Title: North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account: A Comprehensive Guide Introduction: The North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account serves as a crucial tool for accurately verifying and clarifying financial accounts within the state. This checklist aims to ensure compliance with legal requirements and maintain transparency in financial documentation. In this article, we will delve into the essential aspects included in the North Dakota Checklist, providing a detailed description of its purpose, importance, and the key factors to consider when drafting an account verification. 1. Legal and Regulatory Compliance: — Compliance with North Dakota laws and regulations pertaining to the verification of accounts, such as the North Dakota Century Code, Section 13-44-17. — Familiarity with any specific guidelines or requirements issued by regulatory bodies governing the particular industry or sector. 2. Identification and Background Information: — Include the account holder's full legal name, along with any known aliases and identifying information, such as social security number and date of birth. — Verify the account holder's current address, including both physical and mailing addresses. — If applicable, mention any relevant details about the organization or business entity associated with the account. 3. Account Details: — Clearly state the account number(s) and type(s), such as checking, savings, investment, or credit card accounts. — Specify the financial institution(s) where the account(s) is held, including their complete names and addresses. — Include the opening date of the account(s) and, if known, the account balance(s) at that time. 4. Transaction History and Statements: — Provide a comprehensive summary of the account holder's transaction history, if requested. — Discuss any outstanding loans, debts, or liabilities associated with the account. — Include copies of recent account statements, highlighting relevant details like deposits, withdrawals, and interest accrued. 5. Authoritative Signatures and Notarization: — Ensure the verification is signed by an individual authorized to provide such information, such as an account holder, legal representative, or designated officer. — If required, have the signatures notarized in compliance with North Dakota's notary laws. Different Types of North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account: 1. Personal Account Verification: — Specifically designed for individuals to establish or authenticate their personal accounts, such as banking or credit card accounts. 2. Business Account Verification: — Tailored for businesses and organizations to verify their financial accounts, including checking, investment, or loans connected to their operations. 3. Legal Proceedings Account Verification: — A specialized verification required in legal proceedings, such as divorce or inheritance disputes, where thorough account details and transaction history may be needed. Conclusion: The North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account is a vital framework that ensures accurate and comprehensive verification of financial accounts within the state. By adhering to this checklist, individuals and businesses can maintain compliance with North Dakota's laws and regulations, promoting transparency and integrity in financial record-keeping. Whether it be personal or business accounts, adherence to the checklist's essential factors will support a seamless and thorough verification process.

North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out North Dakota Checklist Of Matters To Be Considered In Drafting A Verification Of An Account?

If you want to full, acquire, or printing legitimate record web templates, use US Legal Forms, the biggest assortment of legitimate types, which can be found on the web. Take advantage of the site`s simple and easy convenient look for to find the papers you require. A variety of web templates for organization and specific purposes are categorized by classes and suggests, or search phrases. Use US Legal Forms to find the North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account in just a handful of click throughs.

When you are previously a US Legal Forms consumer, log in in your profile and then click the Obtain switch to have the North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account. Also you can entry types you formerly downloaded inside the My Forms tab of your profile.

If you are using US Legal Forms initially, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for your proper city/nation.

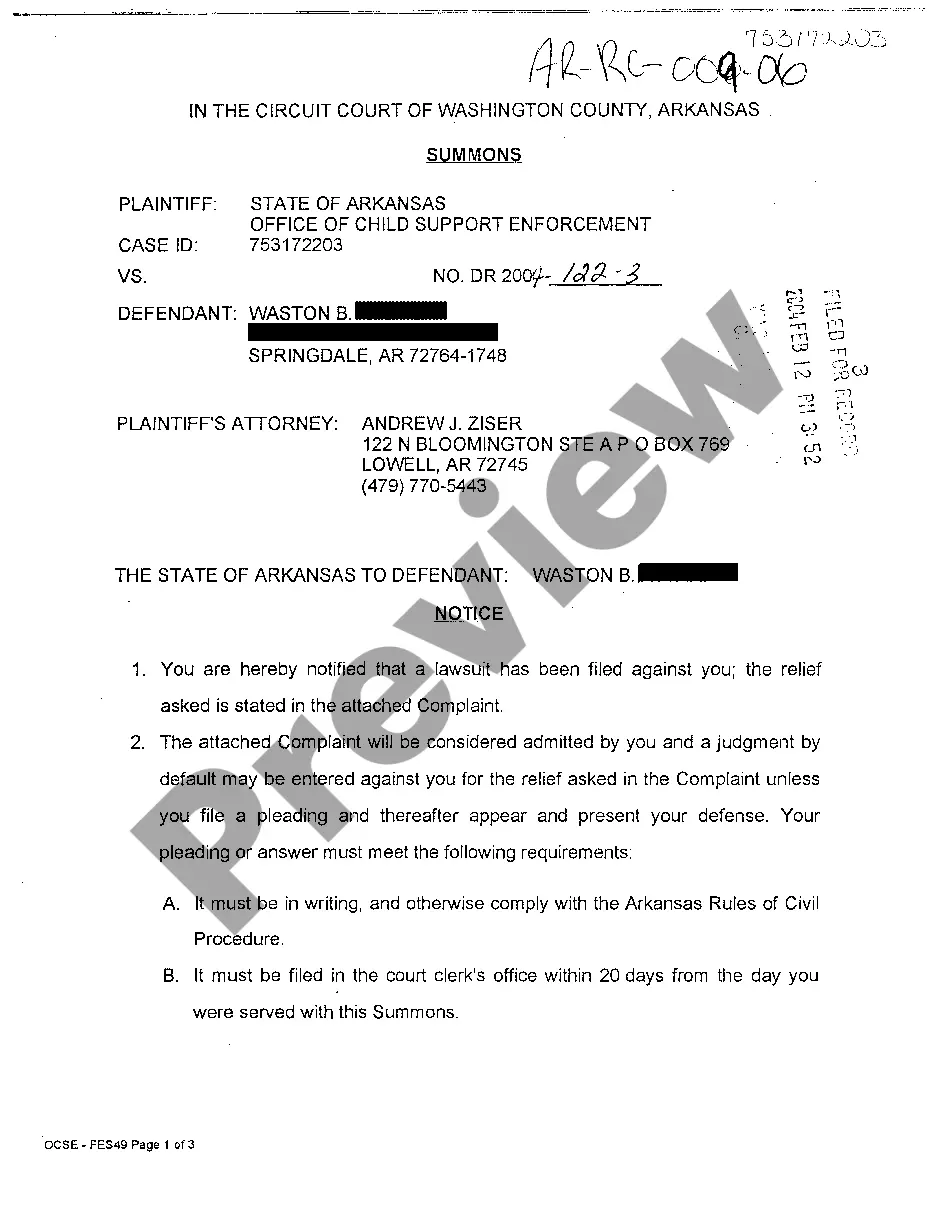

- Step 2. Take advantage of the Review method to look through the form`s content. Never overlook to read through the explanation.

- Step 3. When you are unsatisfied with all the kind, utilize the Research field at the top of the display to discover other types from the legitimate kind format.

- Step 4. When you have discovered the form you require, go through the Get now switch. Opt for the rates strategy you like and add your references to register for the profile.

- Step 5. Process the deal. You can use your bank card or PayPal profile to complete the deal.

- Step 6. Choose the structure from the legitimate kind and acquire it in your device.

- Step 7. Comprehensive, modify and printing or indicator the North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account.

Every single legitimate record format you acquire is your own property for a long time. You have acces to every single kind you downloaded with your acccount. Click on the My Forms portion and decide on a kind to printing or acquire once more.

Contend and acquire, and printing the North Dakota Checklist of Matters to be Considered in Drafting a Verification of an Account with US Legal Forms. There are many skilled and condition-distinct types you can use for your organization or specific demands.