North Dakota Partnership Agreement for Real Estate is a legally binding contract that outlines the rights, responsibilities, and obligations of individuals or entities who enter into a partnership for real estate ventures in the state of North Dakota. This agreement is essential to ensure a comprehensive understanding and proper management of the partnership. In North Dakota, there are several types of partnership agreements for real estate, including: 1. General Partnership Agreement: This type of agreement is formed when two or more individuals or entities come together to conduct real estate activities as co-owners. All partners are equally liable for any debts or obligations incurred by the partnership. 2. Limited Partnership Agreement: This agreement involves at least one general partner who has unlimited liability and one or more limited partners who have limited liability. Limited partners are not actively involved in the day-to-day management of the real estate venture but contribute capital or assets. 3. Limited Liability Partnership (LLP) Agreement: Laps offer liability protection to all partners. Each partner's liability is limited to their investment or contribution to the partnership. This agreement is often chosen by professionals in the real estate industry, such as attorneys or accountants. 4. Limited Liability Company (LLC) Operating Agreement: Although not a traditional partnership, an LLC operating agreement is commonly used for real estate ventures. It provides limited liability protection to members while allowing flexibility in management and taxation. A North Dakota Partnership Agreement for Real Estate typically includes the following key elements: 1. Identification of Partners: The agreement clearly identifies all partners involved in the real estate venture, including their names, addresses, and roles within the partnership. 2. Purpose and Scope: It outlines the specific purpose and scope of the partnership, including the type of real estate activities to be undertaken and any limitations or restrictions. 3. Capital Contributions: The agreement specifies the amount of capital or assets each partner will contribute to the partnership, whether cash, property, or services. 4. Profit and Loss Allocation: It details how profits and losses will be allocated among partners, usually based on their capital contributions or as agreed upon. 5. Management and Decision-Making: The agreement outlines the decision-making process, responsibilities, and authority of each partner. It may designate a managing partner or establish a voting system for major decisions. 6. Transfer of Interests: The agreement sets forth the rules and procedures for transferring or selling partnership interests, including any restrictions or rights of first refusal. 7. Dissolution and Termination: It outlines the circumstances under which the partnership may be dissolved and the procedures to be followed, including the distribution of assets and liabilities. 8. Dispute Resolution: This section stipulates the methods and processes for resolving disputes arising between partners, such as mediation or arbitration. North Dakota Partnership Agreements for Real Estate are crucial to clearly define the rights and obligations of partners and provide a framework for successful real estate ventures.

North Dakota Partnership Agreement for Real Estate

Description

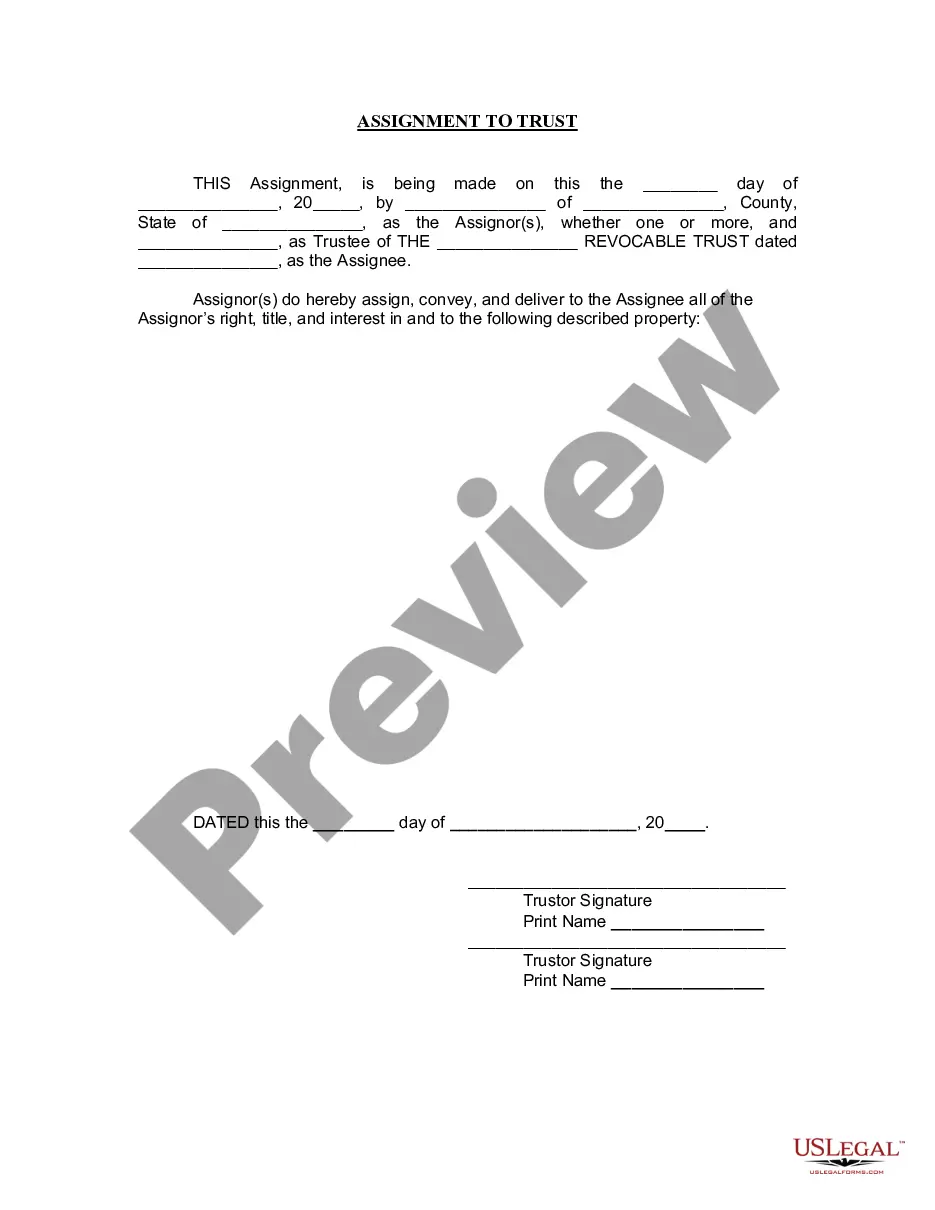

How to fill out Partnership Agreement For Real Estate?

US Legal Forms - among the greatest libraries of legal varieties in the States - offers a wide array of legal file web templates you may download or print out. While using internet site, you can find thousands of varieties for company and specific functions, categorized by classes, states, or key phrases.You will find the newest variations of varieties such as the North Dakota Partnership Agreement for Real Estate in seconds.

If you already possess a monthly subscription, log in and download North Dakota Partnership Agreement for Real Estate in the US Legal Forms library. The Download button can look on every single form you view. You gain access to all earlier delivered electronically varieties inside the My Forms tab of your accounts.

If you would like use US Legal Forms for the first time, allow me to share basic recommendations to help you get began:

- Make sure you have selected the right form for your personal town/county. Click on the Review button to analyze the form`s content. Browse the form description to actually have chosen the appropriate form.

- When the form doesn`t match your requirements, take advantage of the Search discipline near the top of the screen to obtain the the one that does.

- If you are happy with the shape, verify your choice by simply clicking the Purchase now button. Then, opt for the rates program you favor and provide your accreditations to register for the accounts.

- Process the deal. Utilize your credit card or PayPal accounts to perform the deal.

- Pick the structure and download the shape on your system.

- Make alterations. Load, edit and print out and indication the delivered electronically North Dakota Partnership Agreement for Real Estate.

Every web template you included in your account does not have an expiration date and is also your own permanently. So, if you would like download or print out another copy, just go to the My Forms area and click on around the form you need.

Gain access to the North Dakota Partnership Agreement for Real Estate with US Legal Forms, by far the most substantial library of legal file web templates. Use thousands of professional and status-specific web templates that meet your small business or specific needs and requirements.

Form popularity

FAQ

These are the steps you can follow to write a partnership agreement:Step 1 : Give your partnership agreement a title.Step 2 : Outline the goals of the partnership agreement.Step 3 : Mention the duration of the partnership.Step 4 : Define the contribution amounts of each partner (cash, property, services, etc.).More items...?14-Aug-2021

Tips for a successful business partnershipWrite a formal partnership agreement.Know your partner for a reasonable amount of time.Start on the same page.Basic information.Allocation of profits or losses.Partner responsibilities.Guidelines for leaving.What must happen if one of the partners dies.More items...?10-Jun-2020

Written partnership agreements protect the company and each partner's investment in it. If there is no written partnership agreement, partners are not allowed to draw a salary. Instead, they share the profits and losses in the business equally.

Structuring a 50/50 partnership requires consent, input and trust from all business partners. To avoid conflict and maintain trust between you and your partner(s), be sure to discuss all business goals, the commitment level of each partner and salaries prior to signing the agreement.

Features of partnership form of organisation are discussed as below:Two or More Persons:Contract or Agreement:Lawful Business:Sharing of Profits and Losses:Liability:Ownership and Control:Mutual Trust and Confidence:Restriction on Transfer of Interest:More items...

A partnership agreement is a foundational document and is legally binding on all partners. The agreement outlines the business's day-to-day operations and the rights and responsibilities of each partner. In this way, the document is not unlike a set of corporate bylaws.

If you are a business owner, looking to draft your own partnership agreement, you can do so using free templates available online. It is advisable to contact a business lawyer or a partnership agreement lawyer to ensure that the agreement follows the federal, state and local laws.

8 things your small business partnership agreement should includeWhat each business partner will contribute.How finances will be managed.Distribution of profits and losses.A process for dispute resolution.A non-compete clause.A non-disclosure confidentiality clause.A non-solicitation clause.More items...?

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.

A Partnership is defined by the Indian Partnership Act, 1932, as 'the relation between persons who have agreed to share profits of the business carried on by all or any of them acting for all'. Agreement is the essential part of partnership business. It secure the right of both party.