North Dakota Debt Adjustment Agreement with Creditor: A Comprehensive Guide In North Dakota, a Debt Adjustment Agreement with a Creditor refers to a legally binding contract between a debtor and a creditor that aims to resolve outstanding debts through a structured payment plan. This agreement offers debtors an opportunity to repay their debts in a more manageable manner, effectively helping them regain financial stability. The Debt Adjustment Agreement with a Creditor in North Dakota is governed by state-specific laws, such as the North Dakota Debt Management Services Act, which ensures the protection of both debtors and creditors in these arrangements. The agreement typically entails negotiations between the debtor, creditor, and a licensed debt management service provider, known as a debt adjuster or a credit counseling agency. Types of North Dakota Debt Adjustment Agreements with Creditors: 1. Debt Consolidation Agreement: This type of agreement allows debtors to consolidate multiple debts into a single monthly payment. Debtors work closely with their debt adjuster to create a feasible repayment plan, ensuring the debtor can clear their debts without further financial burden. 2. Debt Settlement Agreement: In this agreement, debtors negotiate with creditors to reduce the outstanding debt amount. Typically, debtors agree to make a lump-sum payment or a settlement amount lower than the total outstanding debt. This option is suitable for debtors facing severe financial hardships who are unable to repay their debts in full. 3. Debt Management Agreement: The Debt Management Agreement focuses on creating an affordable repayment plan by negotiating reduced interest rates and waiving late fees or penalties. Debtors work with debt adjusters to analyze their financial situation and develop a budget, enabling them to make timely payments and clear their debts over a specific period. The North Dakota Debt Adjustment Agreement with a Creditor provides benefits for both debtors and creditors. For debtors, it offers an opportunity to regain control over their finances, avoid bankruptcy, and work towards becoming debt-free. Creditors benefit by recovering a portion of the outstanding debt, ensuring they receive at least a percentage of the owed amount. It is crucial for debtors to approach licensed debt management service providers who are familiar with North Dakota's laws and regulations regarding debt adjustment agreements. These providers facilitate the negotiation process, mediate between the debtor and creditor, and ensure compliance with the agreed upon terms. In conclusion, a North Dakota Debt Adjustment Agreement with a Creditor is an effective mechanism for debtors in the state to repay their debts in a structured manner. Whether through debt consolidation, settlement, or management, debtors have options to alleviate their financial burdens and work towards a debt-free future within the confines of the agreement. However, it is important to seek professional advice and work with a reputed debt management service provider to ensure a successful resolution to outstanding debts.

North Dakota Debt Adjustment Agreement with Creditor

Description

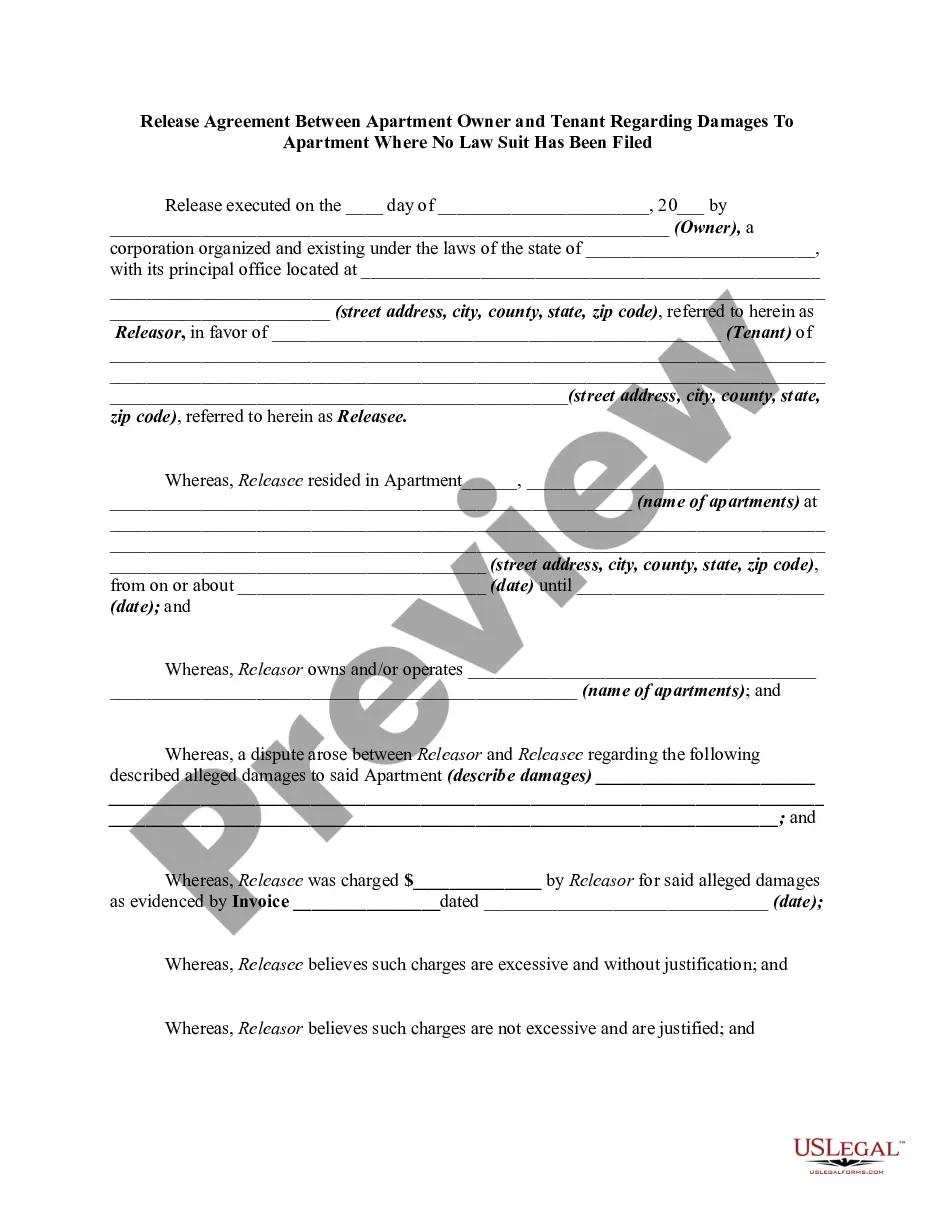

How to fill out North Dakota Debt Adjustment Agreement With Creditor?

US Legal Forms - one of several largest libraries of authorized forms in the USA - delivers a wide range of authorized document layouts you are able to acquire or produce. While using web site, you can find thousands of forms for company and individual purposes, categorized by categories, says, or keywords and phrases.You can find the most up-to-date models of forms like the North Dakota Debt Adjustment Agreement with Creditor in seconds.

If you currently have a membership, log in and acquire North Dakota Debt Adjustment Agreement with Creditor from the US Legal Forms catalogue. The Download key will show up on each form you look at. You gain access to all previously downloaded forms in the My Forms tab of your own account.

In order to use US Legal Forms the first time, listed below are easy guidelines to help you began:

- Be sure to have chosen the correct form to your city/region. Select the Review key to analyze the form`s information. Browse the form outline to ensure that you have selected the proper form.

- If the form does not fit your demands, utilize the Lookup industry near the top of the screen to obtain the one who does.

- Should you be happy with the form, confirm your decision by clicking the Acquire now key. Then, pick the costs prepare you want and supply your qualifications to register for the account.

- Method the deal. Utilize your bank card or PayPal account to accomplish the deal.

- Choose the structure and acquire the form on your own product.

- Make alterations. Load, revise and produce and indication the downloaded North Dakota Debt Adjustment Agreement with Creditor.

Every format you added to your money does not have an expiration date and is yours for a long time. So, if you would like acquire or produce one more backup, just go to the My Forms segment and click on around the form you will need.

Gain access to the North Dakota Debt Adjustment Agreement with Creditor with US Legal Forms, by far the most considerable catalogue of authorized document layouts. Use thousands of expert and condition-certain layouts that satisfy your company or individual requirements and demands.