North Dakota Loan Agreement for Personal Loan: Comprehensive Overview of Loan Types, Important Clauses, and Key Considerations A North Dakota Loan Agreement for Personal Loan serves as a legally binding contract between a lender and a borrower in North Dakota, outlining the terms and conditions for borrowing a personal loan. Personal loans are an ideal financing option for individuals seeking funds for various purposes such as debt consolidation, home renovations, education expenses, or emergencies. In North Dakota, several types of loan agreements exist, tailored to meet different borrower needs. Let's explore some key types of loan agreements commonly used in North Dakota: 1. Secured Personal Loan Agreement: This type of loan agreement requires collateral, such as a vehicle or property, to secure the loan. In case of default, the lender can seize the collateral to recover the loan amount. Secured loans generally offer lower interest rates compared to unsecured loans due to reduced risk for the lender. 2. Unsecured Personal Loan Agreement: Unlike a secured loan, this agreement doesn't require collateral, making it more accessible to borrowers who don't possess valuable assets. As these loans present a higher risk to lenders, interest rates may be slightly higher compared to secured loan agreements. 3. Co-Signed Personal Loan Agreement: If an individual has a limited credit history or a low credit score, they may need a co-signer with a stronger credit profile to guarantee the loan. In this agreement, both the borrower and the co-signer assume equal responsibility for loan repayment. Important Clauses found in North Dakota Loan Agreements: 1. Loan Amount and Interest: Loan agreements specify the principal loan amount and the applicable interest rate. The interest rate may be fixed or variable throughout the loan term. 2. Repayment Terms: This clause outlines the repayment schedule, including the frequency of payments (e.g., monthly, bi-weekly), the total number of payments, and the due dates. It further delineates the consequences of late payments or default. 3. Prepayment Penalties: Some loan agreements may incur penalties if the borrower chooses to pay off the loan earlier than the agreed-upon term. These penalties compensate the lender for potential lost interest. 4. Late Payment Charges: When a borrower fails to make payments on time, lenders may impose penalties or late fees. This clause details the exact amount or percentage charges, ensuring prompt repayment. 5. Consequences of Default: In case of default, the loan agreement stipulates the actions a lender may take to recover the loan, such as legal proceedings or collection agency involvement. Key Considerations for North Dakota Loan Agreements: 1. Review the Interest Rate: Ensure you understand the interest rate, whether fixed or adjustable, and compare it with prevailing market rates to ensure you receive a competitive loan offer. 2. Scrutinize the Repayment Terms: Pay close attention to the repayment schedule, monthly payments, and total repayment amount to determine if it aligns with your financial capacity. 3. Thoroughly Understand the Consequences of Default: Evaluate the potential penalties and repercussions for late payments or default to comprehend the risks involved. 4. Seek Legal Advice: Before signing any loan agreement, consulting a legal professional is prudent. They can provide crucial guidance, review the terms, and clarify any ambiguities to protect your interests. In conclusion, a North Dakota Loan Agreement for Personal Loan is a crucial document that outlines the terms, conditions, and obligations between a lender and borrower. Understanding the various loan types, important clauses, and key considerations enables borrowers to make informed decisions and safeguard their financial well-being.

North Dakota Loan Agreement for Personal Loan

Description

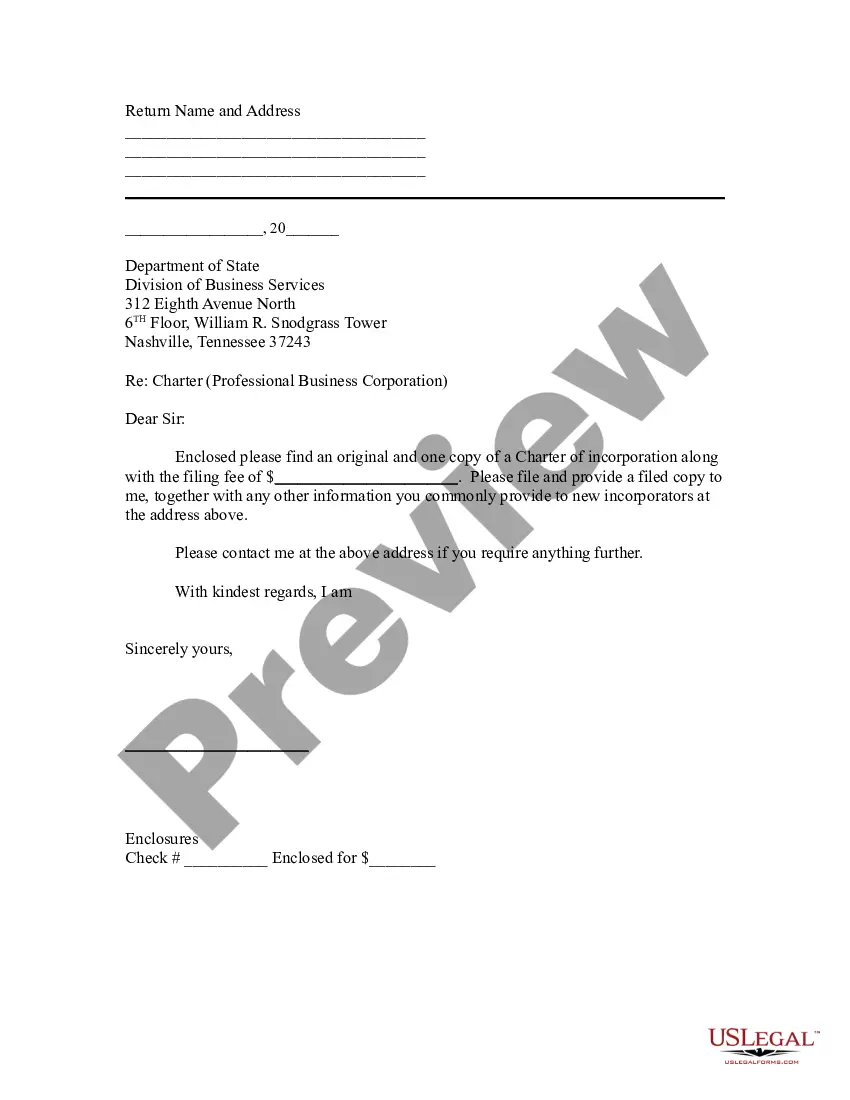

How to fill out Loan Agreement For Personal Loan?

If you wish to full, download, or print out authorized document web templates, use US Legal Forms, the greatest selection of authorized kinds, which can be found online. Use the site`s basic and hassle-free research to discover the papers you will need. A variety of web templates for company and individual uses are sorted by types and states, or search phrases. Use US Legal Forms to discover the North Dakota Loan Agreement for Personal Loan with a number of mouse clicks.

If you are currently a US Legal Forms client, log in to the profile and then click the Down load switch to have the North Dakota Loan Agreement for Personal Loan. Also you can gain access to kinds you previously saved inside the My Forms tab of your profile.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for that proper city/country.

- Step 2. Use the Review solution to examine the form`s information. Never forget about to learn the explanation.

- Step 3. If you are unsatisfied with all the develop, take advantage of the Research discipline towards the top of the screen to find other models of the authorized develop design.

- Step 4. Upon having found the form you will need, select the Acquire now switch. Opt for the prices program you like and put your references to sign up for an profile.

- Step 5. Procedure the transaction. You can utilize your bank card or PayPal profile to finish the transaction.

- Step 6. Pick the file format of the authorized develop and download it on the product.

- Step 7. Comprehensive, revise and print out or signal the North Dakota Loan Agreement for Personal Loan.

Every single authorized document design you get is your own eternally. You have acces to each and every develop you saved with your acccount. Click on the My Forms portion and decide on a develop to print out or download yet again.

Be competitive and download, and print out the North Dakota Loan Agreement for Personal Loan with US Legal Forms. There are millions of expert and state-distinct kinds you can utilize for the company or individual needs.

Form popularity

FAQ

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

FindLaw Newsletters Stay up-to-date with how the law affects your life Legal Maximum Rate of Interest6% (§47-14-05); if contract in writing, up to 5.5% higher than average interest on treasury bills, but maximum must be at least 7% (§47-14-09)Interest Rates on JudgmentsContract rate, otherwise 12% (§28-20-34)2 more rows

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.