North Dakota Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee

Description

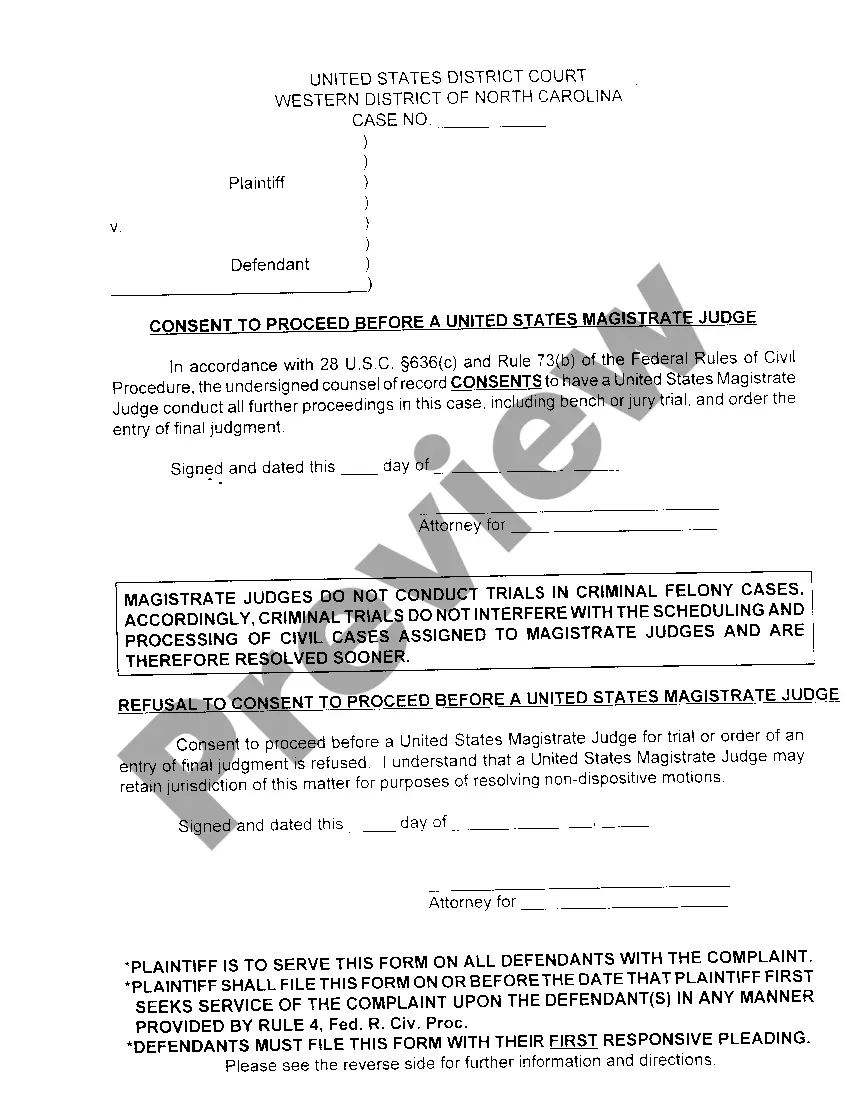

How to fill out Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee?

If you have to total, acquire, or produce legal record web templates, use US Legal Forms, the most important assortment of legal forms, which can be found online. Use the site`s simple and hassle-free look for to get the files you want. Various web templates for enterprise and personal functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to get the North Dakota Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee within a number of clicks.

In case you are already a US Legal Forms buyer, log in in your account and click the Obtain option to obtain the North Dakota Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee. You can also accessibility forms you in the past acquired in the My Forms tab of your account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for the appropriate town/nation.

- Step 2. Use the Review solution to look through the form`s content material. Do not forget about to read the description.

- Step 3. In case you are unhappy with all the type, use the Lookup field on top of the display screen to get other types from the legal type design.

- Step 4. Once you have identified the shape you want, go through the Purchase now option. Opt for the costs prepare you prefer and include your credentials to register on an account.

- Step 5. Procedure the financial transaction. You should use your bank card or PayPal account to complete the financial transaction.

- Step 6. Find the structure from the legal type and acquire it on your device.

- Step 7. Complete, modify and produce or indicator the North Dakota Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee.

Every legal record design you purchase is the one you have eternally. You might have acces to each type you acquired with your acccount. Click on the My Forms portion and pick a type to produce or acquire again.

Be competitive and acquire, and produce the North Dakota Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee with US Legal Forms. There are many expert and status-specific forms you can utilize for your personal enterprise or personal needs.