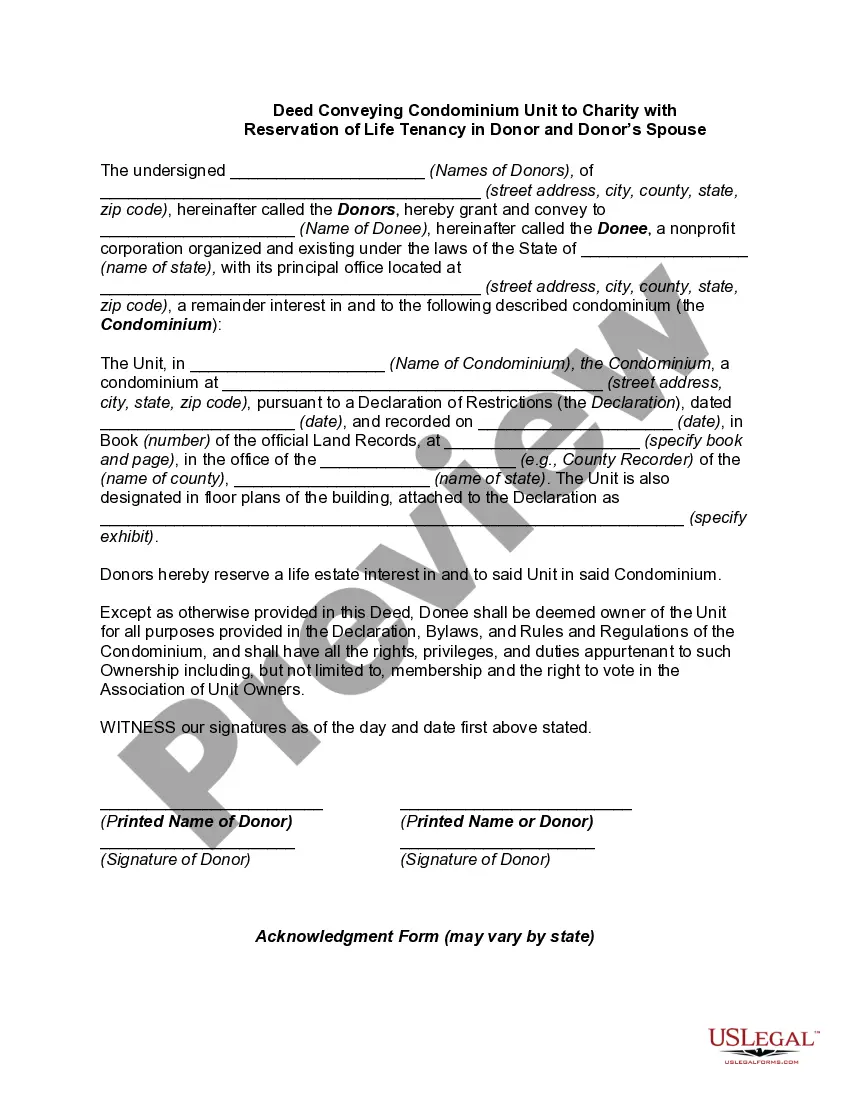

A North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse refers to a legal document used to transfer ownership of a condominium unit to a charitable organization while reserving the right to live in the property for the donor and their spouse's lifetime. This type of deed allows individuals to make a charitable contribution while still maintaining the right to occupy and use the property during their lifetime. There are various types of North Dakota Deeds Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse. These include: 1. Traditional North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse: This is the standard type of deed where the ownership of a condominium unit is transferred to a charitable organization, with the donor and their spouse retaining the life tenancy rights. 2. Irrevocable North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse: This type of deed ensures that the transfer of the condominium unit to the charity is permanent and irrevocable. Once the deed is executed, the donor and their spouse cannot change their decision or reclaim ownership of the property. 3. Revocable North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse: In contrast to the irrevocable deed, this type of deed allows the donor and their spouse to revoke or cancel the transfer of the condominium unit to the charity during their lifetime if they decide to do so. 4. North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Enhanced Life Estate: This variation of the deed provides additional rights and privileges to the donor and their spouse during their lifetime. These enhanced life estates may include the right to receive income generated by the property or the ability to make changes or improvements to the condominium unit. By utilizing any of these North Dakota Deeds Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse, individuals can support charitable causes while maintaining the right to reside in the property for the remainder of their lives. These deeds offer estate planning advantages by combining philanthropic aspirations with personal lifetime usage and are often used as part of a comprehensive estate plan. It is crucial to consult with a qualified attorney or estate planner to ensure that all legal requirements are met and that the chosen deed aligns with personal goals and circumstances.

North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse

Description

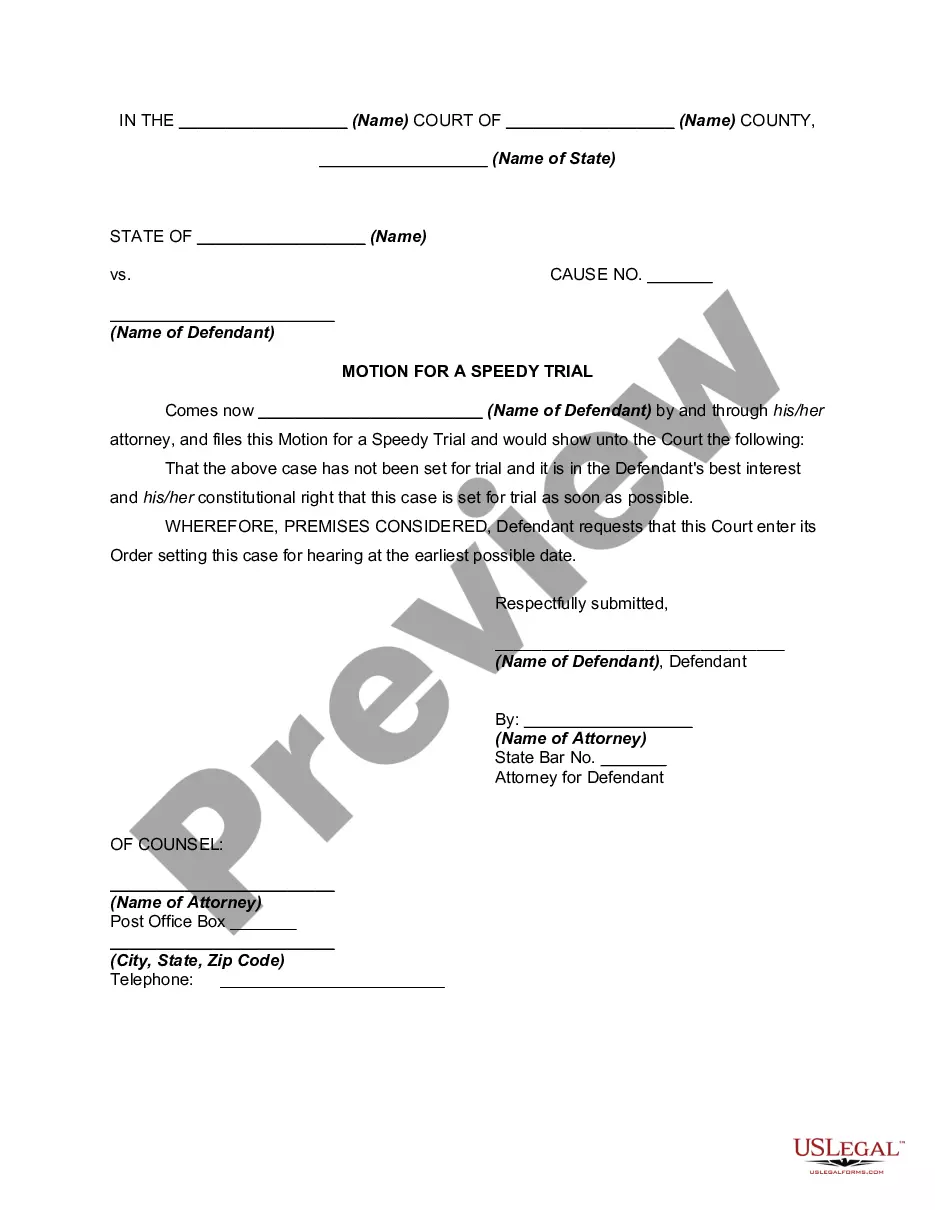

How to fill out Deed Conveying Condominium Unit To Charity With Reservation Of Life Tenancy In Donor And Donor's Spouse?

US Legal Forms - among the largest libraries of legal types in the USA - gives a variety of legal file templates you are able to acquire or produce. Making use of the site, you can find thousands of types for company and specific functions, sorted by groups, says, or keywords and phrases.You can find the latest variations of types much like the North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse within minutes.

If you have a registration, log in and acquire North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse from the US Legal Forms catalogue. The Acquire switch can look on every develop you look at. You have access to all previously downloaded types in the My Forms tab of your respective account.

In order to use US Legal Forms initially, allow me to share simple guidelines to obtain began:

- Be sure you have picked out the correct develop for the area/state. Click the Preview switch to check the form`s content material. Browse the develop description to ensure that you have chosen the appropriate develop.

- In case the develop does not match your demands, utilize the Research industry towards the top of the display to obtain the the one that does.

- If you are satisfied with the form, affirm your decision by visiting the Buy now switch. Then, pick the costs plan you like and provide your credentials to register for the account.

- Approach the purchase. Use your credit card or PayPal account to complete the purchase.

- Pick the structure and acquire the form on the gadget.

- Make changes. Fill out, revise and produce and sign the downloaded North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse.

Each template you added to your bank account lacks an expiration time and it is the one you have permanently. So, in order to acquire or produce yet another copy, just visit the My Forms section and click in the develop you will need.

Get access to the North Dakota Deed Conveying Condominium Unit to Charity with Reservation of Life Tenancy in Donor and Donor's Spouse with US Legal Forms, by far the most substantial catalogue of legal file templates. Use thousands of specialist and status-certain templates that meet up with your business or specific demands and demands.

Form popularity

FAQ

When the life tenant dies, the remainderman typically receives a step-up tax basis in the property. This means the remainderman takes ownership of the home at its fair market value at the time of the life tenant's death. This can save the remainderman capital gains tax when the property is sold.

When you inherit property, the IRS applies what is known as a stepped-up cost basis. You do not automatically pay taxes on any property that you inherit. If you sell, you owe capital gains taxes only on any gains that the asset made since you inherited it.

A remainderman is a property law term that refers to a person who stands to inherit property at a future point in time upon the termination of a preceding estate?usually a life estate. A remainderman is a third person other than the estate's creator, initial holder, or either's heirs.

A North Dakota transfer-on-death deed?often called a TOD deed?is a written legal document that transfers property on the death of an owner to one or more beneficiaries named in the document. North Dakota transfer-on-death deeds were first authorized by statute in 2011.

This means a property owner conveys real property to another person but reserves the right to ?enjoy? the property for the grantor's life. The grantor is called the ?life tenant? and the grantee is called the ?remainderman.?

Remainderman is an individual getting ownership rights upon the demise of a life tenant. In comparison, a beneficiary is someone who receives an advantage from something. It is strictly related to real estate property and trust funds, but a beneficiary can benefit from the money, security, assets, etc.

When the parent passes away, the life estate automatically ceases, and the child now has all of the rights associated with the property. As far as income tax, when the parent dies, the property receives a ?step up? in basis to the date of death value.