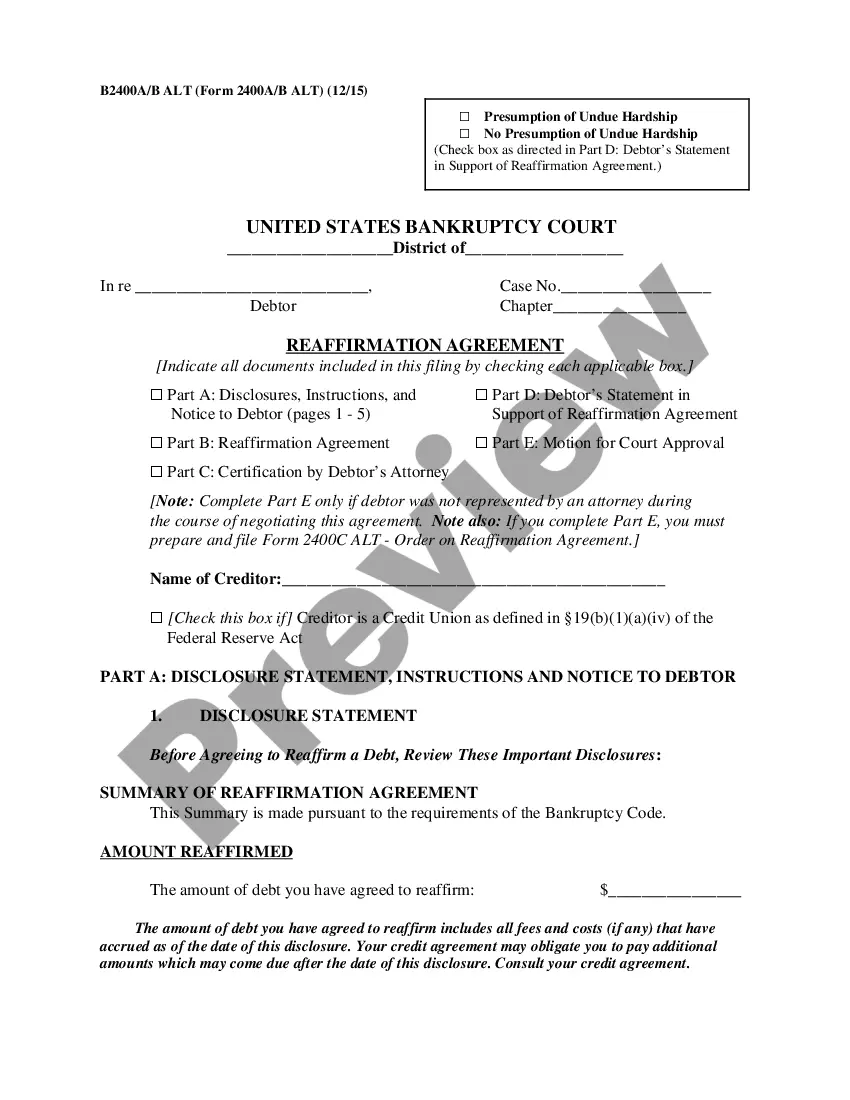

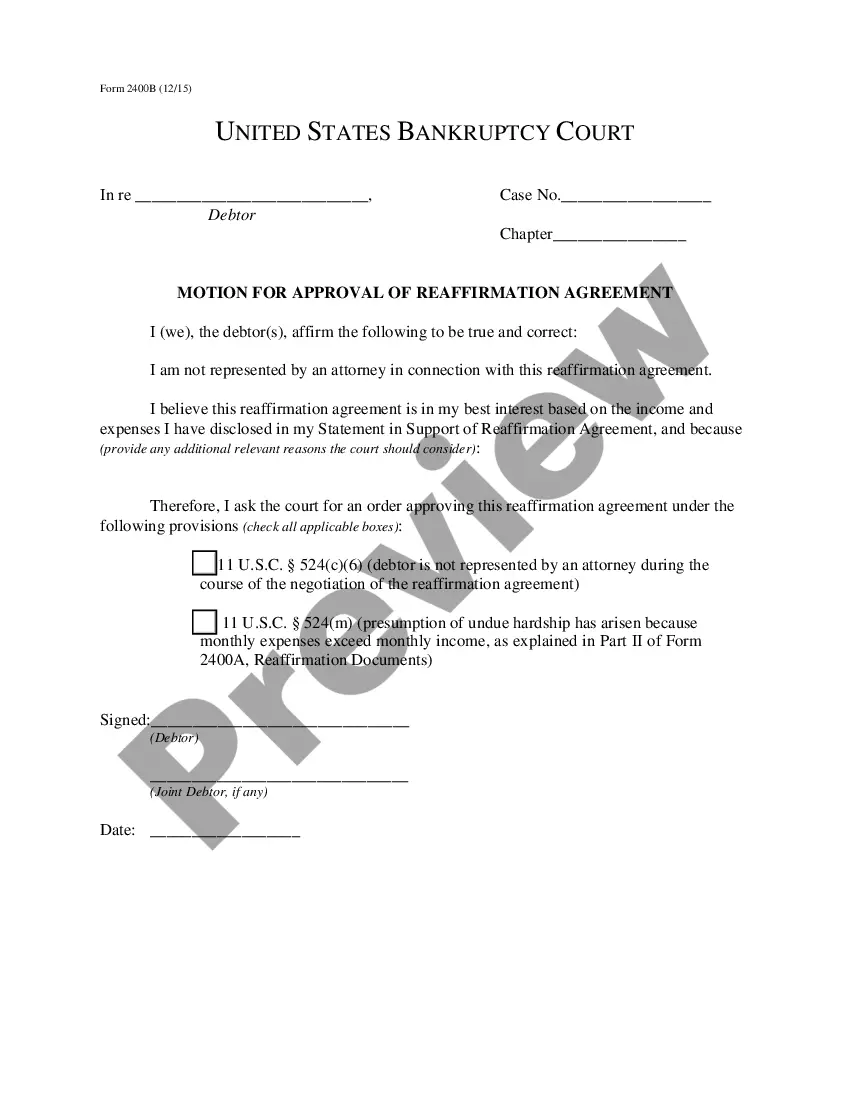

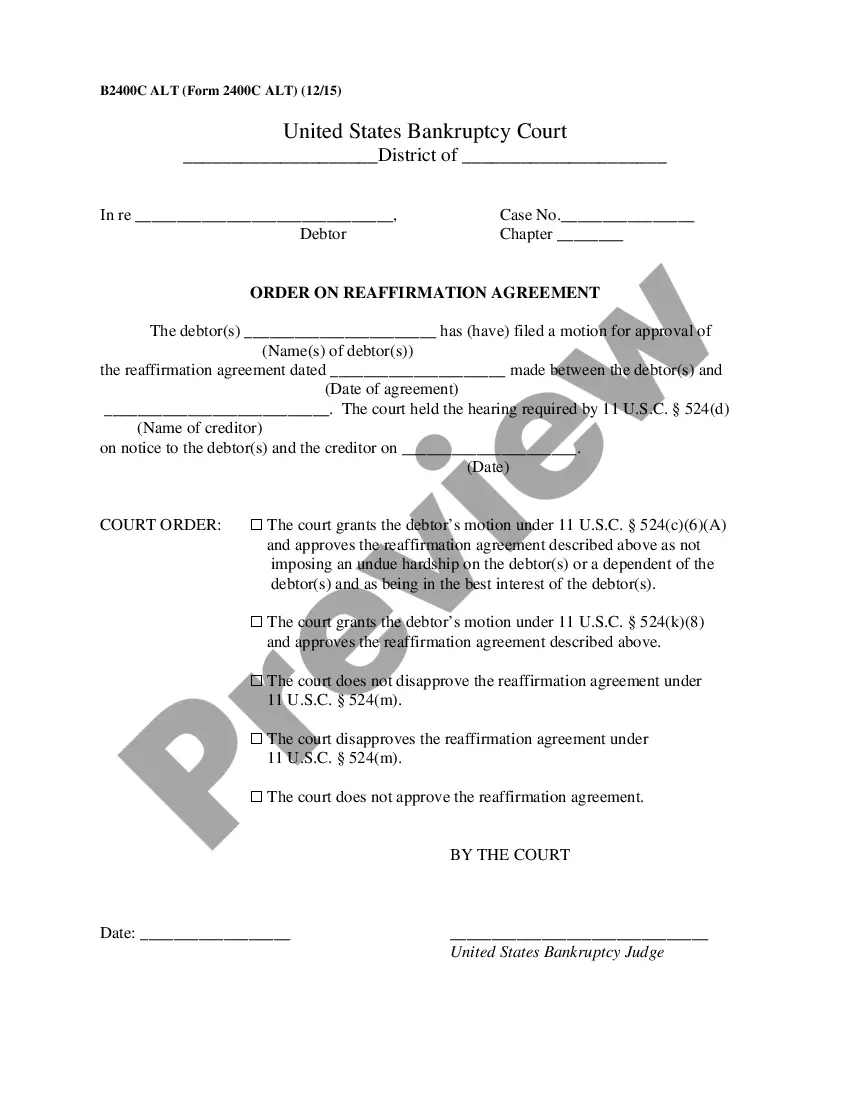

North Dakota Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

Choosing the right legal papers web template could be a struggle. Naturally, there are plenty of templates available on the net, but how do you find the legal form you require? Take advantage of the US Legal Forms internet site. The services gives thousands of templates, like the North Dakota Reaffirmation Agreement, Motion and Order, which can be used for business and personal demands. All the forms are checked out by professionals and satisfy federal and state requirements.

If you are previously registered, log in for your bank account and click the Down load button to have the North Dakota Reaffirmation Agreement, Motion and Order. Make use of your bank account to appear with the legal forms you have bought previously. Go to the My Forms tab of your respective bank account and obtain an additional duplicate of the papers you require.

If you are a whole new customer of US Legal Forms, listed below are straightforward recommendations for you to stick to:

- Initially, make certain you have chosen the appropriate form for your personal area/region. It is possible to look over the shape utilizing the Preview button and browse the shape information to ensure this is basically the best for you.

- If the form is not going to satisfy your expectations, make use of the Seach area to discover the right form.

- When you are sure that the shape would work, click on the Acquire now button to have the form.

- Choose the pricing plan you need and enter the needed info. Build your bank account and pay for your order making use of your PayPal bank account or bank card.

- Pick the document format and download the legal papers web template for your system.

- Total, edit and produce and sign the attained North Dakota Reaffirmation Agreement, Motion and Order.

US Legal Forms is the biggest local library of legal forms that you can find various papers templates. Take advantage of the service to download expertly-created paperwork that stick to state requirements.

Form popularity

FAQ

Reaffirming puts you personally on the hook for the debt, even after your discharge. The Court may not approve the reaffirmation if it is not in your best interest. The agreement is voluntary for you and for the creditor?the creditor may refuse to offer a reaffirmation.

What's a Presumption of Undue Hardship? A presumption of undue hardship arises when a filer's expenses exceed their monthly income. This shows there isn't enough money to cover the monthly payment that would be required by the reaffirmation agreement.

A reaffirmed debt remains your personal legal obligation to pay. Your reaffirmed debt is not discharged in your bankruptcy case. That means that if you default on your reaffirmed debt after your bankruptcy case is over, your creditor may be able to take your property or your wages.

A reaffirmation agreement is where you agree to pay a debt even though you could have eliminated the debt in your bankruptcy case. When you reaffirm a debt, you continue to be legally responsible for paying it back. This gives the creditor some legal rights.

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

To cancel a reaffirmation agreement, you must notify the creditor. It is a good idea to notify the creditor in writing via certified mail with a return receipt postcard so you have proof that you have rescinded the agreement.

Even if the debtor signs a reaffirmation agreement, and the agreement is approved by the court, the debtor has 60 days after the agreement is filed with the court (or the date of entry of discharge, whichever is later) to change his/her mind and rescind the agreement.