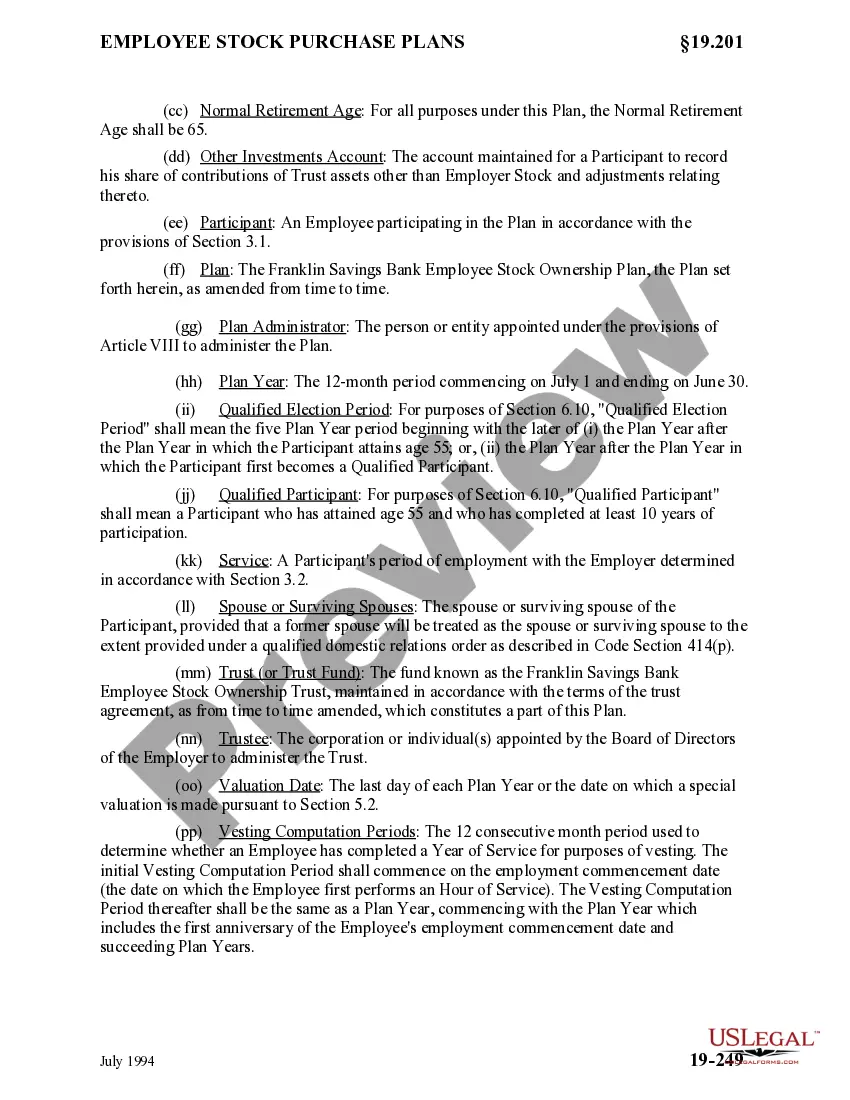

North Dakota Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

How to fill out Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

If you have to complete, download, or print legitimate file web templates, use US Legal Forms, the most important variety of legitimate varieties, that can be found on the web. Make use of the site`s simple and practical research to discover the documents you require. Numerous web templates for enterprise and specific reasons are categorized by categories and says, or search phrases. Use US Legal Forms to discover the North Dakota Employee Stock Ownership Plan of Franklin Savings Bank - Detailed in just a number of mouse clicks.

In case you are already a US Legal Forms consumer, log in to the bank account and then click the Down load key to get the North Dakota Employee Stock Ownership Plan of Franklin Savings Bank - Detailed. You can also entry varieties you in the past acquired in the My Forms tab of the bank account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form for that proper town/region.

- Step 2. Utilize the Review solution to look through the form`s content. Don`t overlook to read through the outline.

- Step 3. In case you are not satisfied with all the type, utilize the Search industry near the top of the screen to get other variations in the legitimate type web template.

- Step 4. After you have found the form you require, select the Purchase now key. Pick the rates plan you prefer and put your credentials to sign up on an bank account.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal bank account to complete the purchase.

- Step 6. Find the formatting in the legitimate type and download it on the product.

- Step 7. Total, edit and print or indication the North Dakota Employee Stock Ownership Plan of Franklin Savings Bank - Detailed.

Each and every legitimate file web template you purchase is yours for a long time. You might have acces to every type you acquired within your acccount. Go through the My Forms section and decide on a type to print or download once more.

Be competitive and download, and print the North Dakota Employee Stock Ownership Plan of Franklin Savings Bank - Detailed with US Legal Forms. There are millions of skilled and express-certain varieties you can use for your enterprise or specific needs.

Form popularity

FAQ

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

An Employee Share Ownership Plan (ESOP) allows employees, who qualify, to acquire shares in their employer's company, with or without monetary assistance from the company. Employees can acquire shares and ownership through an ESOP that can range from one percent to 100 percent.

In an ESOP, a company sets up an employee benefit trust, which it funds by contributing cash to buy company stock, contributing shares directly, or having the trust borrow money to buy stock.

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.