North Dakota Annuity as Consideration for Transfer of Securities is a financial arrangement offered in the state of North Dakota where individuals can transfer their securities in exchange for an annuity. This arrangement helps individuals diversify their investment portfolio and provides them with a reliable income stream for their retirement years. An annuity is a long-term investment product offered by insurance companies, and it comes in different types, depending on the specific needs and preferences of the individual. In North Dakota, there are three main types of annuities available as consideration for the transfer of securities: 1. Fixed Annuities: This type of annuity guarantees a fixed interest rate for a specified period, providing stability and certainty to the investor. It offers a predictable income stream, making it suitable for individuals who prefer minimal risk. 2. Variable Annuities: Variable annuities allow investors to allocate their funds into various investment options such as mutual funds, stocks, and bonds. The returns on these annuities depend on the performance of the chosen investments, offering potential growth opportunities to the investor. However, they also come with higher risks compared to fixed annuities. 3. Indexed Annuities: Indexed annuities provide investors with a return that is linked to a specific market index, such as the S&P 500. These annuities offer the potential for higher returns while also protecting the principal investment from market downturns. Indexed annuities provide a balance between the stability of fixed annuities and the potential growth of variable annuities. Individuals who choose the North Dakota Annuity as Consideration for Transfer of Securities benefit from tax-deferred growth, meaning they do not have to pay taxes on their investment earnings until they start receiving annuity payments. This can help individuals maximize their savings and potentially increase their overall retirement income. It is important for individuals considering the North Dakota Annuity as Consideration for Transfer of Securities to carefully evaluate their financial goals, risk tolerance, and investment preferences before selecting a specific type of annuity. Consulting with a financial advisor who specializes in annuities can help investors make an informed decision and design a retirement strategy that aligns with their needs.

North Dakota Annuity as Consideration for Transfer of Securities

Description

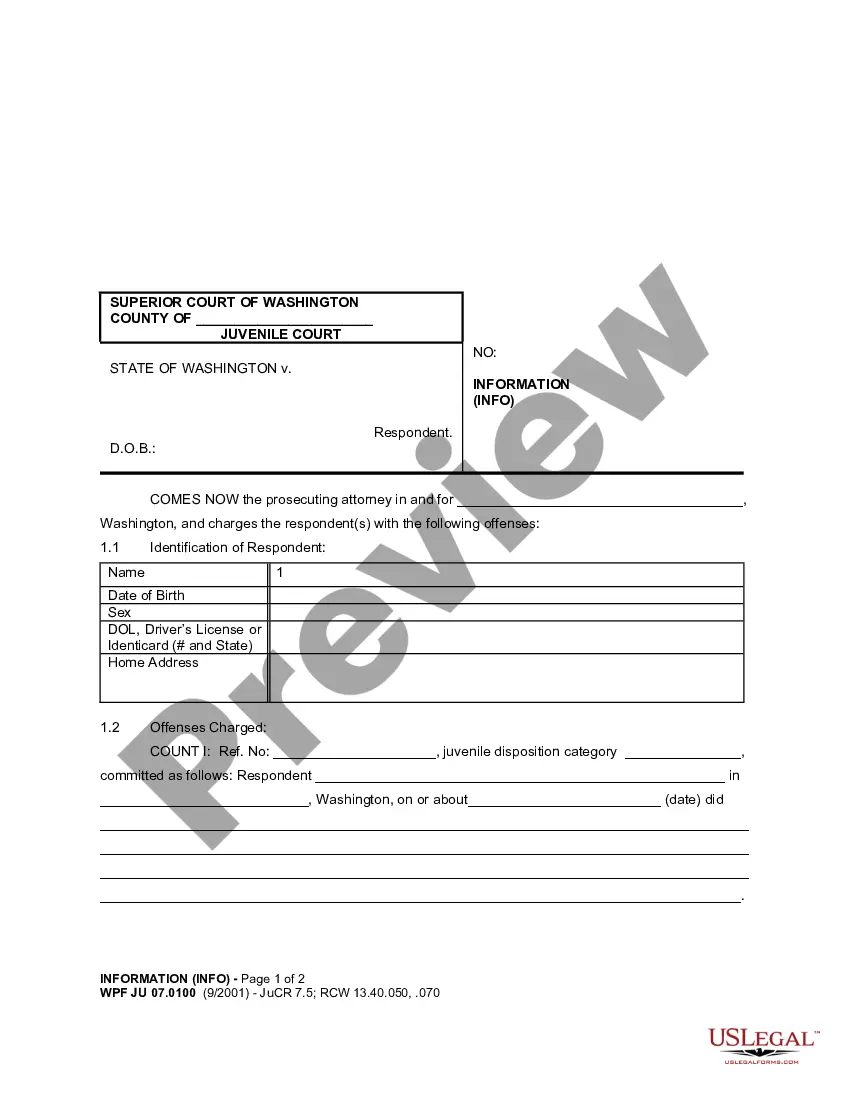

How to fill out North Dakota Annuity As Consideration For Transfer Of Securities?

Choosing the right legal document design can be a have a problem. Naturally, there are a variety of web templates available on the Internet, but how will you obtain the legal kind you want? Make use of the US Legal Forms internet site. The support delivers thousands of web templates, like the North Dakota Annuity as Consideration for Transfer of Securities, that you can use for enterprise and private demands. Each of the forms are checked out by pros and satisfy federal and state specifications.

In case you are currently authorized, log in in your account and then click the Download switch to get the North Dakota Annuity as Consideration for Transfer of Securities. Utilize your account to look with the legal forms you may have purchased earlier. Check out the My Forms tab of your own account and obtain another version in the document you want.

In case you are a fresh customer of US Legal Forms, listed here are easy directions that you can comply with:

- Very first, ensure you have selected the right kind for the city/area. You can examine the shape while using Review switch and look at the shape description to ensure this is the right one for you.

- If the kind is not going to satisfy your requirements, utilize the Seach field to get the right kind.

- When you are sure that the shape is suitable, click on the Purchase now switch to get the kind.

- Choose the pricing prepare you want and enter the essential information and facts. Build your account and pay money for an order making use of your PayPal account or bank card.

- Select the data file formatting and down load the legal document design in your gadget.

- Comprehensive, change and print out and signal the received North Dakota Annuity as Consideration for Transfer of Securities.

US Legal Forms will be the most significant catalogue of legal forms in which you can see various document web templates. Make use of the company to down load professionally-manufactured paperwork that comply with state specifications.