North Dakota FCRA Disclosure and Authorization Statement

Description

How to fill out FCRA Disclosure And Authorization Statement?

Are you presently inside a place in which you need to have paperwork for either enterprise or individual purposes just about every time? There are a lot of legal record themes available on the Internet, but discovering types you can rely on is not simple. US Legal Forms provides thousands of form themes, such as the North Dakota FCRA Disclosure and Authorization Statement, that happen to be composed to meet state and federal specifications.

Should you be previously knowledgeable about US Legal Forms web site and get your account, simply log in. Next, you are able to obtain the North Dakota FCRA Disclosure and Authorization Statement template.

If you do not have an profile and wish to begin to use US Legal Forms, adopt these measures:

- Find the form you will need and make sure it is for your proper metropolis/area.

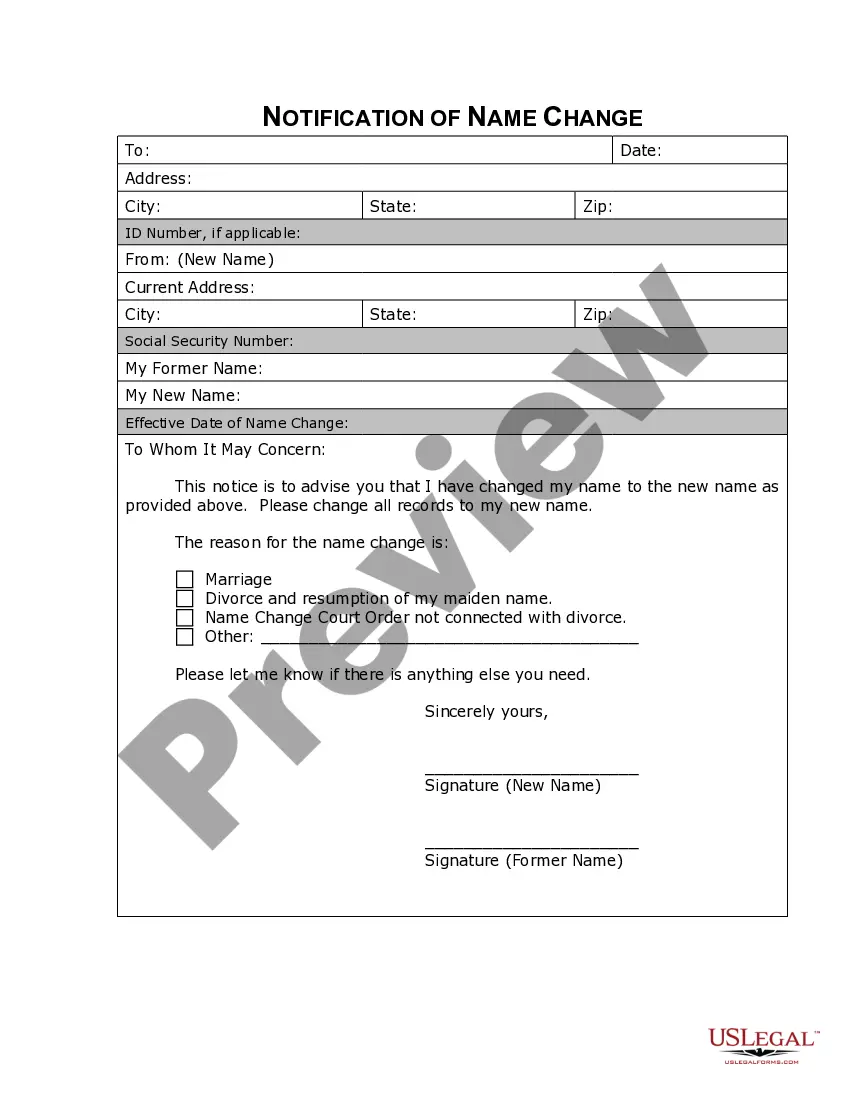

- Make use of the Preview option to check the shape.

- Read the explanation to actually have chosen the proper form.

- When the form is not what you are searching for, utilize the Research discipline to discover the form that meets your requirements and specifications.

- Once you obtain the proper form, just click Get now.

- Opt for the pricing program you would like, complete the required information to create your money, and buy your order using your PayPal or charge card.

- Select a convenient document file format and obtain your copy.

Locate each of the record themes you may have purchased in the My Forms food list. You may get a additional copy of North Dakota FCRA Disclosure and Authorization Statement any time, if necessary. Just select the needed form to obtain or printing the record template.

Use US Legal Forms, the most considerable collection of legal kinds, to save time and avoid errors. The services provides appropriately created legal record themes which you can use for an array of purposes. Create your account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy. Restrictions around who can access your reports.

FCRA Authorization: Obtain Permission for a Background Check A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

A Summary of Your Rights Under the Fair Credit Reporting Act. The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of. information in the files of consumer reporting agencies.

Specifically, the FCRA requires that you must provide a clear and conspicuous written notice that consists solely of the disclosure. In other words, the disclosure must be (1) clear and conspicuous; and (2) exist as a standalone document.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

What is FCRA Compliance? FCRA compliance is designed to protect consumers. The FCRA regulates employers that use background reports and the Consumer Reporting Agencies (CRAs) (aka background screening companies) that provide the information.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.

The state of North Dakota does not have any restrictions on what can be reported in a background screening report beyond what the Fair Credit Reporting Act (FCRA) dictates.

The FCRA requires that before an employer pulls a consumer report for employment purposes that the employer give the applicant a clear and conspicuous disclosure that the employer may obtain such a report. The disclosure must be in a document that consists solely of the disclosure. 15 U.S.C. 1681b(b)(2)(A)(i).