North Dakota Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

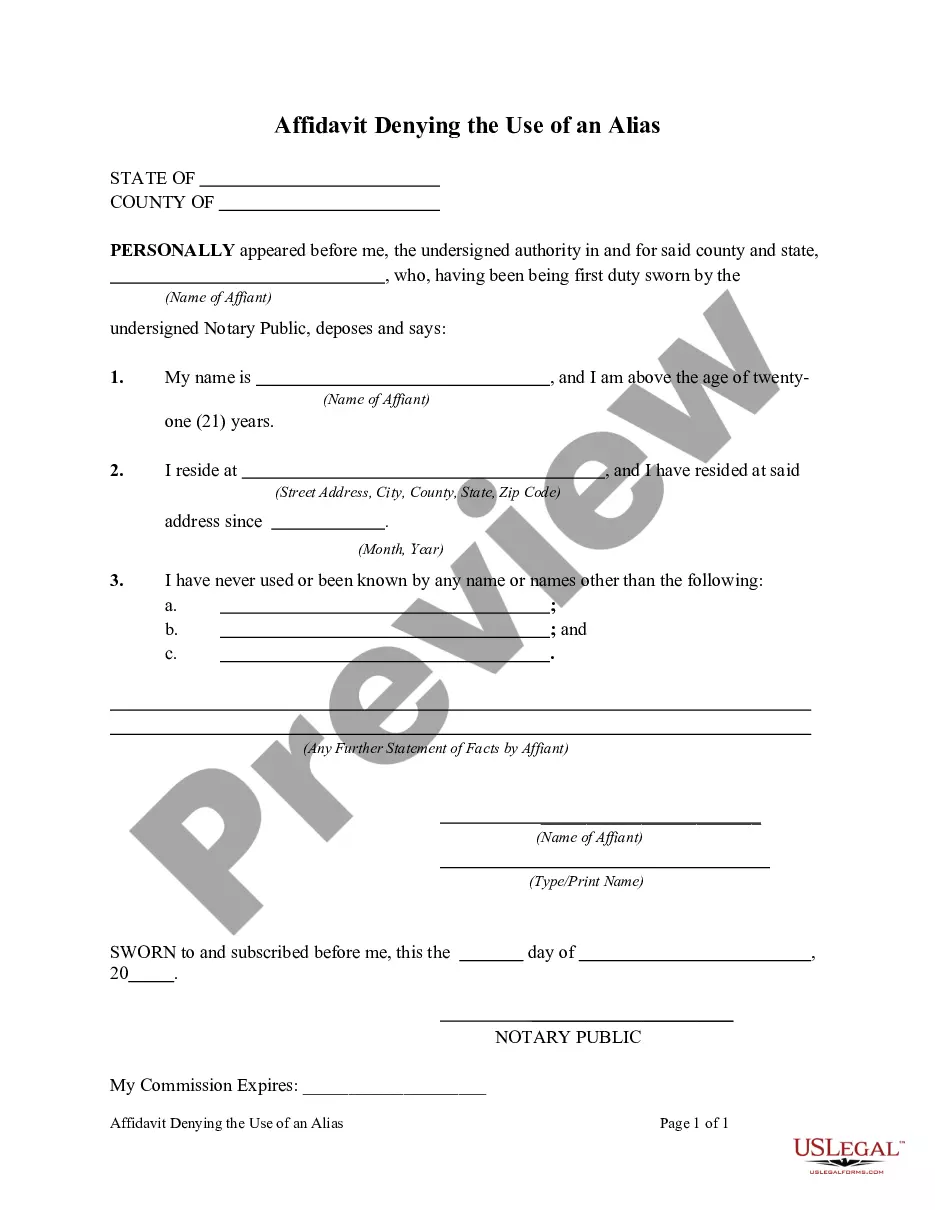

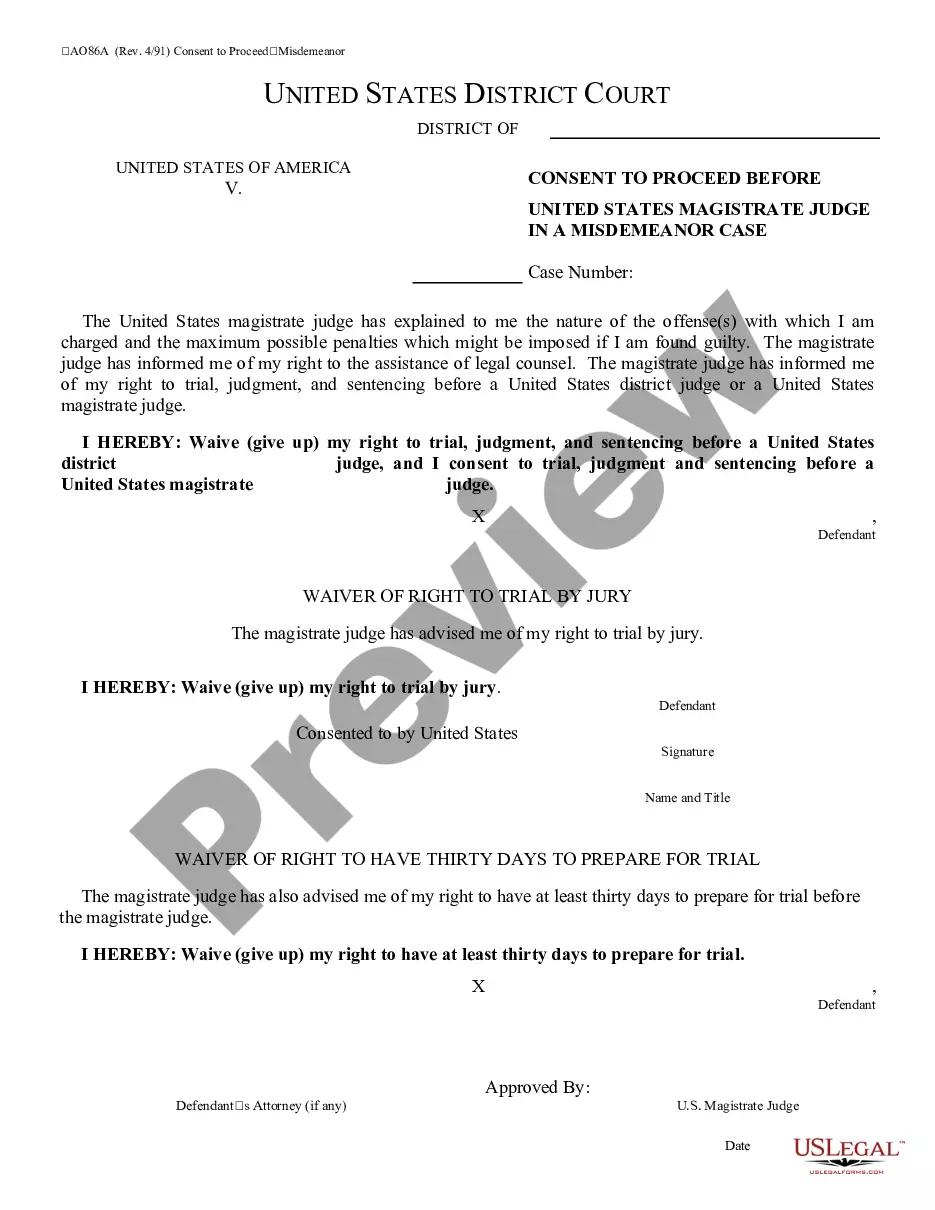

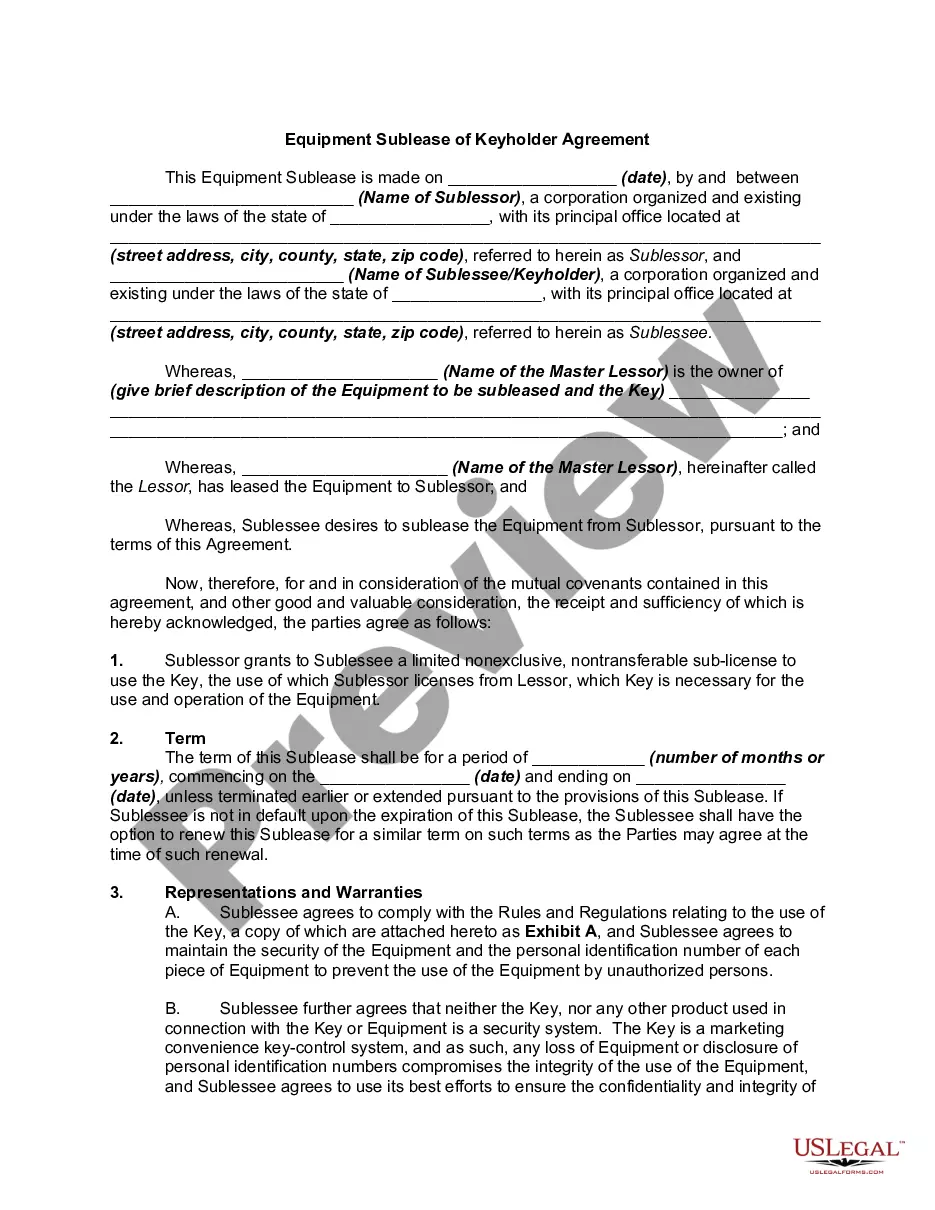

Locating the appropriate legitimate record template might pose a challenge. Clearly, there are numerous templates available online, but how do you find the correct document you need? Utilize the US Legal Forms website. The service offers a vast array of templates, including the North Dakota Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner, which you can utilize for both business and personal purposes. All the forms are reviewed by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click on the Download button to obtain the North Dakota Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner. Use your account to search for the legal forms you have purchased in the past. Navigate to the My documents tab of your account and download an additional copy of the document you require.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: Firstly, ensure you have selected the correct template for your specific area/state. You can review the form using the Review button and go through the form details to confirm it is the right one for you. If the form does not meet your requirements, use the Search box to find the appropriate template. Once you are certain that the form is suitable, select the Get now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the format and download the legal document template onto your device. Complete, modify, and print, then sign the obtained North Dakota Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner.

US Legal Forms boasts the largest collection of legal templates from which you can acquire various document formats. Leverage the service to obtain properly designed documents that adhere to state regulations.

- Avoid altering or removing any HTML tags.

- Focus solely on synonyms for plain text outside of the HTML tags.

- Ensure compliance with state regulations.

- Utilize the website for various legal document templates.

- Follow straightforward steps for downloading forms.

- Access previously purchased documents from your account.

Form popularity

FAQ

1 : to give or leave by will (see will entry 2 sense 1) used especially of personal property a ring bequeathed to her by her grandmother. 2 : to hand down : transmit lessons bequeathed to future generations.

Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.

Applying the archaic legal definitions, the difference between a legatee and a devisee is the kind of property they inherit. A legatee inherits personal property (jewelry, vehicles, cash, etc.) while a devisee inherits real property, such as the family home.

He bequeathed his talent to his son. To hand down; to transmit. To bequeath is to leave assets for others after your death or to give someone something that you own, especially something of value. An example of bequeath is writing a will that leaves your home to your child.

Bequests are gifts of personal property while devises are gifts of real estate. There are three types of bequests: specific, general and residuary. Specific bequests are of named property (e.g., my gold ring to my sister Taylor). General bequests are usually stated amounts (e.g., $10,000 to my cousin Corey).

Bequests are gifts that are made as part of a will or trust. A bequest can be to a person, or it can be a charitable bequest to a nonprofit organization, trust or foundation. Anyone can make a bequestin any amountto an individual or charity.

General Bequests For example, you might say something along the lines of I hereby leave $300,000 to my nephew Aaron, rather than I hereby bequeath my primary residence at 4566 Maple Street in New Hampshire, CT to my nephew Aaron. The bequest is paid using the general pool of assets in the estate.

Strictly speaking, a devise (verb: to devise) is a testamentary gift of real property (bienes inmuebles), the beneficiary of which is known as a devisee. In contrast, a bequest (verb: to bequeath) usually refers to a testamentary gift of personal property (bienes muebles), often excluding money.

You can bequeath property, or transfer it upon death, by writing a will. In the will, you'll name the beneficiary for your property, which is the person who will receive it when you die. Drafting a will is easy, and you can do it yourself.

If you are making a bequest for a specific purpose, spell out your wishes so the recipient will know exactly what you intend. Charitable organizations usually prefer unrestricted bequests since this allows the board of directors/trustees to apply the gift where it is needed most.