North Dakota Combined Declaration and Assignment

Description

How to fill out Combined Declaration And Assignment?

Are you currently within a situation the place you need paperwork for both business or specific functions just about every working day? There are a variety of legitimate record web templates available on the net, but locating kinds you can trust isn`t effortless. US Legal Forms gives a large number of form web templates, such as the North Dakota Combined Declaration and Assignment, that happen to be created to meet federal and state specifications.

If you are presently informed about US Legal Forms site and possess a free account, simply log in. After that, you can acquire the North Dakota Combined Declaration and Assignment format.

Unless you come with an account and wish to begin using US Legal Forms, follow these steps:

- Discover the form you want and make sure it is for that right town/county.

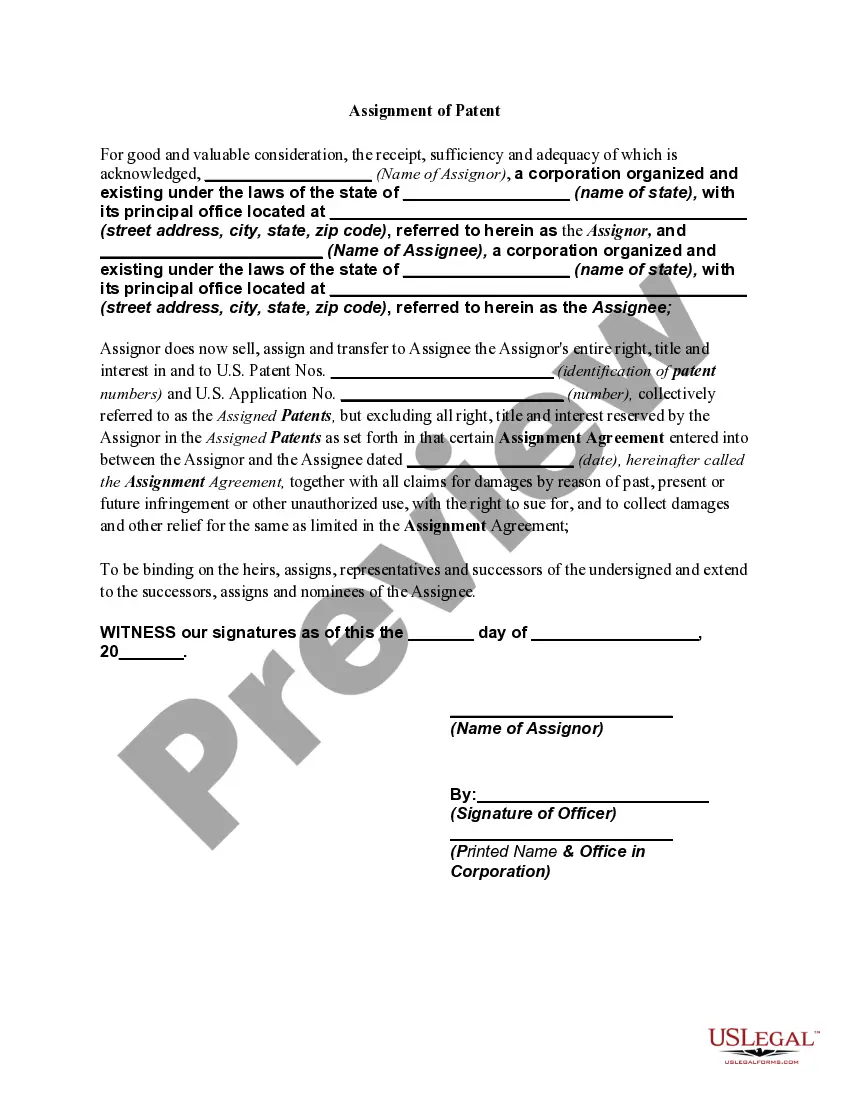

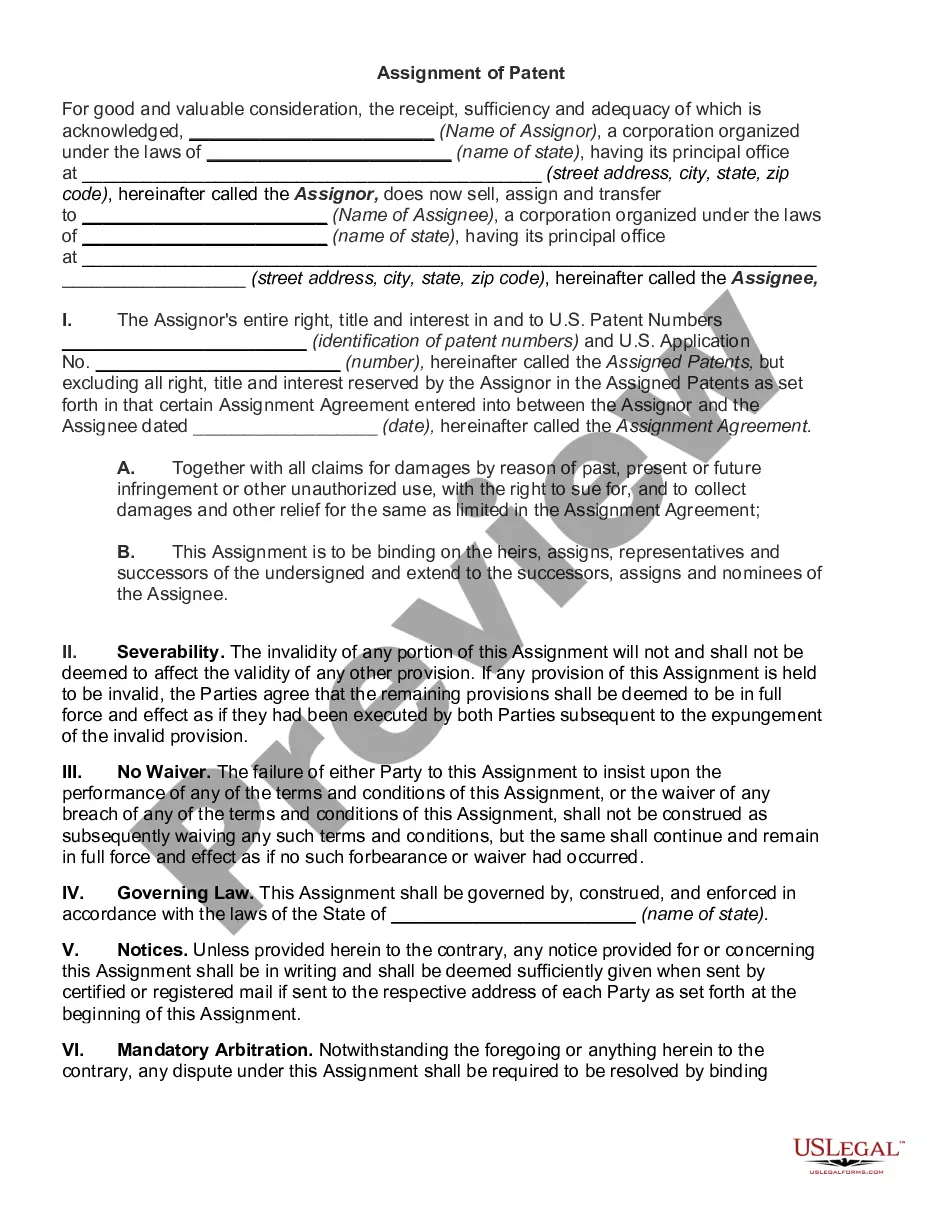

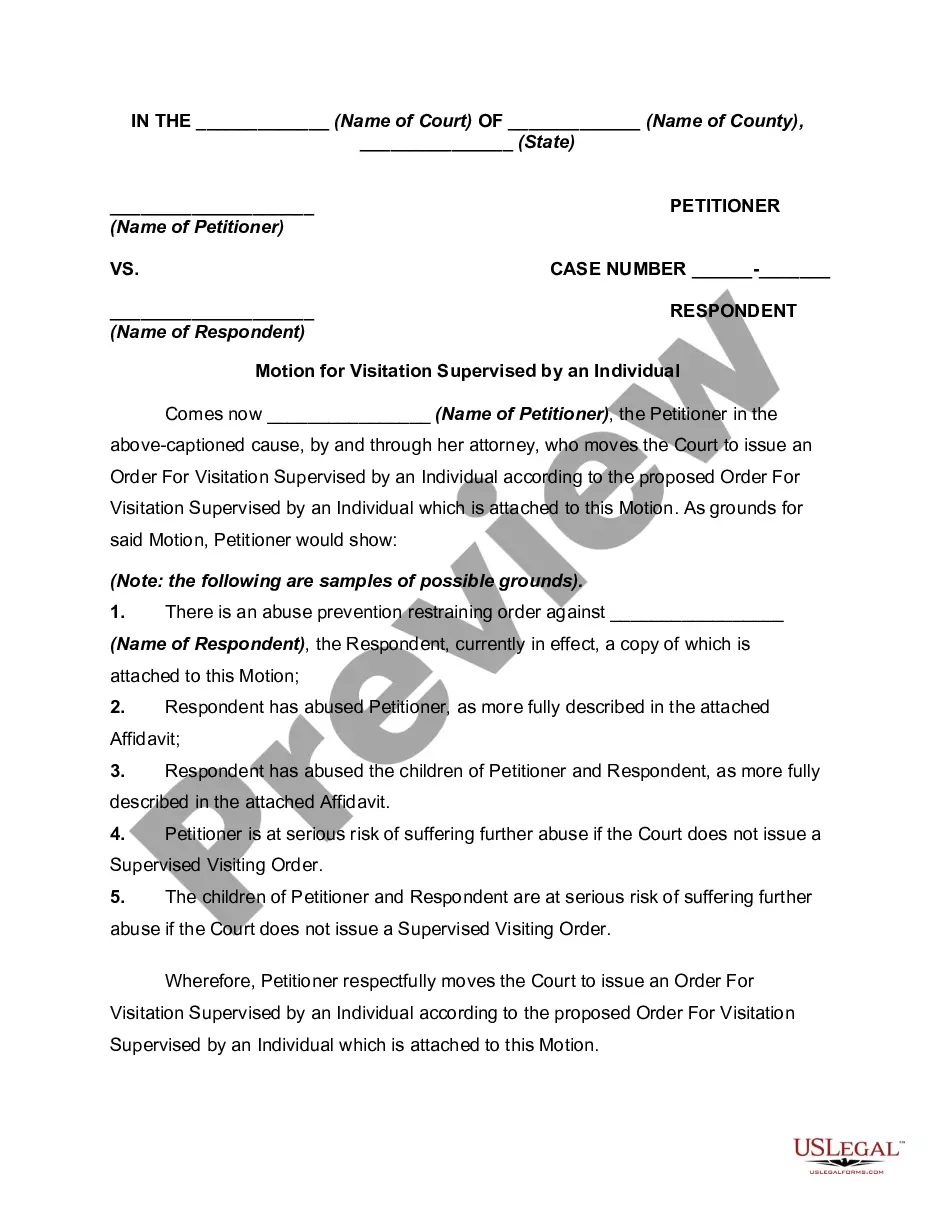

- Utilize the Review button to review the form.

- Look at the outline to ensure that you have chosen the correct form.

- In case the form isn`t what you`re searching for, take advantage of the Lookup discipline to find the form that suits you and specifications.

- Whenever you discover the right form, simply click Get now.

- Opt for the pricing strategy you need, submit the desired information to create your money, and buy the transaction using your PayPal or credit card.

- Pick a handy data file formatting and acquire your duplicate.

Find every one of the record web templates you may have purchased in the My Forms food selection. You may get a extra duplicate of North Dakota Combined Declaration and Assignment at any time, if required. Just click the required form to acquire or print out the record format.

Use US Legal Forms, one of the most considerable selection of legitimate forms, to save time as well as steer clear of mistakes. The support gives appropriately made legitimate record web templates which you can use for a selection of functions. Make a free account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

The Form 306, North Dakota Income Tax Withholding return must be filed by every employer, even if compensation was not paid during the period covered by this return. Form 306 and the tax due on it must be submitted electronically if the amount withheld during the previous calendar year was $1,000 or more.

Under North Dakota Century Code (N.D.C.C.) § 57-38-31.1, a passthrough entity is required to withhold North Dakota income tax at the rate of 2.90% from a nonresident member's North Dakota distributive share of income if (1) it is $1,000 or more and (2) it is not included in a composite return.

A North Dakota tax power of attorney (Form 500), otherwise known as the ?Office of North Dakota State Tax Commissioner Authorization to Disclose Tax Information and Designation of Representative Form,? is used to designate a person as a representative of your interests in tax matters before the concerned tax authority. North Dakota Tax Power of Attorney (Form 500) - eForms eforms.com ? power-of-attorney ? north-dakota-t... eforms.com ? power-of-attorney ? north-dakota-t...

Do I Need to File? You must file an income tax return if you are a resident, part-year resident, or nonresident and: Are required to file a federal return. Receive income from a source in North Dakota.

Under North Dakota Century Code (N.D.C.C.) § 57-38-31.1, a passthrough entity is required to withhold North Dakota income tax at the rate of 2.90% from a nonresident member's North Dakota distributive share of income if (1) it is $1,000 or more and (2) it is not included in a composite return. Form PWA - Passthrough Entity Withholding-Nonresident Member ... nd.gov ? fiduciary ? form-pwa-2022 nd.gov ? fiduciary ? form-pwa-2022

Some customers are exempt from paying sales tax under North Dakota law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction. North Dakota Sales & Use Tax Guide - Avalara avalara.com ? taxrates ? state-rates ? north-d... avalara.com ? taxrates ? state-rates ? north-d...

307. North Dakota Transmittal Of Wage And Tax Statement. Form 307 - North Dakota Transmittal of Wage and Tax Statement 2022 nd.gov ? forms ? business ? it-withholding nd.gov ? forms ? business ? it-withholding