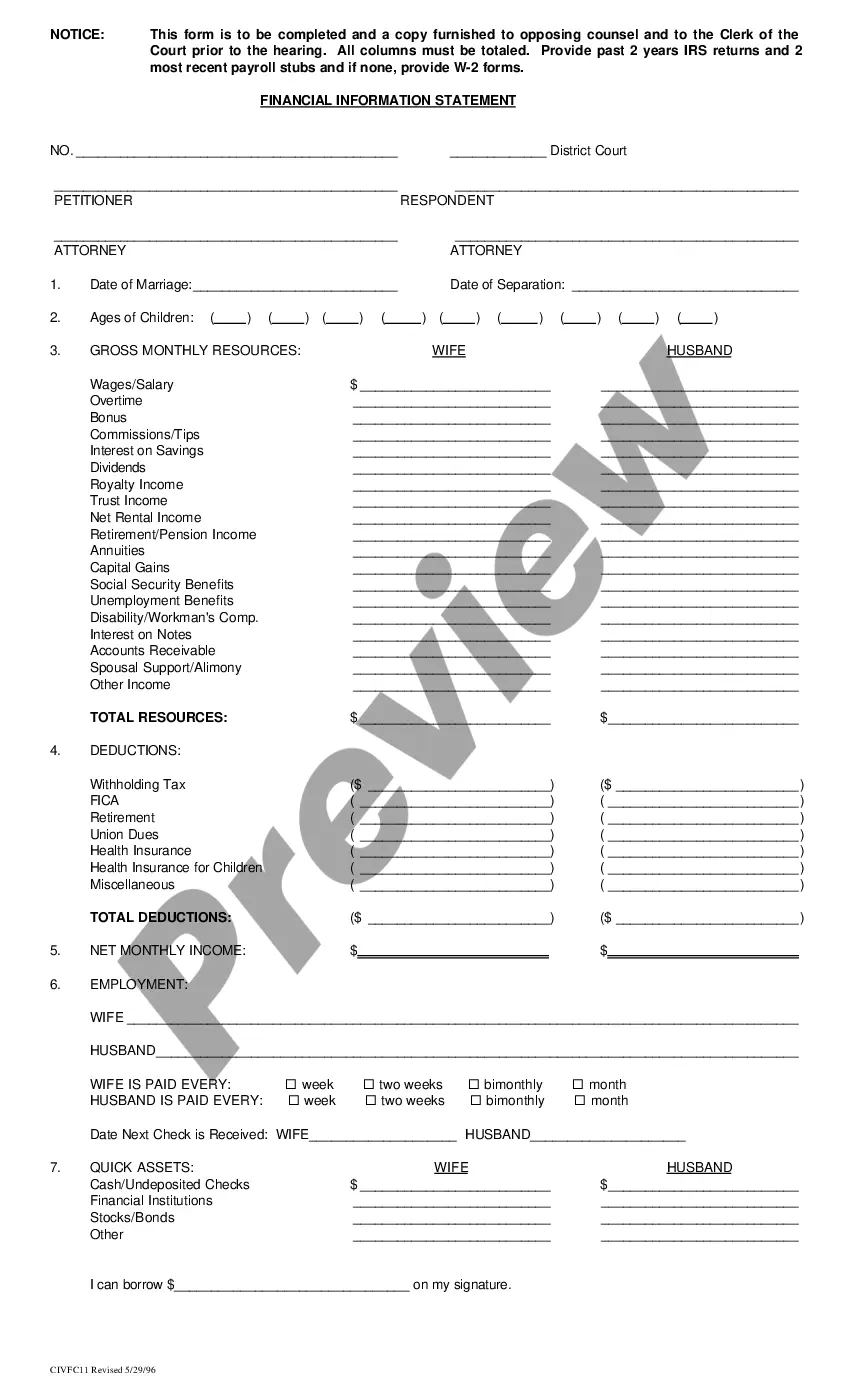

A North Dakota receipt for balance of account is a legal document that provides a detailed record of the remaining amount or balance due from a transaction or account. This receipt serves as proof of payment and ensures transparency between the payer and recipient. It outlines the financial obligations of both parties involved and establishes a paper trail in case of future disputes or discrepancies. The North Dakota receipt for balance of account includes essential information such as the date of the transaction, the name and contact information of the payer and recipient, a unique receipt number, and a breakdown of the outstanding balance. It also typically specifies the mode of payment, whether it was made in cash, check, credit card, or any other accepted form of payment. This receipt plays a crucial role in the reconciliation process as well, enabling individuals and businesses to track their financial transactions accurately. It helps ensure that all payments are duly recorded and accounted for, preventing any confusion or errors in financial records. Different types of North Dakota receipts for balance of account may include: 1. Personal Receipt for Balance of Account: This type of receipt is commonly used between individuals for personal financial transactions, such as repaying a loan or settling shared expenses. It serves as documentation for any remaining balance that needs to be paid. 2. Business Receipt for Balance of Account: This receipt variant is utilized in business transactions, including supplier invoices, customer payments, or account settlements. It helps businesses maintain accurate records of the balance due from their clients or suppliers, facilitating smoother financial management. 3. Vendor Receipt for Balance of Account: This type of receipt is often issued by vendors or service providers to their customers for any remaining amount due after a transaction. It includes details about the services rendered or products provided, along with the outstanding balance to be paid. 4. Outstanding Invoice Receipt for Balance of Account: In some cases, a business may issue an outstanding invoice receipt for the balance of account. This receipt type helps in consolidating multiple unpaid invoices or dues into a single document for ease of reference and settlement. In conclusion, a North Dakota receipt for balance of account is a vital financial document for individuals and businesses alike. It ensures transparency, accuracy, and accountability in financial transactions, while facilitating effective record-keeping and financial dispute resolution.

North Dakota Receipt for Balance of Account

Description

How to fill out North Dakota Receipt For Balance Of Account?

If you want to full, obtain, or print out authorized file layouts, use US Legal Forms, the biggest selection of authorized kinds, that can be found on-line. Utilize the site`s basic and convenient search to get the documents you will need. Different layouts for business and specific functions are sorted by groups and claims, or search phrases. Use US Legal Forms to get the North Dakota Receipt for Balance of Account in a couple of clicks.

If you are currently a US Legal Forms consumer, log in in your accounts and click on the Download option to find the North Dakota Receipt for Balance of Account. You may also gain access to kinds you in the past acquired inside the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape to the correct area/nation.

- Step 2. Make use of the Review choice to look over the form`s information. Don`t neglect to read through the description.

- Step 3. If you are not satisfied together with the type, make use of the Look for field near the top of the display to discover other variations in the authorized type template.

- Step 4. After you have discovered the shape you will need, click on the Buy now option. Opt for the pricing prepare you prefer and add your accreditations to register for an accounts.

- Step 5. Method the deal. You may use your credit card or PayPal accounts to accomplish the deal.

- Step 6. Pick the file format in the authorized type and obtain it on your system.

- Step 7. Total, change and print out or indication the North Dakota Receipt for Balance of Account.

Each and every authorized file template you buy is your own permanently. You have acces to every type you acquired inside your acccount. Go through the My Forms portion and pick a type to print out or obtain yet again.

Contend and obtain, and print out the North Dakota Receipt for Balance of Account with US Legal Forms. There are many specialist and condition-certain kinds you can utilize for your business or specific needs.