The North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 is an essential document used in bankruptcy cases within the state of North Dakota. The purpose of this statement is to determine a debtor's current monthly income and calculate their disposable income, which is crucial for the successful completion of a Chapter 13 bankruptcy repayment plan. This document plays a significant role in ensuring fair distribution of income among creditors while enabling debtors to regain their financial stability. The North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 consists of several components. These components may vary slightly depending on the specific region or jurisdiction within North Dakota, but the fundamental purpose remains consistent. Some key elements commonly included in this document are: 1. Debtor Information: This pertains to the debtor's personal details, such as their full legal name, address, contact information, and other necessary identification information. 2. Income Sources: This section requires the debtor to disclose all sources of income, including employment, self-employment, rental income, investments, government assistance, pensions, and any other sources contributing to their monthly earnings. 3. Calculation of Current Monthly Income: Here, the debtor must provide accurate details of their average monthly income over the past six months. This includes wages, bonuses, commissions, tips, and any other regular income received during that period. 4. Deductions: This section allows the debtor to deduct various expenses and payments required to determine their disposable income accurately. Tax deductions, medical expenses, child support, spousal support, and certain other legally allowed deductions are taken into consideration. 5. Disposable Income Calculation: Once the current monthly income and deductions have been established, this section calculates the debtor's disposable income. Disposable income refers to the remaining funds available to be allocated towards debt repayment under the Chapter 13 repayment plan. Different types or variations of the North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 may exist based on specific local regulations or court preferences. However, the ultimate goal is to assess the debtor's financial capacity and create a reasonable repayment plan that aligns with their income and expenses. This statement serves as a crucial document in a Chapter 13 bankruptcy case, allowing debtors and creditors alike to evaluate the debtor's financial situation accurately. It facilitates transparency and fairness throughout the bankruptcy process, ensuring that debtors can responsibly repay their debts while protecting their rights and interests. In conclusion, the North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 — Post 2005 is a comprehensive document used to determine a debtor's current monthly income and disposable income. By accurately assessing a debtor's financial situation, this statement aids in establishing a reasonable repayment plan that allows debtors to regain control of their finances and successfully navigate the bankruptcy process.

North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out North Dakota Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

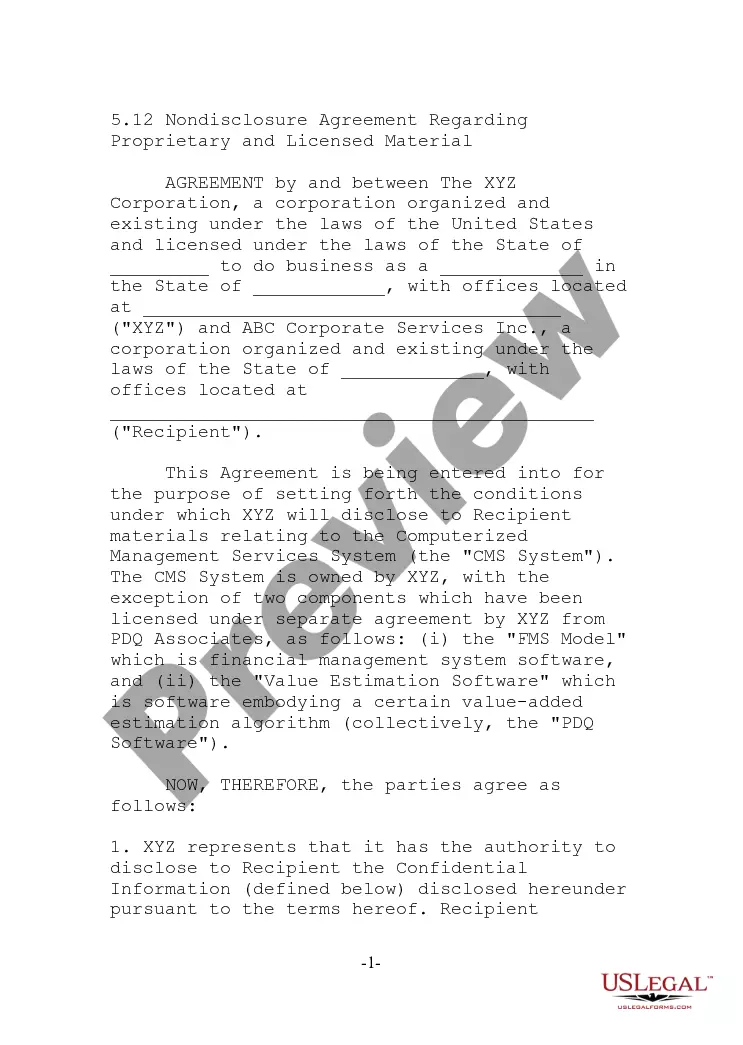

Choosing the best authorized papers web template can be a have a problem. Needless to say, there are a lot of themes accessible on the Internet, but how would you discover the authorized form you will need? Utilize the US Legal Forms website. The service offers a large number of themes, including the North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005, which you can use for organization and personal requirements. All the kinds are examined by experts and meet up with state and federal requirements.

If you are already registered, log in for your accounts and click the Acquire button to find the North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Make use of accounts to check through the authorized kinds you may have bought earlier. Go to the My Forms tab of your respective accounts and acquire one more copy of the papers you will need.

If you are a fresh end user of US Legal Forms, allow me to share simple recommendations so that you can stick to:

- First, ensure you have chosen the right form for your personal city/area. You are able to look over the form making use of the Review button and browse the form explanation to ensure this is basically the best for you.

- In the event the form fails to meet up with your needs, utilize the Seach area to discover the proper form.

- When you are certain the form is suitable, select the Acquire now button to find the form.

- Choose the prices program you would like and enter in the required details. Make your accounts and purchase the transaction using your PayPal accounts or bank card.

- Select the file file format and download the authorized papers web template for your device.

- Full, change and produce and indication the obtained North Dakota Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

US Legal Forms may be the biggest local library of authorized kinds in which you can find numerous papers themes. Utilize the service to download skillfully-manufactured papers that stick to status requirements.