A North Dakota cash award paid to holders of non-exercisable stock options upon merger or consolidation refers to a monetary compensation given to individuals holding stock options in a company that are not currently exercisable, when that company undergoes a merger or consolidation with another entity in the state of North Dakota. This type of cash award serves as a financial recognition for holding these non-exercisable stock options during the merger or consolidation process. During a merger or consolidation, companies may choose to combine their operations, assets, and resources to form a single entity, aiming to enhance efficiency, expand market presence, or achieve strategic objectives. As part of this process, the treatment of existing stock options held by employees or stakeholders becomes crucial. The North Dakota cash award paid to holders of non-exercisable stock options upon merger or consolidation ensures that individuals who hold these non-exercisable stock options are compensated for the potential value they would have received had these options been exercisable. It provides a fair financial settlement to these stakeholders, recognizing their contribution and aligning their interests with the outcome of the merger or consolidation. The specific types of North Dakota cash awards paid to holders of non-exercisable stock options upon merger or consolidation can vary based on the terms and conditions specified in the company's stock option plan and the provisions agreed upon during the merger or consolidation process. These types may include: 1. Cash bonus: Holders of non-exercisable stock options may receive a cash bonus equivalent to the difference between the strike price (the predetermined price at which the option can be exercised) and the fair market value of the stock at the time of the merger or consolidation. 2. Restricted stock units (RSS): Instead of a cash award, holders may be granted RSS, which represent a promise to deliver company stock at a specified future date or event. The number of RSS granted can be determined based on factors such as market conditions, outstanding options, or negotiations during the merger or consolidation. 3. Phantom stock: Similar to RSS, holders may be awarded phantom stock, which creates a synthetic form of ownership without actual shares. These phantom units have a cash value tied to the company's stock price and are settled with cash upon the merger or consolidation. 4. Equity conversion: In some cases, the non-exercisable stock options may be converted into exercisable options in the acquiring or surviving company, allowing holders to benefit from potential future stock price increases. When considering a North Dakota cash award paid to holders of non-exercisable stock options upon merger or consolidation, it is essential for companies to consult legal and financial professionals to ensure compliance with applicable laws, contract provisions, and accounting standards.

North Dakota Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out North Dakota Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

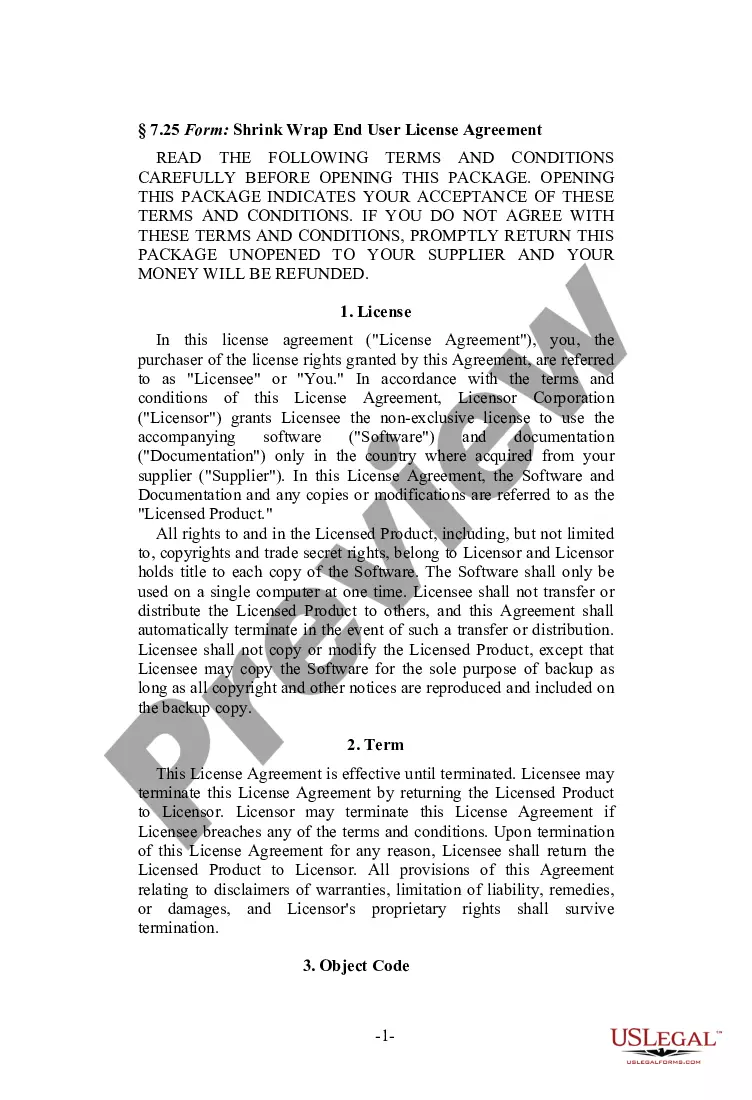

Choosing the best legitimate file template might be a battle. Obviously, there are a lot of themes available on the Internet, but how do you obtain the legitimate type you require? Utilize the US Legal Forms website. The assistance provides 1000s of themes, like the North Dakota Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, which can be used for company and private requirements. All of the types are checked by professionals and meet state and federal requirements.

If you are presently authorized, log in for your bank account and click the Obtain key to obtain the North Dakota Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation. Make use of your bank account to look from the legitimate types you may have purchased formerly. Go to the My Forms tab of your respective bank account and get another backup of your file you require.

If you are a brand new user of US Legal Forms, listed below are basic recommendations that you should comply with:

- Initial, make sure you have selected the right type for the area/county. It is possible to examine the form using the Preview key and browse the form description to make certain this is the best for you.

- If the type will not meet your requirements, make use of the Seach industry to get the proper type.

- When you are sure that the form is suitable, go through the Get now key to obtain the type.

- Choose the costs program you need and enter the required information and facts. Make your bank account and pay money for the transaction making use of your PayPal bank account or credit card.

- Opt for the document format and acquire the legitimate file template for your system.

- Complete, change and print and signal the attained North Dakota Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation.

US Legal Forms will be the largest library of legitimate types in which you can find a variety of file themes. Utilize the company to acquire skillfully-made papers that comply with express requirements.