North Dakota Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee

Description

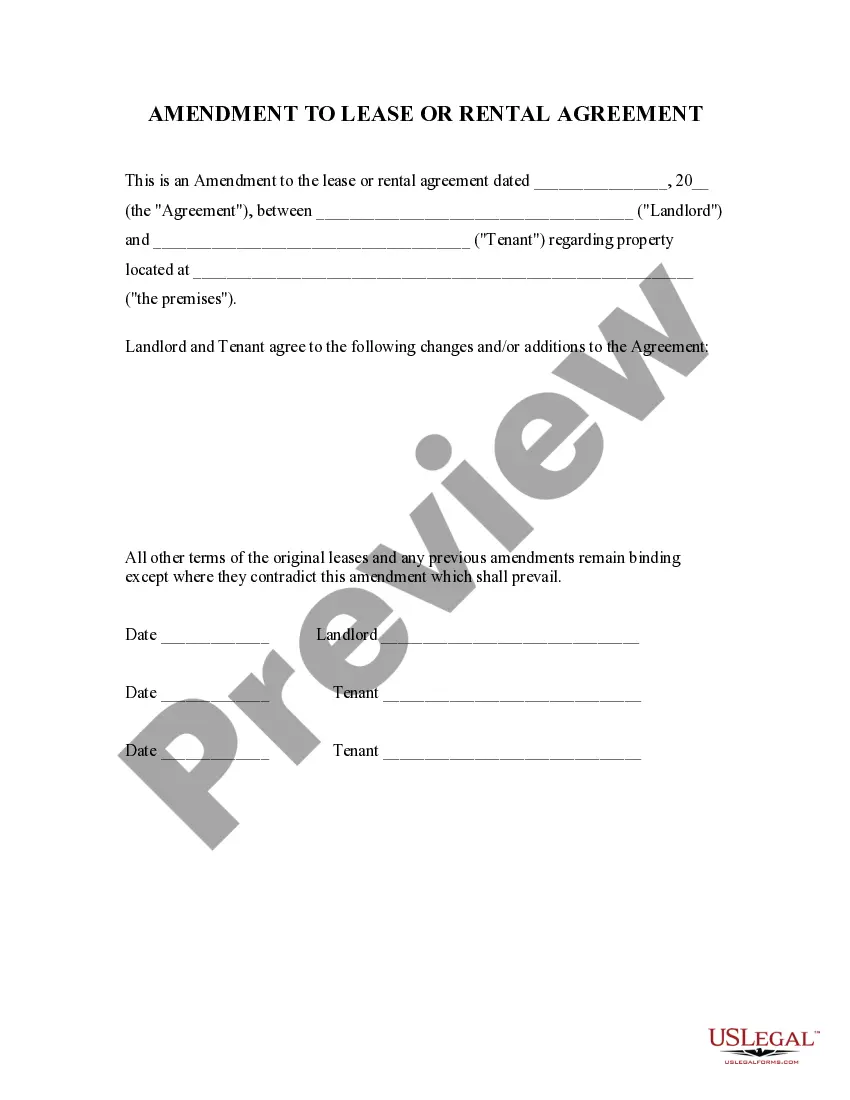

How to fill out Split-Dollar Insurance Agreement With Policy Owned Jointly By Employer And Employee?

You may invest time on the Internet trying to find the lawful record format that suits the federal and state specifications you require. US Legal Forms offers 1000s of lawful types which can be reviewed by specialists. You can actually obtain or produce the North Dakota Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee from the services.

If you already have a US Legal Forms account, it is possible to log in and click the Download key. After that, it is possible to complete, edit, produce, or signal the North Dakota Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee. Every single lawful record format you acquire is your own property permanently. To have one more backup of any purchased type, check out the My Forms tab and click the related key.

If you work with the US Legal Forms website for the first time, adhere to the simple recommendations below:

- First, make certain you have selected the correct record format for your region/city of your liking. Read the type description to ensure you have selected the right type. If accessible, make use of the Preview key to check with the record format too.

- If you wish to locate one more variation of the type, make use of the Lookup discipline to discover the format that fits your needs and specifications.

- Once you have discovered the format you would like, simply click Acquire now to continue.

- Pick the costs strategy you would like, type your accreditations, and sign up for an account on US Legal Forms.

- Complete the transaction. You can utilize your credit card or PayPal account to pay for the lawful type.

- Pick the formatting of the record and obtain it to your device.

- Make changes to your record if required. You may complete, edit and signal and produce North Dakota Split-Dollar Insurance Agreement with Policy Owned Jointly by Employer and Employee.

Download and produce 1000s of record web templates while using US Legal Forms web site, that provides the biggest selection of lawful types. Use skilled and express-particular web templates to tackle your company or individual requires.

Form popularity

FAQ

With a classic split-dollar plan, the employer pays some of the premium (the part that is equal to cash value), while the employee pays the rest. If the employees dies, or the plan is terminated, the surrender cash value is paid to the company, and the death benefits are paid out to beneficiaries.

In collateral assignment split dollar, the policy in the split dollar plan is owned by the insured. In return for its payment of premiums, the insured policyowner assigns the policy to the employer as collateral.

In a split dollar arrangement the employer is offering a loan to the employee which is utilized to pay the premium of a life insurance policy. The employee owns the life insurance contract, names a personal beneficiary and assigns the policy as collateral to the employer, in return for the employer's premium payments.

Collateral assignment / loan regime The employee owns the policy and the employer lends the premium required to pay for it. The employee is taxed on the interest-free element of the loan.

Split-dollar insurance plans: In an economic benefit arrangement, the employer owns the policy, covers the premiums, and has the authority to grant the rights and benefits. For example, an employer may permit the employee to name their beneficiaries, ensuring that the employee control who receives their death benefits.

Employer-Sponsored Health Insurance These are also called group plans. Your employer will typically share the cost of your premium with you. Advantages of an employer plan: Your employer often splits the cost of premiums with you.

Most often, the premiums are paid by the employer, and the benefits are split between the employer and the family of the deceased.

dollar life insurance agreement (or ?splitdollar plan?) is a strategy generally used as an employer benefit or for estate planning involving life insurance. It's an agreement between two or more parties to share the ownership, costs, and benefits of a permanent life insurance policy, like whole life.