North Dakota Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

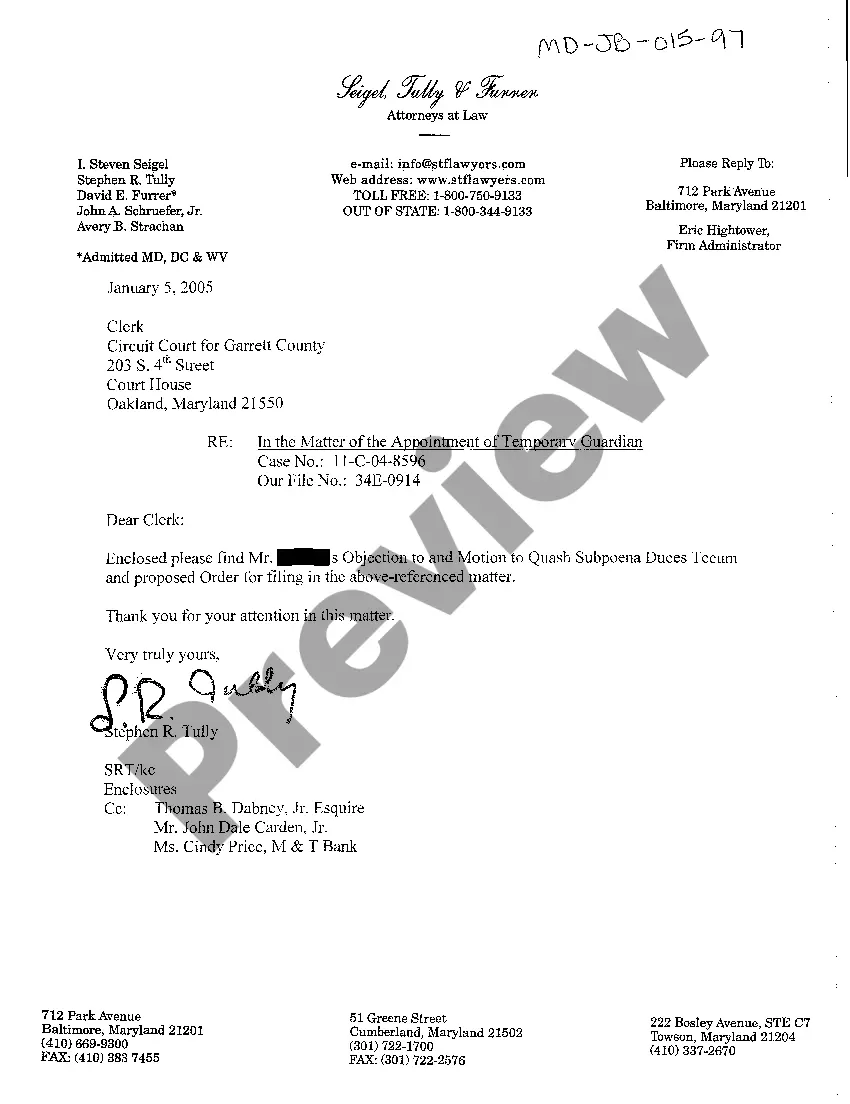

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

If you want to complete, down load, or print out legal papers web templates, use US Legal Forms, the largest collection of legal kinds, which can be found online. Utilize the site`s simple and easy convenient look for to get the documents you will need. A variety of web templates for business and personal reasons are sorted by groups and claims, or key phrases. Use US Legal Forms to get the North Dakota Ratification and approval of directors and officers insurance indemnity fund with copy of agreement with a number of clicks.

If you are already a US Legal Forms consumer, log in to the profile and click on the Obtain button to get the North Dakota Ratification and approval of directors and officers insurance indemnity fund with copy of agreement. You can also gain access to kinds you in the past delivered electronically from the My Forms tab of your respective profile.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for that proper area/region.

- Step 2. Use the Review method to examine the form`s articles. Don`t neglect to read the description.

- Step 3. If you are not happy with the develop, make use of the Lookup area near the top of the display screen to get other types of the legal develop template.

- Step 4. Upon having located the form you will need, select the Purchase now button. Pick the costs strategy you prefer and add your qualifications to sign up for an profile.

- Step 5. Method the financial transaction. You may use your charge card or PayPal profile to perform the financial transaction.

- Step 6. Select the format of the legal develop and down load it in your product.

- Step 7. Total, change and print out or indication the North Dakota Ratification and approval of directors and officers insurance indemnity fund with copy of agreement.

Every single legal papers template you acquire is your own property eternally. You might have acces to every develop you delivered electronically inside your acccount. Go through the My Forms section and decide on a develop to print out or down load once more.

Be competitive and down load, and print out the North Dakota Ratification and approval of directors and officers insurance indemnity fund with copy of agreement with US Legal Forms. There are millions of professional and state-particular kinds you may use for your personal business or personal requirements.

Form popularity

FAQ

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.

A Nominee Director Indemnity Agreement In principle, it states that: The nominee director does not have any role in your company. The nominee director will not give any personal guarantees or sign any business documents, unless they were already signed by the shareholder.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

Similar to your PII, a D & O policy is purchased by the company and arranged in the company name, but the fundamental difference is it provides important financial protection to the individual directors, partners and managers for their day-to-day decisions and actions in running the business.

D&O insurance specifically covers members on a board of directors and officers. Professional liability insurance, on the other hand, covers professionals (of nearly any position within a company) that offer specialized services.