North Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form

Description

How to fill out Discharge Of Joint Debtors - Chapter 7 - Updated 2005 Act Form?

Are you inside a position in which you need to have files for either business or personal reasons nearly every time? There are plenty of legal document web templates available on the Internet, but getting kinds you can depend on is not straightforward. US Legal Forms offers 1000s of type web templates, just like the North Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form, which are composed to fulfill state and federal demands.

Should you be presently familiar with US Legal Forms internet site and have a free account, merely log in. Afterward, you are able to download the North Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form format.

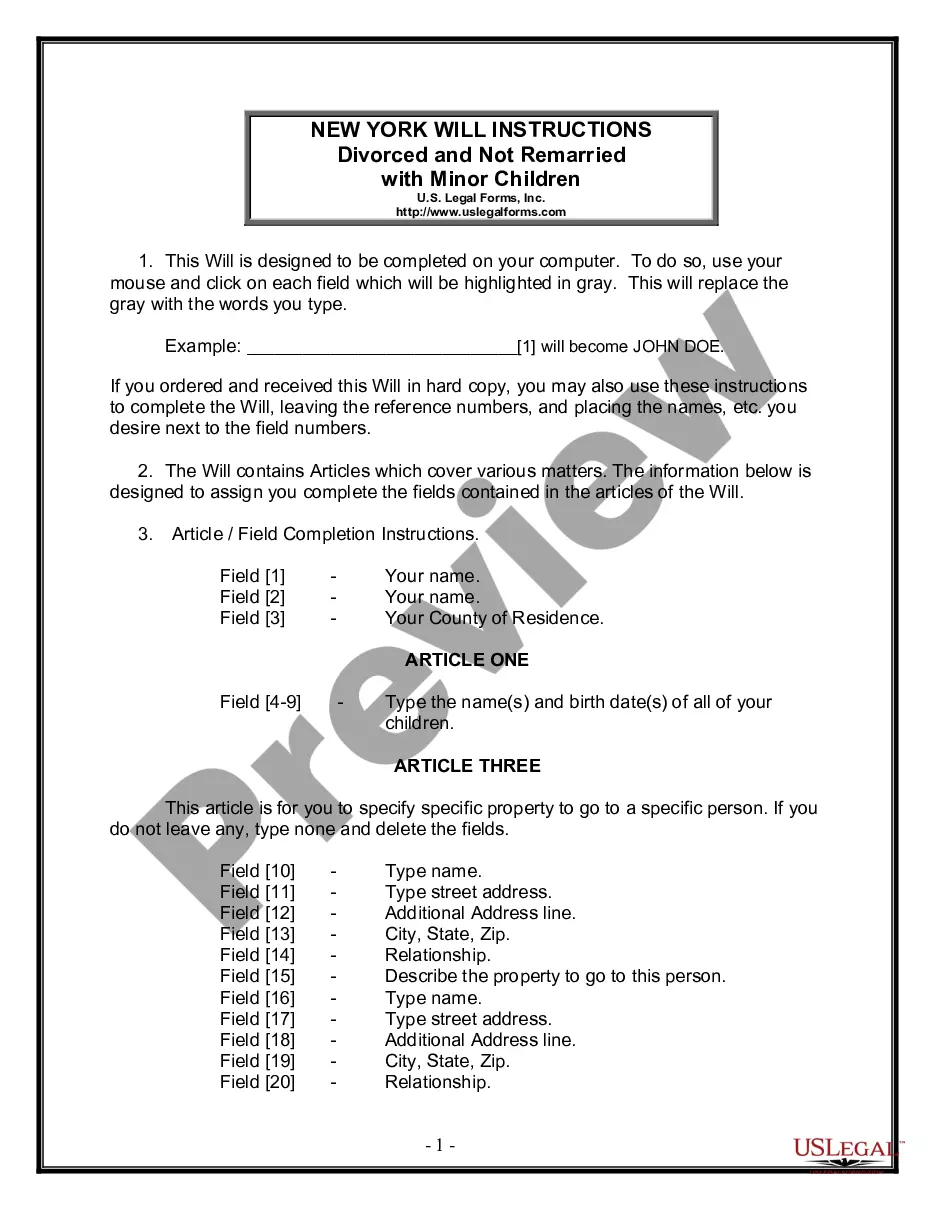

Unless you provide an accounts and want to begin to use US Legal Forms, adopt these measures:

- Get the type you need and ensure it is for your right area/area.

- Make use of the Review button to examine the shape.

- See the outline to ensure that you have chosen the right type.

- When the type is not what you are seeking, make use of the Search industry to get the type that suits you and demands.

- Whenever you find the right type, click on Get now.

- Opt for the prices prepare you need, fill out the necessary details to produce your bank account, and purchase the order utilizing your PayPal or bank card.

- Decide on a handy file structure and download your version.

Discover all of the document web templates you may have purchased in the My Forms food selection. You can obtain a extra version of North Dakota Discharge of Joint Debtors - Chapter 7 - updated 2005 Act form whenever, if necessary. Just click on the required type to download or print out the document format.

Use US Legal Forms, the most extensive assortment of legal types, to save lots of time and stay away from blunders. The assistance offers professionally manufactured legal document web templates which you can use for a selection of reasons. Generate a free account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

The discharge received by an individual debtor in a Chapter 11 case discharges the debtor from all pre-confirmation debts except those that would not be dischargeable in a Chapter 7 case filed by the same debtor.

Dischargeable debts under Chapter 7 include: Personal and payday loans (unsecured) Mortgage or automobile loans for which you are unable to pay (but creditors can reclaim the house or vehicle) HOA fees (if you surrender the home or condo) Utility bills.

That being said, here's what you're not allowed to do with a Chapter 7: Lie under oath about your financial or property assets. Keep property that must be used to discharge your debts. Miss payments to certain creditors in order to keep your home.

Filing Chapter 7 bankruptcy in Florida includes the following steps: Determine if bankruptcy is the best option. ... Evaluate applicable exemptions. ... Prepare the bankruptcy petition. ... Automatic stay. ... Assignment to a Chapter 7 trustee. ... Objection to exemptions. ... Adversary claims. ... Bankruptcy discharge. How to File Chapter 7 Bankruptcy in Florida (Updated 2023) - Alper Law alperlaw.com ? bankruptcy ? chapter-7-ban... alperlaw.com ? bankruptcy ? chapter-7-ban...

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors. What Is The Difference Between Chapter 7, 11 And 13 | Bankruptcy ... bunchandbrocklaw.com ? difference-betwee... bunchandbrocklaw.com ? difference-betwee...

Not All Debts Are Discharged Certain debts will remain on your account when you file for Chapter 7 bankruptcy. You will still be responsible for alimony and child support. Tax liens, student loans, and personal injury debts caused by intoxicated drivers are still on the docket, as well.

A Chapter 7 bankruptcy wipes out mortgages, car loans, and other secured debts. But if you don't continue to pay as agreed, the lender will take back the home, car, or other collateralized property using the lender's lien rights. Which Debts Can You Discharge in Chapter 7 Bankruptcy? - Nolo nolo.com ? legal-encyclopedia ? debt-discha... nolo.com ? legal-encyclopedia ? debt-discha...

Chapter 7 bankruptcy is a type of bankruptcy filing commonly referred to as liquidation because it involves selling the debtor's assets in bankruptcy. Assets, like real estate, vehicles, and business-related property, are included in a Chapter 7 filing.

Chapter 7 is your better bet if you are hopelessly awash in debt from credit cards, medical bills, personal loans, and/or car loans and your income simply cannot keep up. As noted above, you're most likely going to get to keep most of your assets while erasing your unsecured debt.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor. Chapter 7 - Bankruptcy Basics | United States Courts uscourts.gov ? services-forms ? chapter-7-b... uscourts.gov ? services-forms ? chapter-7-b...