North Dakota Employee Evaluation Form for Farmer

Description

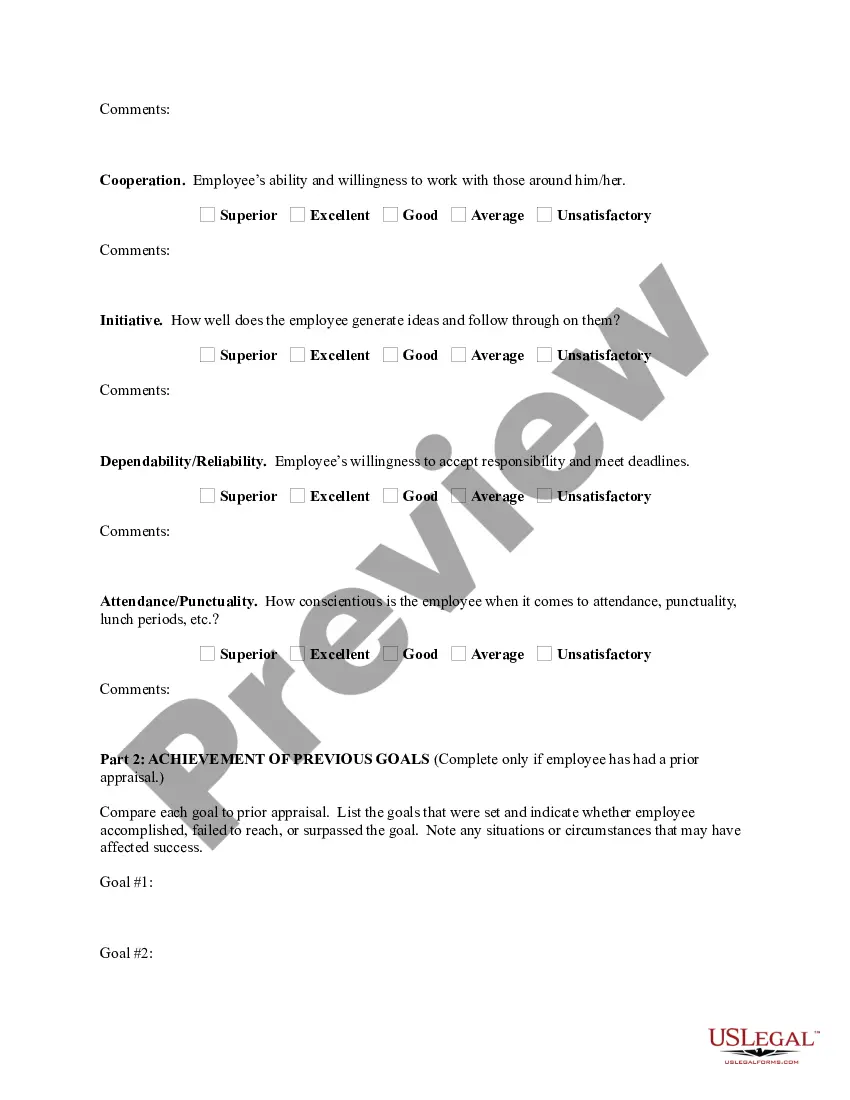

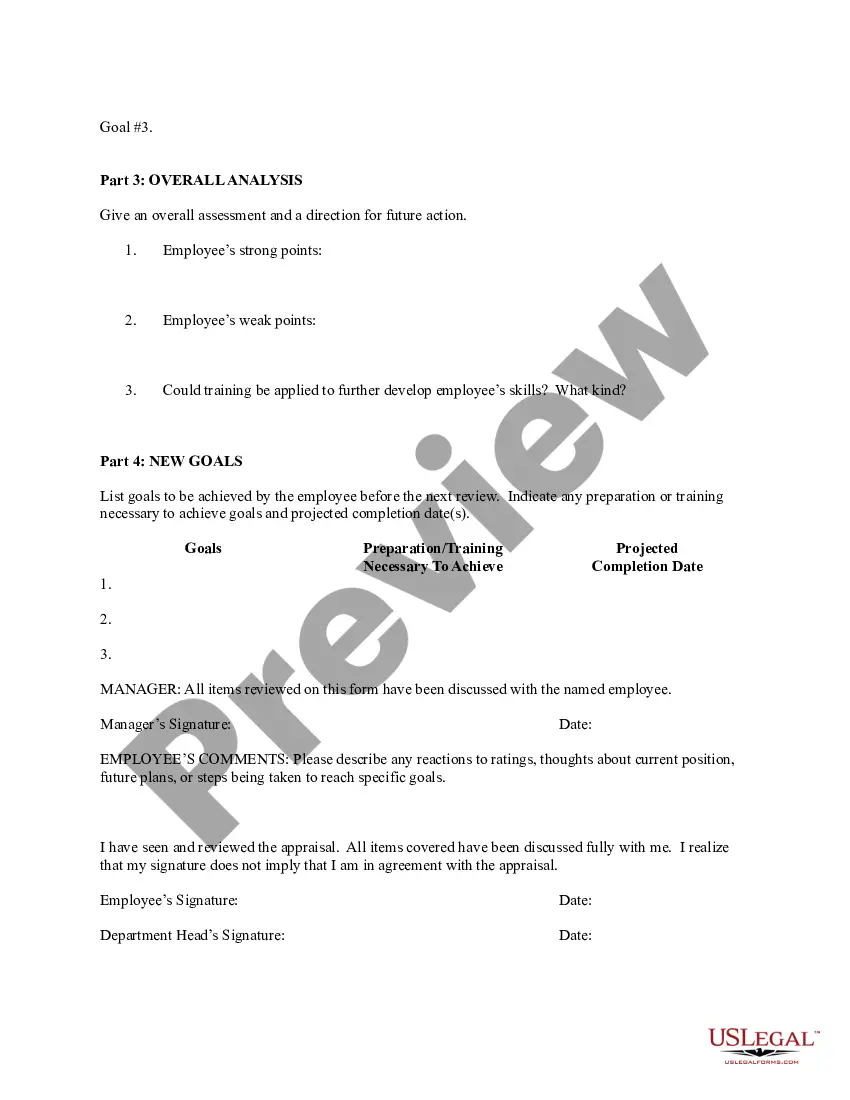

How to fill out North Dakota Employee Evaluation Form For Farmer?

Have you been within a position where you require documents for sometimes business or personal reasons nearly every day? There are a lot of lawful document layouts accessible on the Internet, but getting types you can rely isn`t simple. US Legal Forms gives 1000s of type layouts, like the North Dakota Employee Evaluation Form for Farmer, that happen to be written to fulfill federal and state demands.

Should you be currently familiar with US Legal Forms internet site and get your account, basically log in. Next, you may obtain the North Dakota Employee Evaluation Form for Farmer web template.

Unless you provide an profile and would like to start using US Legal Forms, follow these steps:

- Get the type you need and ensure it is for that appropriate city/state.

- Use the Review switch to review the form.

- Look at the explanation to actually have selected the proper type.

- In case the type isn`t what you are seeking, take advantage of the Search field to find the type that meets your needs and demands.

- If you find the appropriate type, click Get now.

- Opt for the costs plan you need, fill out the desired information and facts to make your account, and pay for an order using your PayPal or Visa or Mastercard.

- Decide on a convenient file file format and obtain your backup.

Get each of the document layouts you have purchased in the My Forms food selection. You can aquire a further backup of North Dakota Employee Evaluation Form for Farmer whenever, if necessary. Just click the required type to obtain or print the document web template.

Use US Legal Forms, probably the most considerable assortment of lawful varieties, to save efforts and prevent faults. The service gives professionally created lawful document layouts which can be used for a variety of reasons. Produce your account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

North Dakota Income Tax WithholdingNorth Dakota requires employers to withhold state income tax from employees' wages and remit the amounts withheld to the State Tax Commissioner.

As an employer, you may need to withhold three types of income tax from employee wages, including federal, state, and local income taxes. You must distribute both federal and state Forms W-4 to employees so you can accurately run payroll.

There are currently seven states which utilize the Federal Withholding elections declared on the Federal Form W-4 for state tax purposes.Colorado.Delaware.Nebraska.New Mexico.North Dakota.South Carolina.Utah.

As of 2021, Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

U.S. States that Require State Tax Withholding FormsAlabama.Arizona.Arkansas.California.Connecticut.District of Columbia.Georgia.Hawaii.More items...

The W-4 is a form that you complete and give to your employer (not the IRS) for federal tax and the equivalent form for state tax withholding. The W-4 communicates to your employer(s) how much federal and/or state tax you - and your spouse if s/he works - wish to have withheld from each paycheck in a pay period.

Tax Forms & Instructions You may determine if you need to pay estimated tax to North Dakota using Form ND1ES Estimated Income Tax Individuals.

127, Bismarck, ND 58505-0599. 2022 Mail Form 307 with paper information returns to: Office of State Tax Commissioner, PO Box 5624, Bismarck, ND 58506-5624.

North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to withhold. For more information regarding income tax withholding, see: Guideline Income Tax Withholding & Information Returns. Income Tax Withholding Rates and Instructions.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.