North Dakota Sample Letter for Release of Funds into Decedent's Estate

Description

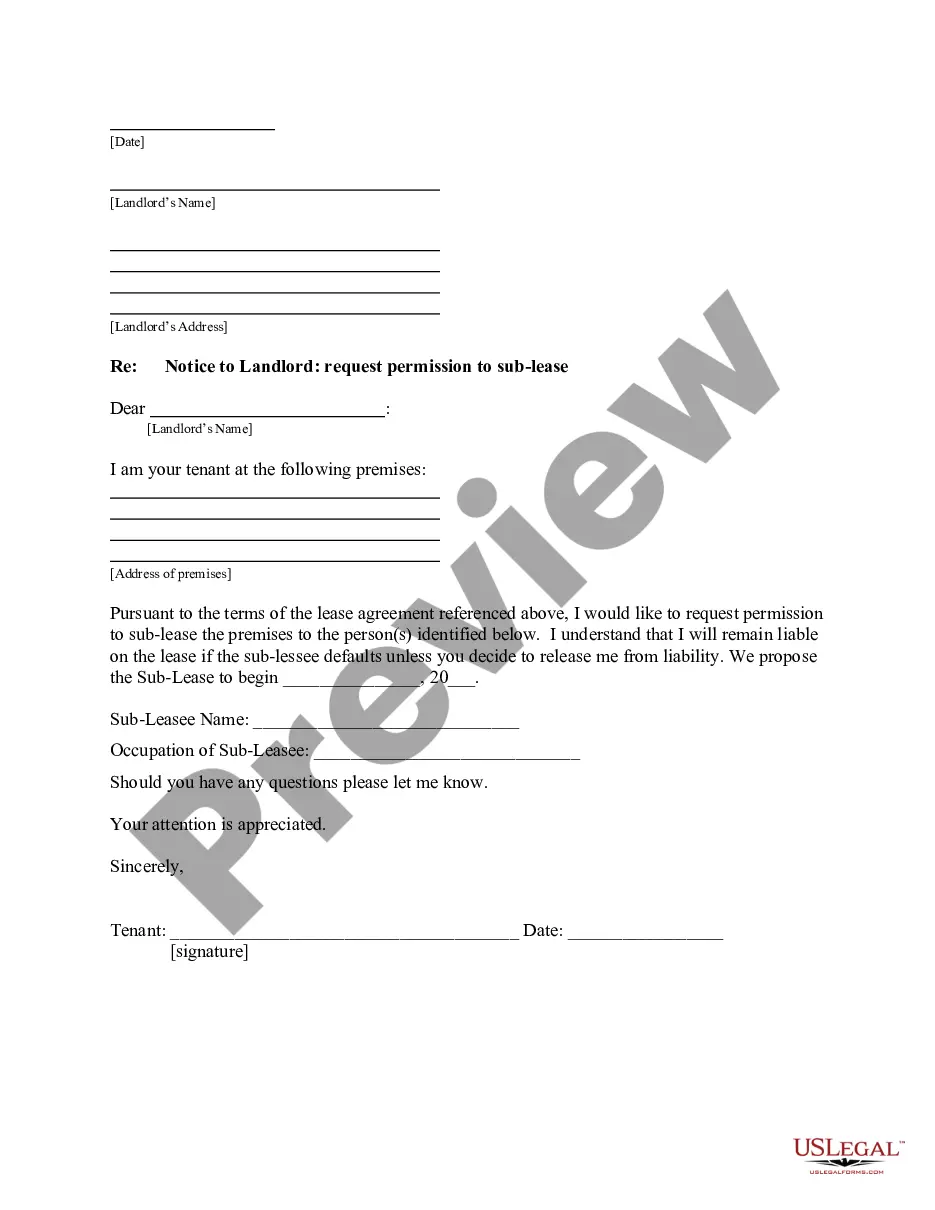

How to fill out Sample Letter For Release Of Funds Into Decedent's Estate?

You are able to commit several hours on the Internet attempting to find the authorized papers format that suits the state and federal specifications you will need. US Legal Forms supplies 1000s of authorized types that are reviewed by experts. It is possible to down load or produce the North Dakota Sample Letter for Release of Funds into Decedent's Estate from the support.

If you already have a US Legal Forms bank account, you can log in and click on the Obtain key. Afterward, you can complete, change, produce, or sign the North Dakota Sample Letter for Release of Funds into Decedent's Estate. Every authorized papers format you purchase is your own property for a long time. To get yet another backup associated with a bought develop, check out the My Forms tab and click on the related key.

If you are using the US Legal Forms web site initially, keep to the easy guidelines below:

- Very first, make sure that you have chosen the right papers format for your state/area of your choosing. Browse the develop outline to make sure you have picked the correct develop. If readily available, take advantage of the Preview key to check through the papers format as well.

- If you would like discover yet another version of your develop, take advantage of the Search area to find the format that meets your needs and specifications.

- After you have discovered the format you need, click on Purchase now to move forward.

- Select the prices prepare you need, type your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal bank account to fund the authorized develop.

- Select the structure of your papers and down load it in your system.

- Make modifications in your papers if required. You are able to complete, change and sign and produce North Dakota Sample Letter for Release of Funds into Decedent's Estate.

Obtain and produce 1000s of papers web templates using the US Legal Forms website, that provides the largest assortment of authorized types. Use specialist and state-particular web templates to tackle your organization or specific needs.

Form popularity

FAQ

Die unmarried and intestate in North Dakota and your estate goes to your children in equal shares. If you don't have any children, then your parents are next in line. Finally, if you don't have a spouse, children, or surviving parents, then your estate will go to your grandparents, or descendants of your grandparents.

In North Dakota, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

A transfer on death (TOD) deed is like a regular deed you might use to transfer your North Dakota real estate, but with a crucial difference: It doesn't take effect until your death.

It involves proving the will is valid, identifying and inventorying the deceased person's property, having the property appraised, paying debts and taxes, and distributing the remaining property as the will directs. In North Dakota, the cost for probate can range from $2,700 to $6,950 or more.

Probate is almost always required in North Dakota. If you have a larger estate, you must go through probate, especially if real estate is involved. Other deciding factors for requiring probate include: A poorly written will.

The surviving spouse who is a devisee of the decedent has the highest priority for consideration as the personal representative in informal probate proceedings.

The total value of the probated property (minus any debts or other encumbrances on the property) is less than $50,000.00; No real property (real estate) is part of the probated estate; No probate case is started or completed in a North Dakota state district court, a court of any other state, or a tribal court; and.

Probate is almost always required in North Dakota. If you have a larger estate, you must go through probate, especially if real estate is involved. Other deciding factors for requiring probate include: A poorly written will.