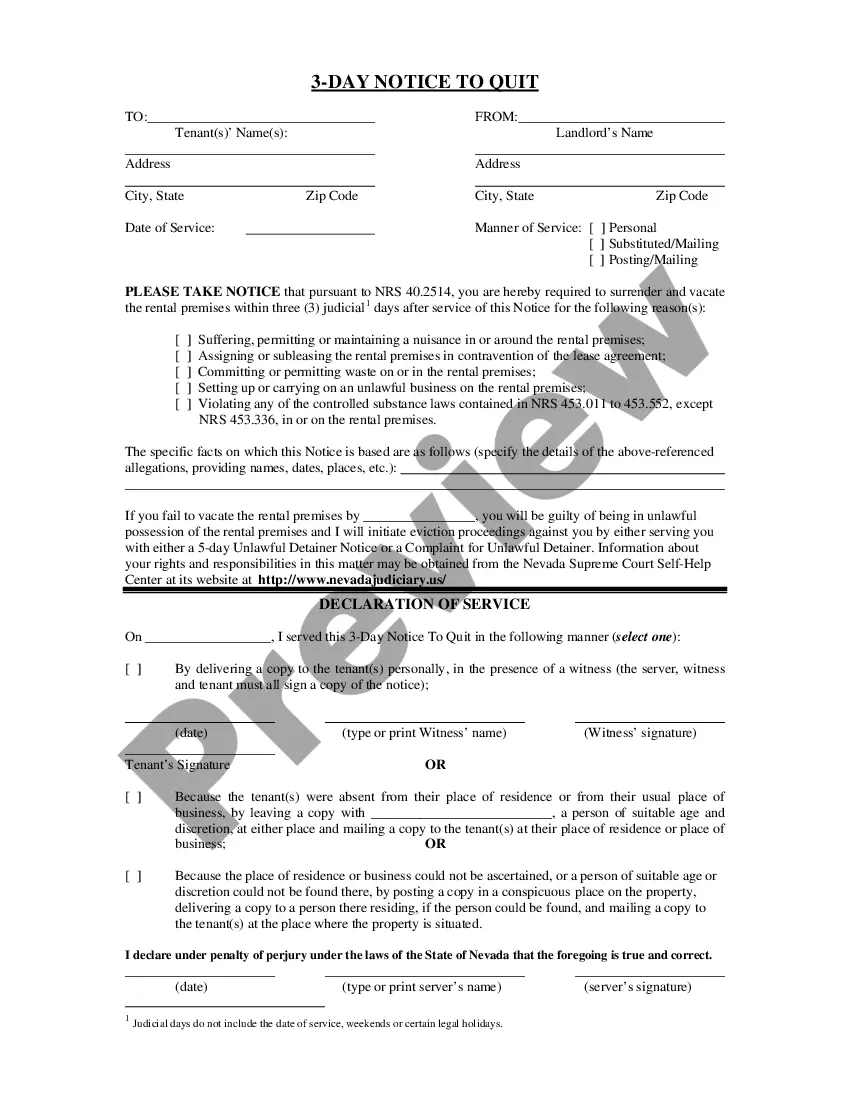

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP] Subject: North Dakota Sample Letter for Foreclosed Home of Estate Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to you regarding my recently foreclosed home of estate in North Dakota. First and foremost, I would like to express my sincere gratitude for your attention and consideration towards my situation. I understand that dealing with foreclosed properties can be a complex process, and I appreciate your assistance throughout this matter. Per the laws and regulations of North Dakota, I have diligently reviewed and compiled all the necessary documents required for the foreclosed home of estate. Enclosed, you will find the following items: 1. Notice of Foreclosure: This document serves as official notice of the foreclosure process initiated on my property. It outlines the due process and legal steps taken by the lender. 2. Mortgage and Loan Agreement: This agreement highlights the terms and conditions of the loan taken on the property. It includes details such as repayment schedule, interest rates, and any other pertinent clauses. 3. Title Deed: The original title deed serves as proof of ownership and clearly identifies the property in question. I have included a certified copy for your reference. 4. Appraisal Report: Attached is a recent appraisal report that provides an estimated value of the property. This will help in determining any potential equity remaining after the foreclosure sale. 5. Financial Statements: I have enclosed my financial statements, including income and expense statements, bank statements, and tax returns. These documents offer a comprehensive overview of my current financial situation. 6. Communication Logs: For your convenience, I have prepared a log detailing all prior communication related to the foreclosed home of estate. This will ensure transparency and assist in resolving any discrepancies, if any. Moreover, it is crucial to mention that I am open to exploring all feasible options to resolve this matter efficiently and amicably. These may include loan modification, short sale, or other available alternatives within the state of North Dakota. I kindly request your guidance and support in identifying the best course of action. If necessary, I am prepared to attend mediation or negotiation sessions, as mandated by North Dakota foreclosure laws, to facilitate a fair and equitable resolution. In conclusion, I would like to express my sincere desire for a prompt resolution to this unfortunate situation. I genuinely believe that with your expertise and understanding of North Dakota's foreclosure process, we can find a favorable outcome. I kindly request your earliest possible response and eagerly anticipate discussing the next steps. Please feel free to contact me at your convenience via the contact information provided above. Thank you for your time and attention to my case. Yours sincerely, [Your Name]

North Dakota Sample Letter for Foreclosed Home of Estate

Description

How to fill out North Dakota Sample Letter For Foreclosed Home Of Estate?

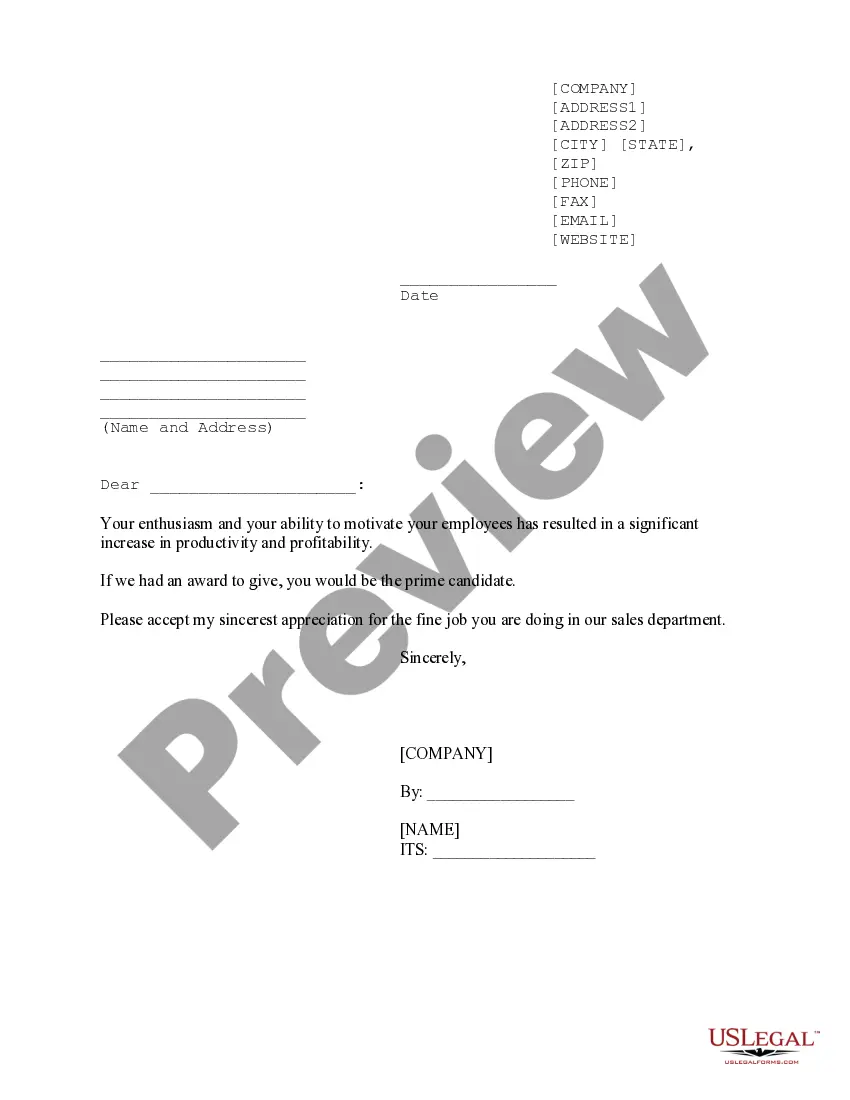

It is possible to spend time on the web attempting to find the lawful record design that fits the federal and state demands you require. US Legal Forms gives 1000s of lawful kinds which are evaluated by experts. You can actually down load or print the North Dakota Sample Letter for Foreclosed Home of Estate from your services.

If you already have a US Legal Forms bank account, you may log in and click on the Obtain key. Following that, you may complete, edit, print, or indication the North Dakota Sample Letter for Foreclosed Home of Estate. Every single lawful record design you acquire is the one you have for a long time. To obtain an additional copy of any acquired kind, check out the My Forms tab and click on the corresponding key.

If you use the US Legal Forms internet site initially, adhere to the basic instructions beneath:

- Initially, ensure that you have selected the correct record design for that county/area of your choosing. See the kind explanation to ensure you have selected the proper kind. If offered, utilize the Preview key to appear through the record design as well.

- If you wish to locate an additional version in the kind, utilize the Search field to discover the design that suits you and demands.

- After you have discovered the design you would like, click on Purchase now to move forward.

- Find the rates program you would like, key in your credentials, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You can use your Visa or Mastercard or PayPal bank account to pay for the lawful kind.

- Find the structure in the record and down load it to the device.

- Make changes to the record if needed. It is possible to complete, edit and indication and print North Dakota Sample Letter for Foreclosed Home of Estate.

Obtain and print 1000s of record layouts making use of the US Legal Forms site, which offers the greatest collection of lawful kinds. Use professional and state-distinct layouts to handle your small business or specific requires.

Form popularity

FAQ

Which state has the longest foreclosure process? The state with the longest foreclosure process is Hawaii, followed by Louisiana, Kentucky, Nevada, and Connecticut.

Redeeming the Property In some states, the borrower can redeem (repurchase) the property within a specific period after the foreclosure. In North Dakota, the borrower generally gets the right to redeem the property within 60 days after the sale except for property that's abandoned or agricultural.

Equity of redemption (also termed right of redemption or equitable right of redemption) is a defaulting mortgagor's right to prevent foreclosure proceedings on the property and redeem the mortgaged property by discharging the debt secured by the mortgage within a reasonable amount of time (thereby curing the default).

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

When available, the redemption period generally ranges from 30 days to a year. In most states that provide a post-sale redemption period, specific factors often change the redemption period's length. For example: The redemption period might vary depending on whether the foreclosure is judicial or nonjudicial.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Redeeming the Property In some states, the borrower can redeem (repurchase) the property within a specific period after the foreclosure. In North Dakota, the borrower generally gets the right to redeem the property within 60 days after the sale except for property that's abandoned or agricultural.