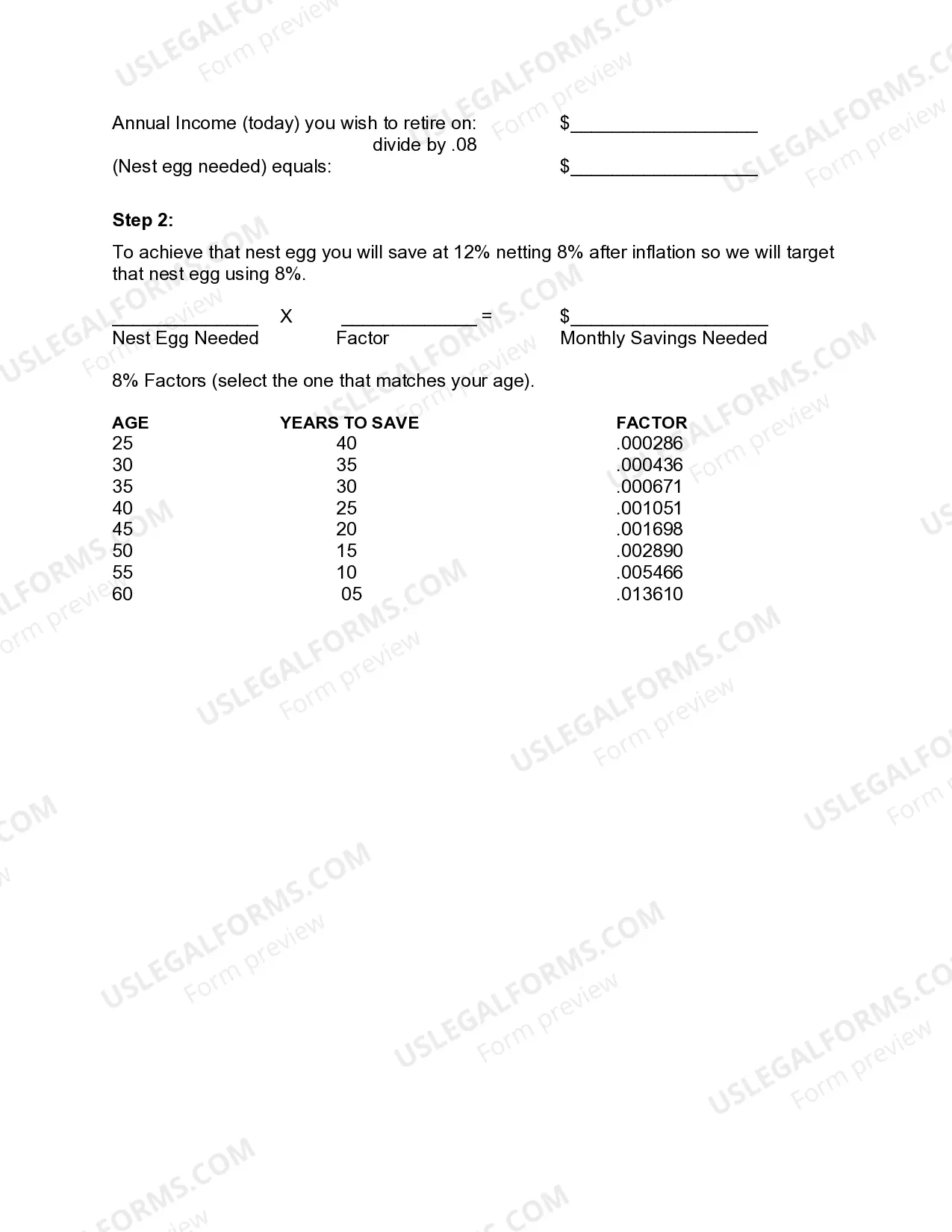

North Dakota Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

Are you presently facing a scenario where you require documents for organizational or personal objectives almost every single day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of template options, such as the North Dakota Monthly Retirement Planning, which are designed to comply with federal and state regulations.

Once you find the appropriate form, click on Get now.

Select the subscription plan you desire, enter the required information to set up your account, and complete the transaction using your PayPal or credit card. Choose a convenient file format and download your copy. You can locate all the document templates you have purchased in the My documents section. You can download or print the North Dakota Monthly Retirement Planning template whenever necessary. Utilize US Legal Forms, the largest collection of legal templates, to save time and prevent errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the template for North Dakota Monthly Retirement Planning.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to your specific city or county.

- Utilize the Preview button to inspect the form.

- Read the description to confirm that you have selected the right form.

- If the form does not meet your requirements, use the Search field to find a form that fits your needs.

Form popularity

FAQ

Yes, you can establish your own retirement plan through options like individual retirement accounts (IRAs) or self-employed retirement accounts. This flexibility suits many people engaging in North Dakota Monthly Retirement Planning, as it allows you to tailor your investments to your preferences. Researching the available options ensures you choose the best plan for your situation.

Receive a lifetime annuity (retire as early as age 50 or attaining Rule of 85, or age 55, whichever is earlier). Interest no longer accrues when you receive retirement benefit.

SDRS benefits are based on the member's final average compensation, the member's years of credited service, and a benefit multiplier. Retirement benefits are payable for member's lifetime. Surviving spouse benefits are also available.

A pension, or defined benefit plan, is a retirement fund in which the company makes contributions during the work life of the employee. Upon retirement, employees receive a guaranteed payment that is typically based on a percentage of their average salary and the number of years with the company.

You can start your Social Security retirement benefits as early as age 62, but the benefit amount you receive will be less than your full retirement benefit amount.

Unfortunately, the answer is no. The earliest age you can begin receiving Social Security retirement benefits is62. There is a catch. You will reduce your benefit amount if you take Social Security benefits before reaching your new standard retirement age.

The SSA doesn't penalize working retirees forever. You'll receive all of the benefits the government withheld after you reach your full retirement age. At that time, the SSA recalculates your benefit amount.

The minimum eligibility period for receipt of pension is 10 years. A Central Government servant retiring in accordance with the Pension Rules is entitled to receive pension on completion of at least 10 years of qualifying service.

For the full retirement benefit, you must be 62 years old at retirement or, if you have 30 years of credited service, you may retire as early as age 55. With less than 30 years of service, you may retire as early as age 55, but you will receive a reduced benefit.

The NDPERS RHIC Program is a plan that was funded by your employer during your working years. You earn $5 for every year of service credit. Upon retirement, reimbursement up to your monthly RHIC amount may be issued to you for eligible insurance premium expenses.