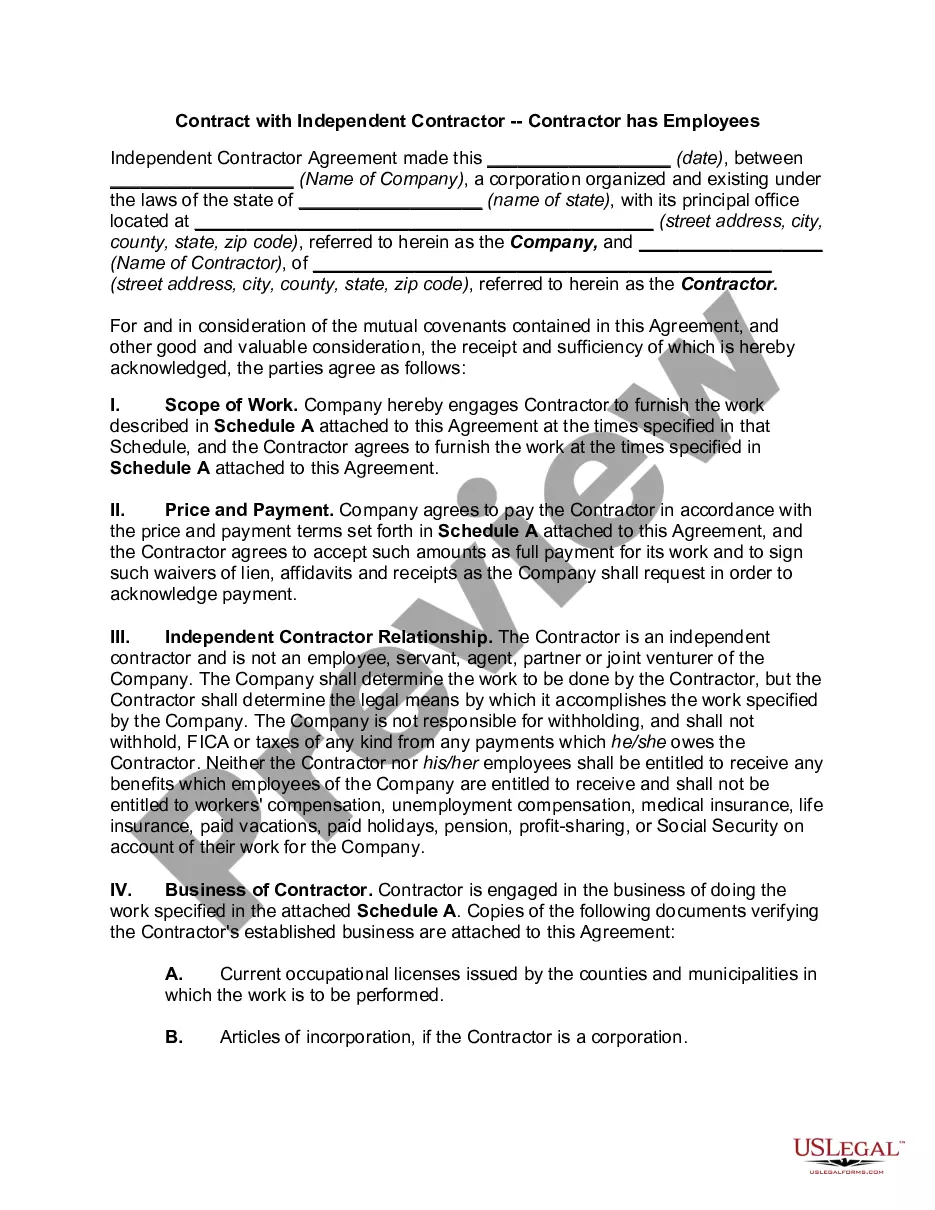

North Dakota Contract with Independent Contractor - Contractor has Employees

Description

How to fill out Contract With Independent Contractor - Contractor Has Employees?

If you intend to compile, acquire, or create official document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's simple and convenient search to find the documents you require.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the needed form, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to obtain the North Dakota Contract with Independent Contractor - Contractor has Employees in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the North Dakota Contract with Independent Contractor - Contractor has Employees.

- You can also access forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the information.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

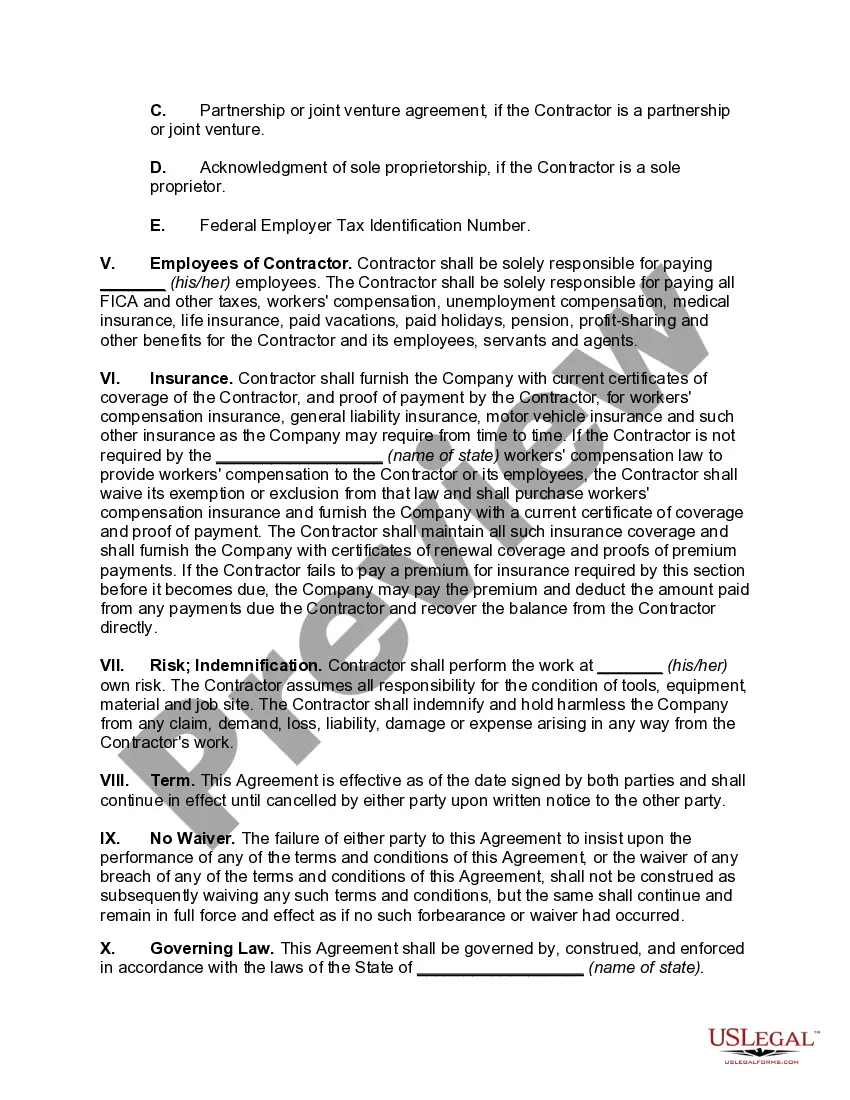

Yes, North Dakota is classified as an employment at-will state. This means that employers can terminate employees for nearly any reason as long as it is not illegal. When entering a North Dakota Contract with Independent Contractor - Contractor has Employees, it is vital to be aware of this aspect of employment law.

A contractor also called a contract worker, independent contractor or freelancer is a self-employed worker who operates independently on a contract basis.

Using our template will ensure you complete the necessary steps:State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

Independent contractors provide goods or services according to the terms of a contract they have negotiated with an employer. Independent contractors are not employees, and therefore they are not covered under most federal employment statutes.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Independent contractors are not employees, nor are they eligible for employee benefits. They do not have taxes withheld from their paychecks but instead must pay estimated income taxes in advance through quarterly payments.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.