North Dakota Proposed Additional Compensation Plan with copy of plan

Description

How to fill out Proposed Additional Compensation Plan With Copy Of Plan?

If you wish to total, download, or print out legitimate record web templates, use US Legal Forms, the biggest selection of legitimate types, that can be found on the web. Use the site`s easy and hassle-free research to get the papers you need. A variety of web templates for organization and individual purposes are sorted by classes and suggests, or keywords. Use US Legal Forms to get the North Dakota Proposed Additional Compensation Plan with copy of plan with a number of click throughs.

When you are presently a US Legal Forms consumer, log in in your profile and click the Obtain switch to get the North Dakota Proposed Additional Compensation Plan with copy of plan. Also you can entry types you earlier acquired from the My Forms tab of your profile.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the form for your correct city/nation.

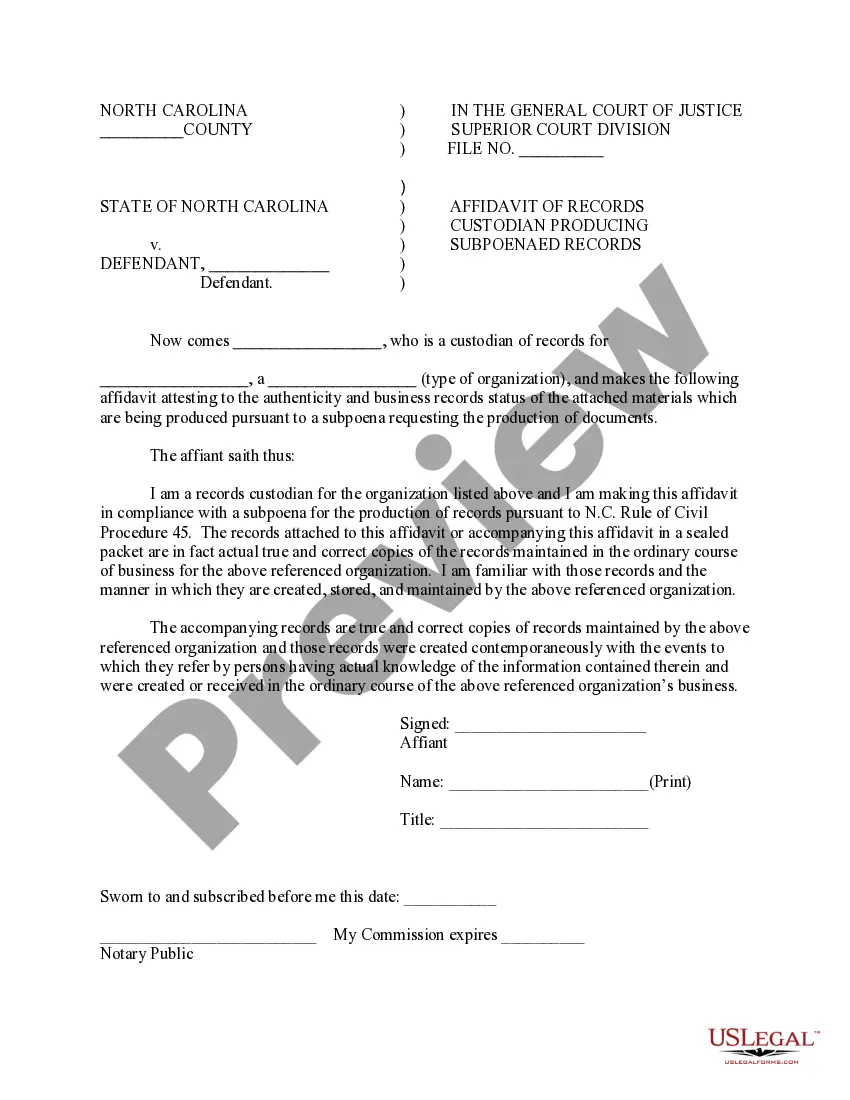

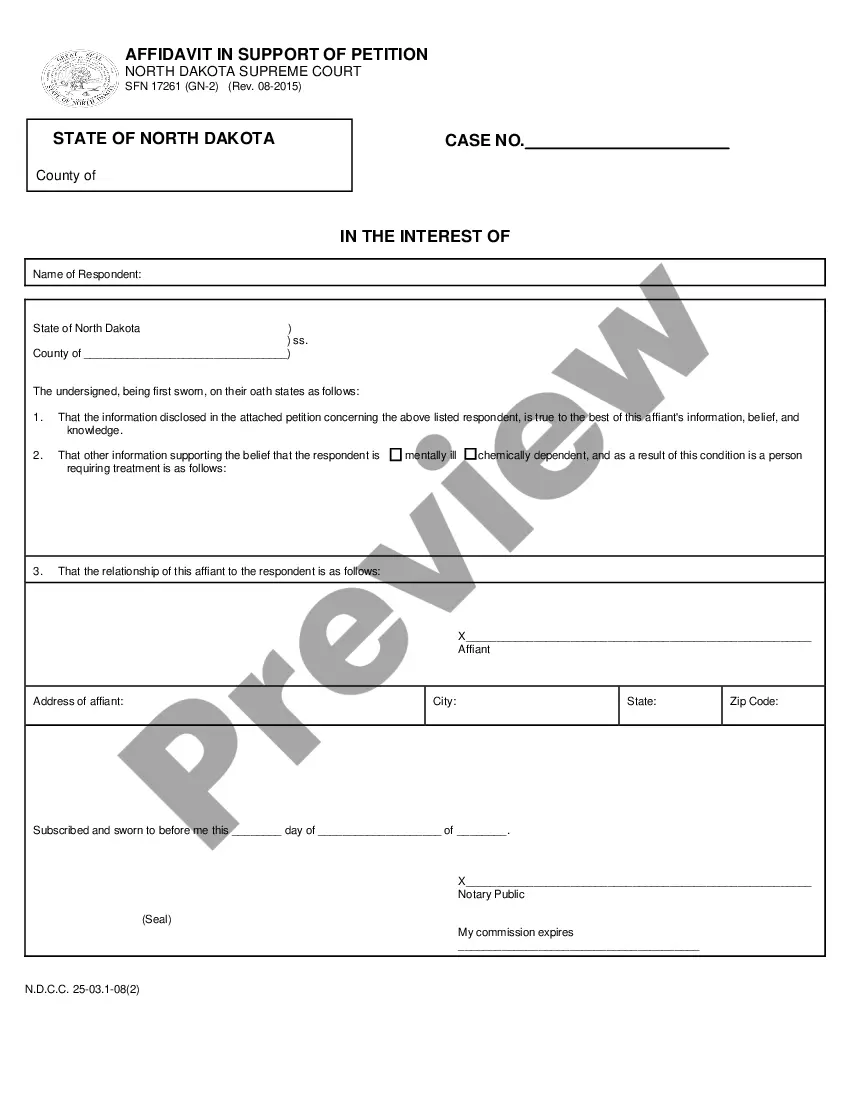

- Step 2. Utilize the Preview method to look over the form`s articles. Do not forget about to read through the outline.

- Step 3. When you are unsatisfied together with the type, use the Search area on top of the display screen to locate other versions in the legitimate type format.

- Step 4. Once you have located the form you need, select the Purchase now switch. Choose the prices plan you choose and put your references to register for the profile.

- Step 5. Procedure the purchase. You should use your credit card or PayPal profile to complete the purchase.

- Step 6. Pick the formatting in the legitimate type and download it in your gadget.

- Step 7. Comprehensive, revise and print out or sign the North Dakota Proposed Additional Compensation Plan with copy of plan.

Every legitimate record format you buy is yours permanently. You may have acces to each type you acquired with your acccount. Go through the My Forms section and pick a type to print out or download once more.

Remain competitive and download, and print out the North Dakota Proposed Additional Compensation Plan with copy of plan with US Legal Forms. There are thousands of skilled and status-certain types you can use for the organization or individual demands.

Form popularity

FAQ

Your contributions help fund the pension plan, guaranteeing monthly benefits for you and other retired teachers in the future. To qualify for this pension plan, you must first meet the following requirements: Age 65 with five years of service. Rule of 90 (your age and service years must add up to 90)

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, 401(k) retirement plans, and employee stock options.

Like many states, North Dakota has no specific retirement age that is mandated by law. This means that individuals are free to retire whenever they choose, as long as they are able to financially support themselves.

Put the plan in writing: Think of it as a contract with your employee. Be sure to include the deferred amount and when your business will pay it. Decide on the timing: You'll need to choose the events that trigger when your business will pay an employee's deferred income.