A North Dakota Waiver of the Right to be Spouse's Beneficiary is a legal document that allows an individual to voluntarily relinquish their rights as a spouse's beneficiary. This waiver is commonly used in estate planning and aims to clarify the intentions of both spouses regarding the distribution of assets upon death. Under North Dakota law, spouses are generally entitled to certain rights and benefits upon the death of their partner. These rights may include the right to inherit a certain portion of the deceased's estate, be named as the beneficiary of life insurance policies or retirement accounts, and claim a homestead allowance or exempt property. However, individuals may decide to waive these rights for various reasons, often to allow for customized estate planning or ensure the distribution of assets in a particular way. The North Dakota Waiver of the Right to be Spouse's Beneficiary must meet specific legal requirements to be valid. It should be in writing and signed by the waiving party in the presence of a notary public. Additionally, it is advisable for both spouses to consult with separate attorneys to ensure the document is drafted accurately and reflects their wishes. There are different types of North Dakota Waiver of the Right to be Spouse's Beneficiary, including: 1. Full Waiver: A full waiver agreement relinquishes all rights and claims the spouse may have as a beneficiary upon the death of their partner. This type of waiver is often used when spouses have separate estate plans, or if one spouse wishes to provide for children from a previous marriage. 2. Partial Waiver: A partial waiver allows the waiving spouse to give up certain rights or benefits while still retaining others. For instance, one may waive their right to inherit from their spouse's estate outright, but retain their entitlement to certain insurance policies or retirement accounts. 3. Temporary Waiver: In some circumstances, a temporary waiver may be appropriate. This type of waiver is often utilized when spouses may be estranged or do not wish to receive benefits during a specific period, such as when a divorce is pending. It allows for flexibility in changing beneficiary designations while still being legally binding. Overall, a North Dakota Waiver of the Right to be Spouse's Beneficiary is a valuable legal tool that allows spouses to customize their estate plans to meet their specific needs and objectives. However, it is crucial for individuals considering such waivers to seek professional legal advice to ensure compliance with North Dakota laws and protect their rights and interests.

North Dakota Waiver of the Right to be Spouse's Beneficiary

Description

How to fill out North Dakota Waiver Of The Right To Be Spouse's Beneficiary?

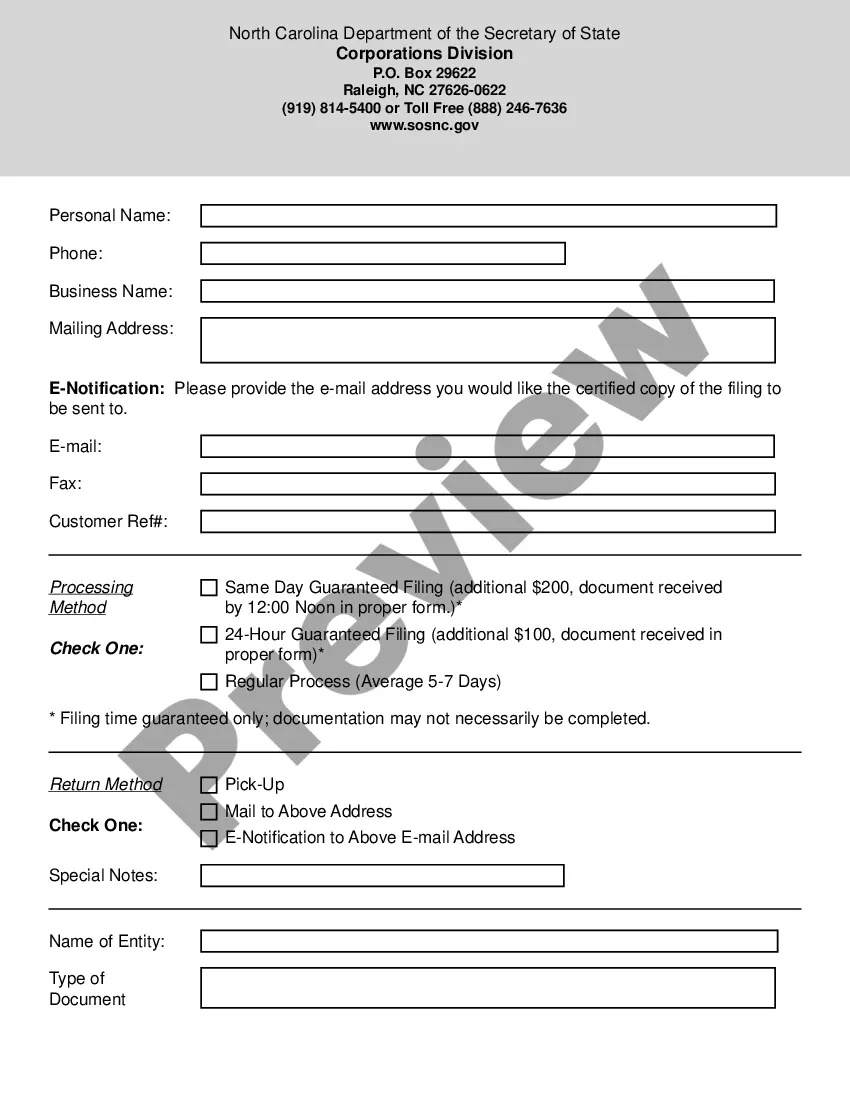

You are able to devote several hours on the web searching for the legal file design which fits the state and federal specifications you need. US Legal Forms gives a large number of legal varieties which can be evaluated by specialists. It is possible to acquire or produce the North Dakota Waiver of the Right to be Spouse's Beneficiary from our service.

If you already possess a US Legal Forms account, you are able to log in and click the Download button. Next, you are able to full, modify, produce, or signal the North Dakota Waiver of the Right to be Spouse's Beneficiary. Every single legal file design you get is your own forever. To obtain another version associated with a purchased develop, visit the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website the first time, stick to the straightforward instructions below:

- Very first, be sure that you have chosen the right file design to the area/area that you pick. Browse the develop information to ensure you have selected the proper develop. If readily available, take advantage of the Review button to appear through the file design also.

- In order to locate another edition from the develop, take advantage of the Lookup field to discover the design that meets your requirements and specifications.

- Upon having identified the design you want, simply click Acquire now to carry on.

- Choose the rates plan you want, type your accreditations, and register for an account on US Legal Forms.

- Full the purchase. You can use your Visa or Mastercard or PayPal account to cover the legal develop.

- Choose the structure from the file and acquire it for your system.

- Make adjustments for your file if needed. You are able to full, modify and signal and produce North Dakota Waiver of the Right to be Spouse's Beneficiary.

Download and produce a large number of file web templates making use of the US Legal Forms website, that provides the largest variety of legal varieties. Use professional and status-particular web templates to tackle your organization or personal requirements.

Form popularity

FAQ

If you die intestate in North Dakota, your estate will pass on to your closest living relatives, but to whom depends on who you leave behind spouses, children, parents, even siblings.

How long does Probate take? Probate will likely take at least 6 months after the initial court date to open the estate. A more realistic minimum time would be 9 to 12 months.

Probate is always needed to deal with a property after the owner dies. However, other organisations such as the deceased's bank, insurer, or pension provider may also request to see a Grant of Probate before releasing any money held in the deceased's name.

Contesting wills can only be done by your spouse, children, or people included in your will or codicil (or a previous will or codicil). To contest a will, the person must file a contest during the probate process (the court procedure that enacts a will).

What Happens If You Never Go to Probate? If Probate is necessary but never established, beneficiaries will not receive their inheritance or assets. The assets of the deceased person will be held by the state and frozen as there are no legal beneficiaries of the assets.

Is Probate Required in North Dakota? The simple answer is yes, probate is usually required in North Dakota. However, there are exceptions where an estate may not need to go through probate for the heirs to gain access to the assets.

The spouse amending his or her will must provide the other spouse with sufficient notice so that individual can also amend his/her will as desired. However, once one spouse passes away, the surviving spouse cannot amend the mutual will, meaning there is a limited window of opportunity for such an amendment.

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

In North Dakota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).