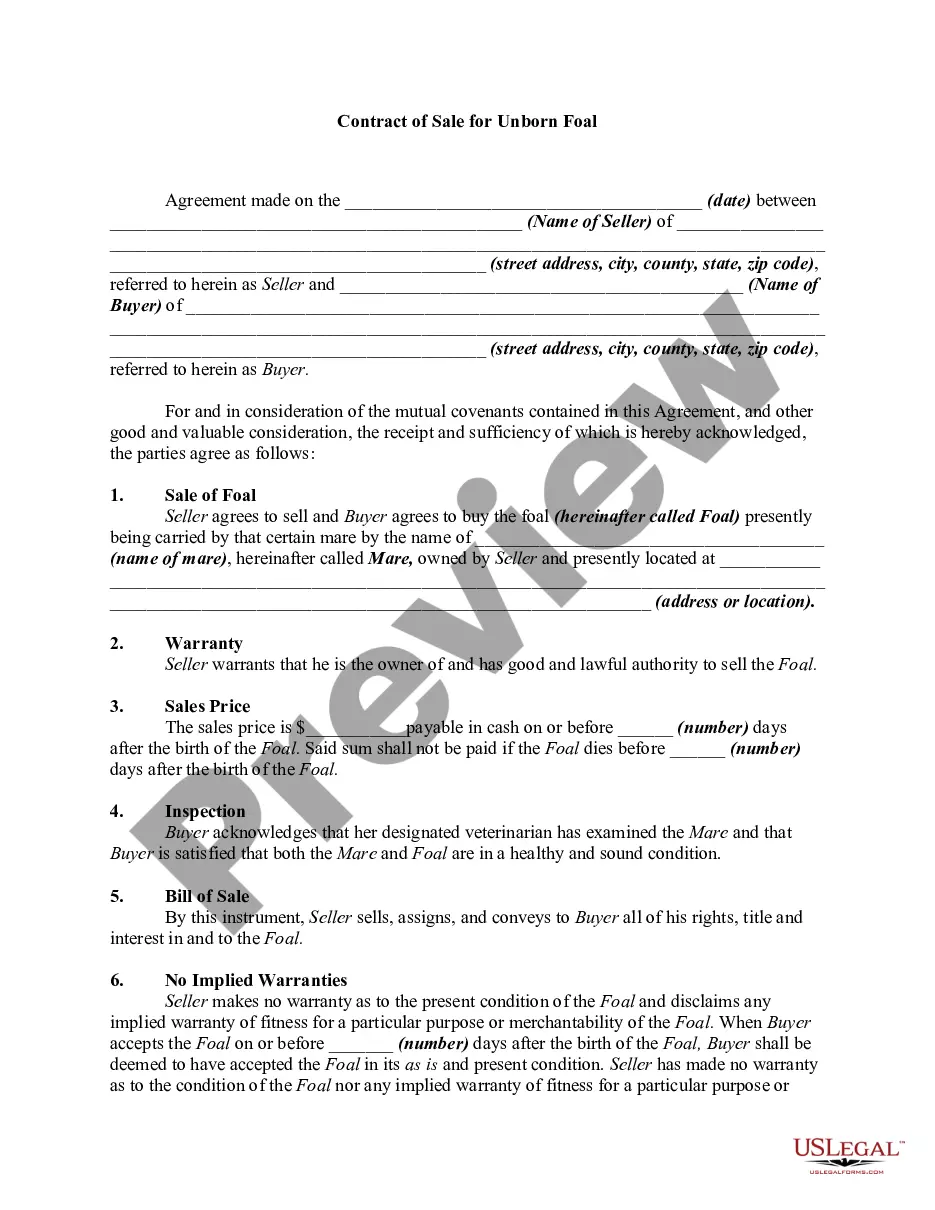

The North Dakota Consumer Equity Sheet is a financial document that provides a comprehensive overview of an individual's or household's assets, liabilities, and net worth. This sheet is an essential tool for assessing financial health and understanding personal wealth accumulation in the state of North Dakota. It aims to empower consumers by offering insights into their financial standings and allowing for informed decision-making. Keywords: North Dakota, Consumer Equity Sheet, financial document, assets, liabilities, net worth, financial health, personal wealth, consumers, decision-making. There are several types of North Dakota Consumer Equity Sheets, each catering to specific purposes: 1. Personal Consumer Equity Sheet: This type focuses on the financial standing of an individual and includes details regarding their personal assets such as bank accounts, investments, real estate, and valuable possessions. It also encompasses liabilities such as mortgages, personal loans, and credit card debt. By calculating the difference between assets and liabilities, the net worth can be determined. 2. Household Consumer Equity Sheet: Applied to families or households, this type encompasses the combined financial status of all members living under one roof. It evaluates the collective assets, liabilities, and net worth of the household, considering factors like joint bank accounts, shared investments, and shared property. 3. Business Consumer Equity Sheet: Designed for business owners or entrepreneurs, this type focuses on the financial state of a business entity operating in North Dakota. It incorporates the company's assets, such as cash, inventory, equipment, and intellectual property. Additionally, it includes liabilities such as loans and outstanding debts. The net worth of the business can be calculated by subtracting liabilities from assets. 4. Real Estate Consumer Equity Sheet: Specific to individuals or households owning real estate properties in North Dakota, this type exclusively focuses on the equity accumulated through property ownership. It includes details about property value, purchase price, outstanding mortgage balance, and other related costs. By subtracting the mortgage balance from the property value, the property's equity can be determined. 5. Investment Consumer Equity Sheet: Catering to individuals who actively invest in various financial instruments, this type highlights the accumulation of equity resulting from investments like stocks, bonds, mutual funds, and retirement accounts. It provides an overview of investment performance, current market value, and any associated ongoing costs or liabilities. In conclusion, the North Dakota Consumer Equity Sheet is a detailed financial document used to evaluate an individual's or household's financial health, net worth, and decision-making capabilities. Different variations of this sheet exist to meet the specific needs of individuals, households, businesses, real estate owners, and investors.

North Dakota Consumer Equity Sheet

Description

How to fill out Consumer Equity Sheet?

If you have to full, obtain, or printing legal papers layouts, use US Legal Forms, the greatest selection of legal types, that can be found on the Internet. Utilize the site`s basic and hassle-free lookup to find the documents you want. A variety of layouts for enterprise and personal reasons are sorted by classes and suggests, or search phrases. Use US Legal Forms to find the North Dakota Consumer Equity Sheet in a handful of mouse clicks.

In case you are presently a US Legal Forms buyer, log in for your account and then click the Acquire key to get the North Dakota Consumer Equity Sheet. You can also access types you formerly downloaded within the My Forms tab of the account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for that right city/region.

- Step 2. Make use of the Preview method to look through the form`s articles. Do not forget to see the information.

- Step 3. In case you are unsatisfied with all the type, take advantage of the Look for discipline on top of the display screen to discover other models from the legal type design.

- Step 4. Upon having identified the shape you want, click the Purchase now key. Choose the prices prepare you like and add your qualifications to sign up for the account.

- Step 5. Process the transaction. You can utilize your bank card or PayPal account to finish the transaction.

- Step 6. Select the format from the legal type and obtain it on the gadget.

- Step 7. Full, modify and printing or signal the North Dakota Consumer Equity Sheet.

Each legal papers design you purchase is yours eternally. You may have acces to each type you downloaded with your acccount. Click the My Forms portion and choose a type to printing or obtain once more.

Remain competitive and obtain, and printing the North Dakota Consumer Equity Sheet with US Legal Forms. There are millions of specialist and state-distinct types you may use for your personal enterprise or personal requirements.