Title: North Dakota Deed Conveying Property to Charity with Reservation of Life Estate — A Comprehensive Guide Keywords: North Dakota Deed, Conveying Property, Charity, Reservation of Life Estate, Types Introduction: A North Dakota Deed Conveying Property to Charity with Reservation of Life Estate is a legal document that enables property owners to transfer their property to a charitable organization while retaining the right to live on the property for the duration of their lifetime. This detailed guide will explore the various aspects of this specific deed, including its purpose, key features, and different types based on specific needs. 1. Purpose of a North Dakota Deed Conveying Property to Charity with Reservation of Life Estate: The primary purpose of using this deed is to provide assistance to a designated charity through the donation of property, while allowing the donor to maintain usage and benefit from the property for their lifetime. This arrangement is mutually beneficial for both the donor and the chosen charitable organization. 2. Key Features of a North Dakota Deed Conveying Property to Charity with Reservation of Life Estate: a) Property Transfer: The deed legally transfers the property ownership from the donor to the designated charitable organization. b) Reservation of Life Estate: The donor retains the right to live on and use the property until their death or until a predetermined time, as specified in the deed. c) Tax Benefits: The donor may be eligible for certain tax benefits associated with charitable giving, such as income tax deductions and reduction of estate taxes. d) Charitable Purpose: The property must be donated to an eligible charitable organization that meets the requirements set forth by the Internal Revenue Service (IRS). 3. Types of North Dakota Deed Conveying Property to Charity with Reservation of Life Estate: a) Irrevocable Life Estate Deed: This type of deed enables the donor to transfer the property to the charitable organization, with the terms being legally binding and unchangeable. b) Revocable Life Estate Deed: This type of deed provides the donor with the flexibility to alter the terms or revoke the deed during their lifetime, if circumstances change. c) Qualified Personnel Residence Trust (PRT): A PRT is a specialized type of life estate deed that allows the donor to transfer a primary residence or second home to a charitable organization. The donor retains the right to live on the property for a specified term before it fully transfers to the charity. Conclusion: A North Dakota Deed Conveying Property to Charity with Reservation of Life Estate offers a valuable option for property owners wishing to support charitable causes while maintaining their right to occupy and utilize the property throughout their lifetime. By choosing the appropriate type of deed and consulting with legal professionals, individuals can maximize both their contribution to charity and the benefits they receive from this unique arrangement.

North Dakota Deed Conveying Property to Charity with Reservation of Life Estate

Description

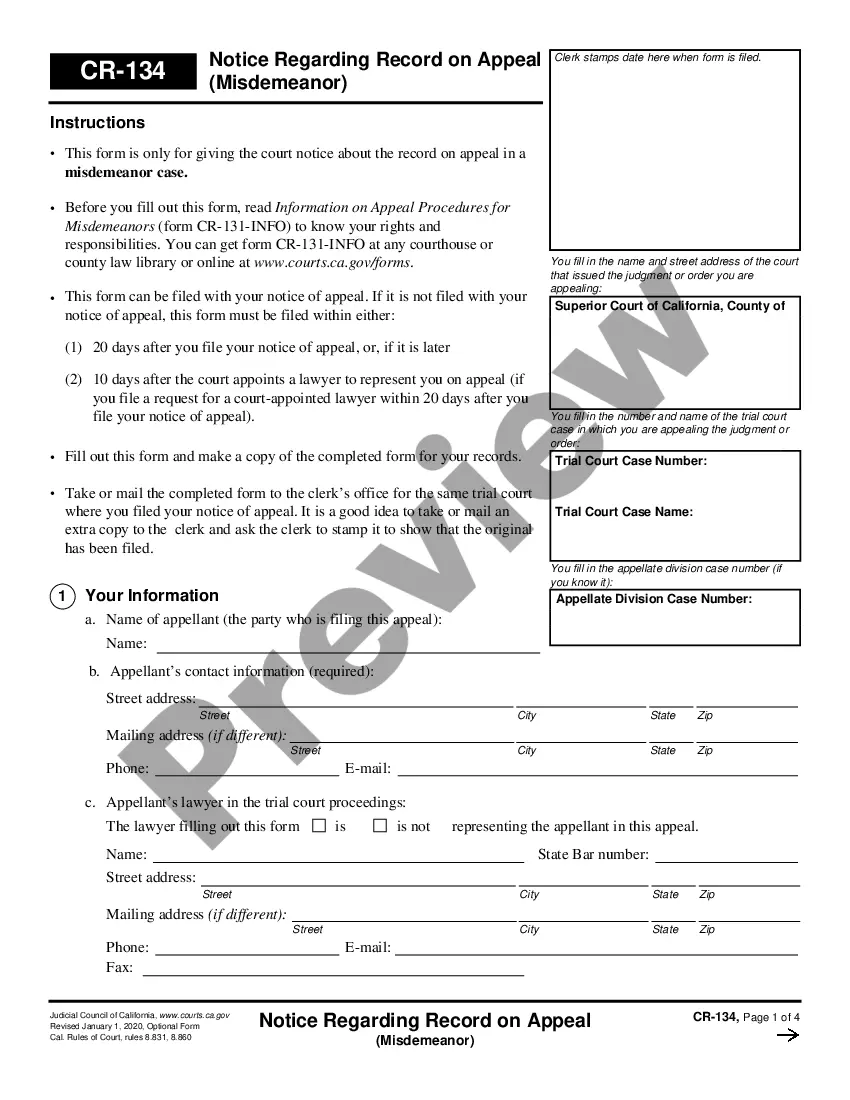

How to fill out North Dakota Deed Conveying Property To Charity With Reservation Of Life Estate?

Discovering the right legal record format might be a have difficulties. Naturally, there are a lot of web templates available online, but how can you find the legal develop you want? Make use of the US Legal Forms web site. The support gives thousands of web templates, for example the North Dakota Deed Conveying Property to Charity with Reservation of Life Estate, that you can use for enterprise and personal requires. All of the forms are checked by professionals and meet state and federal requirements.

If you are presently signed up, log in in your bank account and then click the Obtain switch to get the North Dakota Deed Conveying Property to Charity with Reservation of Life Estate. Utilize your bank account to search throughout the legal forms you might have purchased previously. Check out the My Forms tab of your respective bank account and have one more copy in the record you want.

If you are a brand new user of US Legal Forms, listed here are simple recommendations for you to stick to:

- First, make sure you have chosen the proper develop for your city/region. You are able to look through the shape utilizing the Preview switch and look at the shape explanation to make certain it is the best for you.

- If the develop will not meet your requirements, make use of the Seach field to get the correct develop.

- Once you are certain the shape would work, go through the Purchase now switch to get the develop.

- Choose the costs plan you need and type in the necessary information. Design your bank account and pay money for an order with your PayPal bank account or credit card.

- Pick the document file format and obtain the legal record format in your device.

- Comprehensive, revise and print and indication the attained North Dakota Deed Conveying Property to Charity with Reservation of Life Estate.

US Legal Forms is definitely the largest library of legal forms for which you can see numerous record web templates. Make use of the service to obtain appropriately-made documents that stick to condition requirements.

Form popularity

FAQ

This means a property owner conveys real property to another person but reserves the right to ?enjoy? the property for the grantor's life. The grantor is called the ?life tenant? and the grantee is called the ?remainderman.?

The owner of a life estate cannot leave the property to anyone in their will as their interest in the property will terminate at their death. The holder has full rights to possess and use the property, and may also transfer their interest during their lifetime.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

Dower & Curtesy Defined At common law, the estate of dower is held by a widow upon her husband's death and consists of a life estate of one-third to one-half of the land owned by her husband if he held a freehold interest in the land (e.g., a fee simple) and the land is inheritable by the issue of the marriage.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

A North Dakota transfer-on-death deed?often called a TOD deed?is a written legal document that transfers property on the death of an owner to one or more beneficiaries named in the document. North Dakota transfer-on-death deeds were first authorized by statute in 2011.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.