North Dakota Sample Letter for Closing of Estate with no Distribution

Description

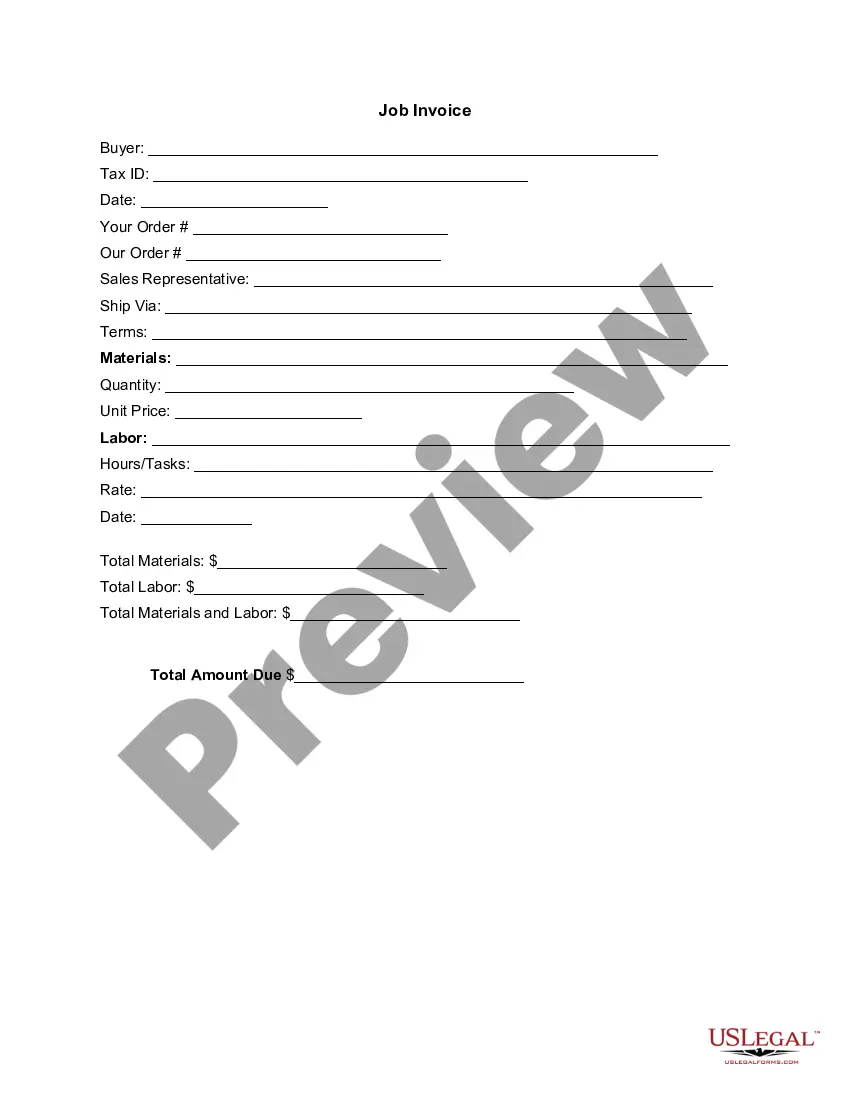

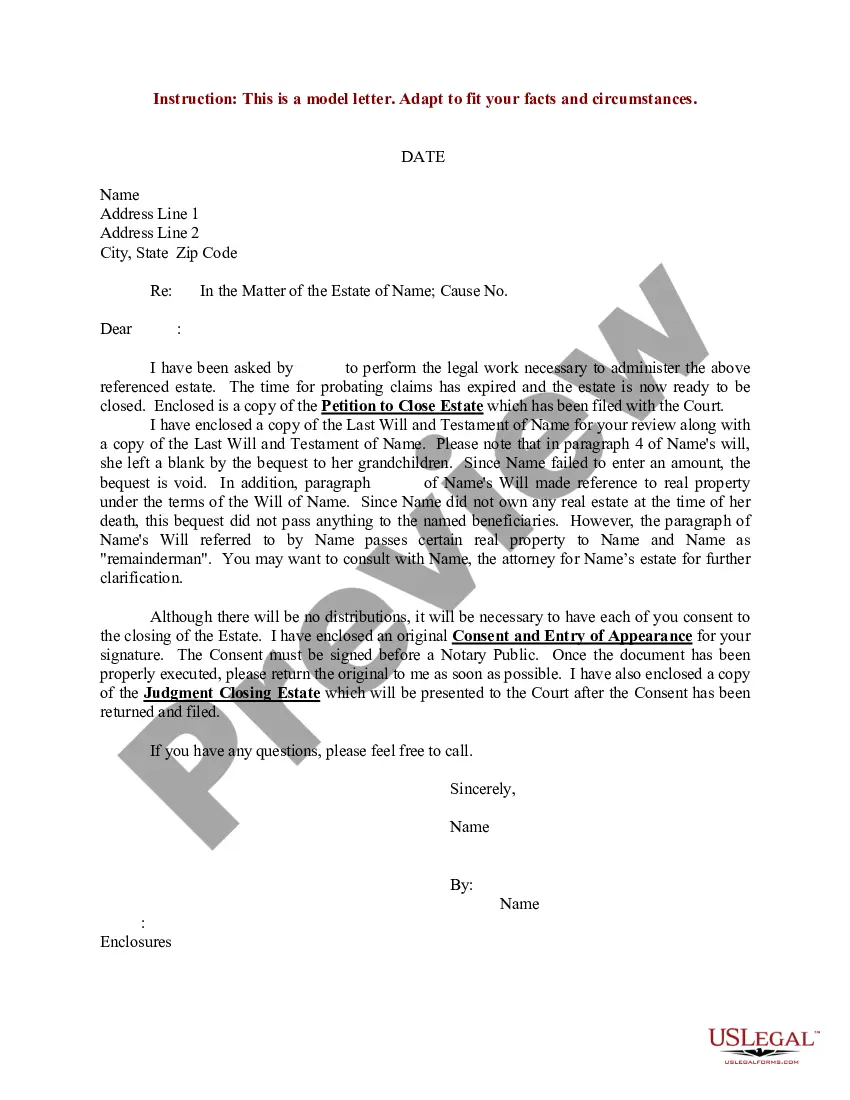

How to fill out Sample Letter For Closing Of Estate With No Distribution?

You are able to devote several hours online looking for the authorized record design that meets the state and federal demands you need. US Legal Forms provides thousands of authorized varieties that are analyzed by professionals. You can easily download or print out the North Dakota Sample Letter for Closing of Estate with no Distribution from my assistance.

If you already have a US Legal Forms accounts, you are able to log in and click the Acquire option. Afterward, you are able to full, change, print out, or indication the North Dakota Sample Letter for Closing of Estate with no Distribution. Every authorized record design you buy is the one you have permanently. To acquire an additional backup for any bought kind, check out the My Forms tab and click the related option.

Should you use the US Legal Forms website the very first time, stick to the straightforward instructions beneath:

- First, make sure that you have chosen the right record design for the area/area of your choosing. See the kind information to make sure you have chosen the proper kind. If available, make use of the Review option to look throughout the record design also.

- If you would like get an additional model in the kind, make use of the Search discipline to get the design that meets your needs and demands.

- Upon having located the design you want, just click Purchase now to move forward.

- Select the pricing plan you want, type your qualifications, and register for an account on US Legal Forms.

- Full the purchase. You should use your bank card or PayPal accounts to purchase the authorized kind.

- Select the file format in the record and download it to the system.

- Make alterations to the record if possible. You are able to full, change and indication and print out North Dakota Sample Letter for Closing of Estate with no Distribution.

Acquire and print out thousands of record themes using the US Legal Forms Internet site, which provides the biggest variety of authorized varieties. Use skilled and status-distinct themes to take on your business or individual requires.

Form popularity

FAQ

North Dakota has adopted the Uniform Probate Code, which allows a person to informally probate a Will and have a personal representative appointed without the necessity of a court appearance or a court hearing, as long as the proper forms are filed and the correct procedures followed.

Probate is almost always required in North Dakota. If you have a larger estate, you must go through probate, especially if real estate is involved. Other deciding factors for requiring probate include: A poorly written will.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

Probate Avoidance Joint Tenancy with Right of Survivorship. Adding another person to your assets as a joint owner or "joint tenant with rights of survivorship" will allow your property to pass to them upon your death without going through probate. ... Beneficiary Designations. ... Revocable Living Trust.

Trusts: If the deceased had a trust, you will not need to go through probate. Trusts are created to allow the deceased's family and friends to inherit without having to go through the long and expensive probate process.

Spouses in North Dakota Inheritance Law Die intestate and leave behind a spouse but no children or parents, and your spouse inherits your entire estate. If you leave behind a spouse and children with that spouse (and your spouse has no other children), then your spouse will inherit your entire estate.

An informal appointment or a formal testacy or appointment proceeding may be commenced thereafter if no proceeding concerning the succession or estate administration has occurred within the three-year period after the decedent's death, but the personal representative has no right to possess estate assets as provided in ...