North Dakota Stock Purchase - Letter of Intent

Description

How to fill out Stock Purchase - Letter Of Intent?

US Legal Forms - one of several largest libraries of legal varieties in the USA - provides a wide range of legal papers themes it is possible to acquire or print out. Making use of the internet site, you will get a huge number of varieties for company and person reasons, categorized by groups, suggests, or search phrases.You can find the most up-to-date versions of varieties just like the North Dakota Stock Purchase - Letter of Intent within minutes.

If you currently have a subscription, log in and acquire North Dakota Stock Purchase - Letter of Intent from your US Legal Forms local library. The Down load option will appear on each and every form you perspective. You have accessibility to all earlier downloaded varieties inside the My Forms tab of the account.

If you want to use US Legal Forms the very first time, here are basic guidelines to help you started out:

- Be sure you have picked out the right form for the area/county. Click the Review option to analyze the form`s content material. Read the form explanation to actually have chosen the appropriate form.

- In case the form does not match your needs, make use of the Lookup field towards the top of the display to get the one which does.

- When you are satisfied with the form, validate your decision by clicking the Purchase now option. Then, pick the rates strategy you favor and provide your credentials to register to have an account.

- Approach the transaction. Make use of your credit card or PayPal account to accomplish the transaction.

- Choose the structure and acquire the form on your own product.

- Make changes. Complete, revise and print out and sign the downloaded North Dakota Stock Purchase - Letter of Intent.

Every single format you added to your bank account does not have an expiration date and is your own property permanently. So, in order to acquire or print out an additional copy, just proceed to the My Forms area and click on around the form you want.

Get access to the North Dakota Stock Purchase - Letter of Intent with US Legal Forms, the most substantial local library of legal papers themes. Use a huge number of specialist and condition-particular themes that fulfill your business or person requirements and needs.

Form popularity

FAQ

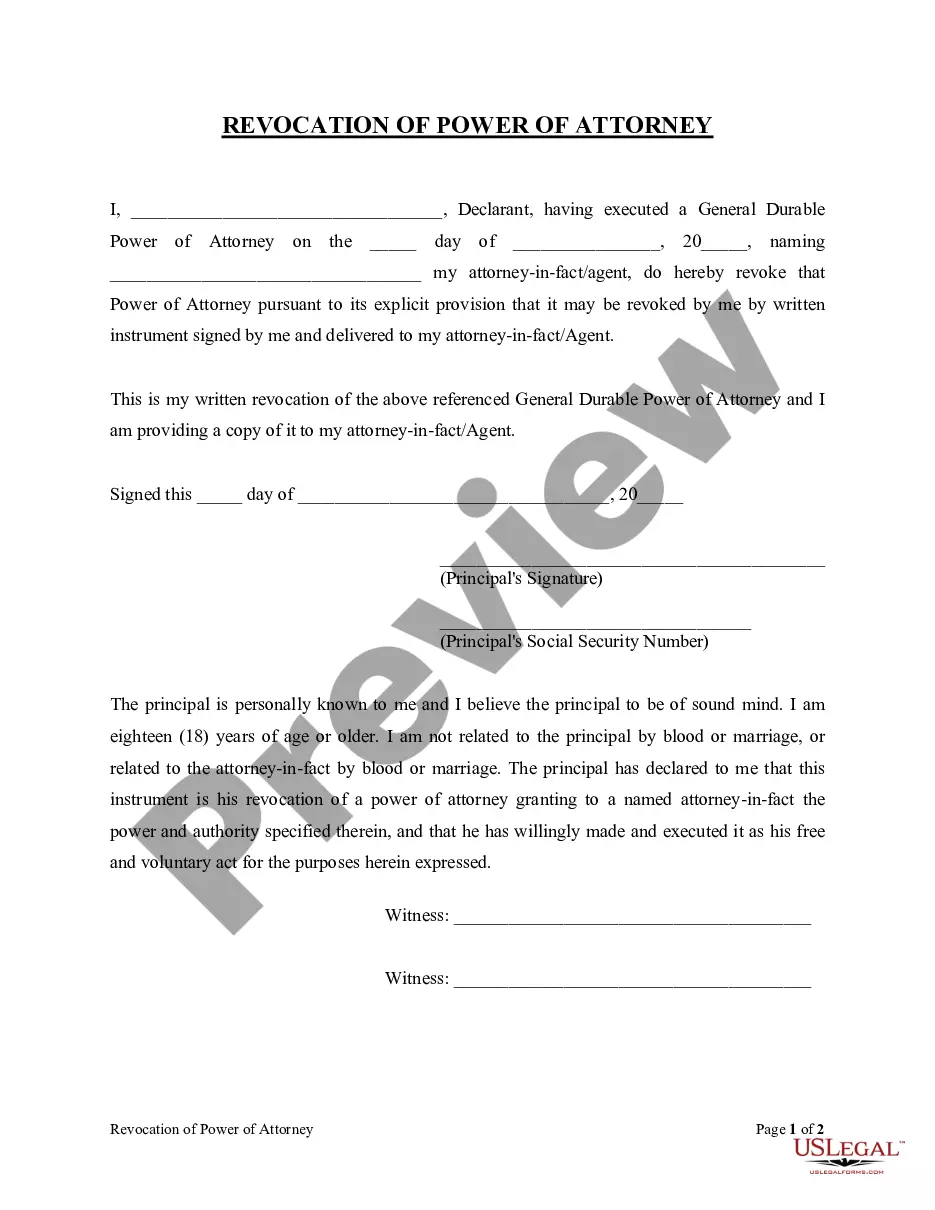

A letter of intent to purchase is a written document in which a buyer establishes their intent to purchase a product or service. The document details what will be purchased, the payment terms, and mutual promises between the parties (such as confidentiality clauses).

A Letter of Intent (LOI) is a short non-binding contract that precedes a binding agreement, such as a share purchase agreement or asset purchase agreement (definitive agreements). There are some provisions, however, that are binding such as non-disclosure, exclusivity, and governing law.

Use the first one or two sentences of your letter to formally introduce yourself. This section can include your name, a brief explanation of your current experience level and your reason for writing. For example, if you're a recent graduate, include information about your degree and areas of study.

What to include in letters of intent to purchase. Name and contact information of the buyer. Name and contact information of the seller. Detailed description of the items or property being sold. Any relevant disclaimers or liabilities. The total purchase price. Method of payment and other payment terms, including dates.

Similar to a cover letter or letter of interest, a letter of intent follows a business letter format. It should be a few paragraphs that introduce you as a candidate, outline your intentions, and encourage the reader to follow up.

A stock purchase letter of intent is used for the purchase of a limited number of stocks in a company or corporation from an individual or entity that owns the desired shares. A letter of intent is often non-binding and is instead a preliminary offer prior to the signing of a purchase agreement.

The Letter of Intent is a written, non- binding document which outlines an agreement in principle for the buyer to purchase the seller's business, stating the proposed price and terms. The mutually signed LOI is required before the buyer proceeds with the ?due diligence? phase of acquisition.

What is a Letter of Intent to Purchase? A letter of intent to purchase is a written document detailing a buyer's intent to purchase a seller's product, assets, or services. It's used to establish and indicate an understanding between two or more parties which provides the basis for a future or proposed agreement.