North Dakota Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

How to fill out Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

US Legal Forms - among the biggest libraries of lawful varieties in the USA - offers a variety of lawful papers web templates you may obtain or printing. While using site, you will get a huge number of varieties for organization and individual uses, sorted by classes, suggests, or key phrases.You will find the latest models of varieties like the North Dakota Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans in seconds.

If you already have a registration, log in and obtain North Dakota Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans from your US Legal Forms catalogue. The Down load button can look on every single develop you look at. You have accessibility to all formerly downloaded varieties in the My Forms tab of the profile.

If you want to use US Legal Forms the first time, listed here are basic recommendations to help you started out:

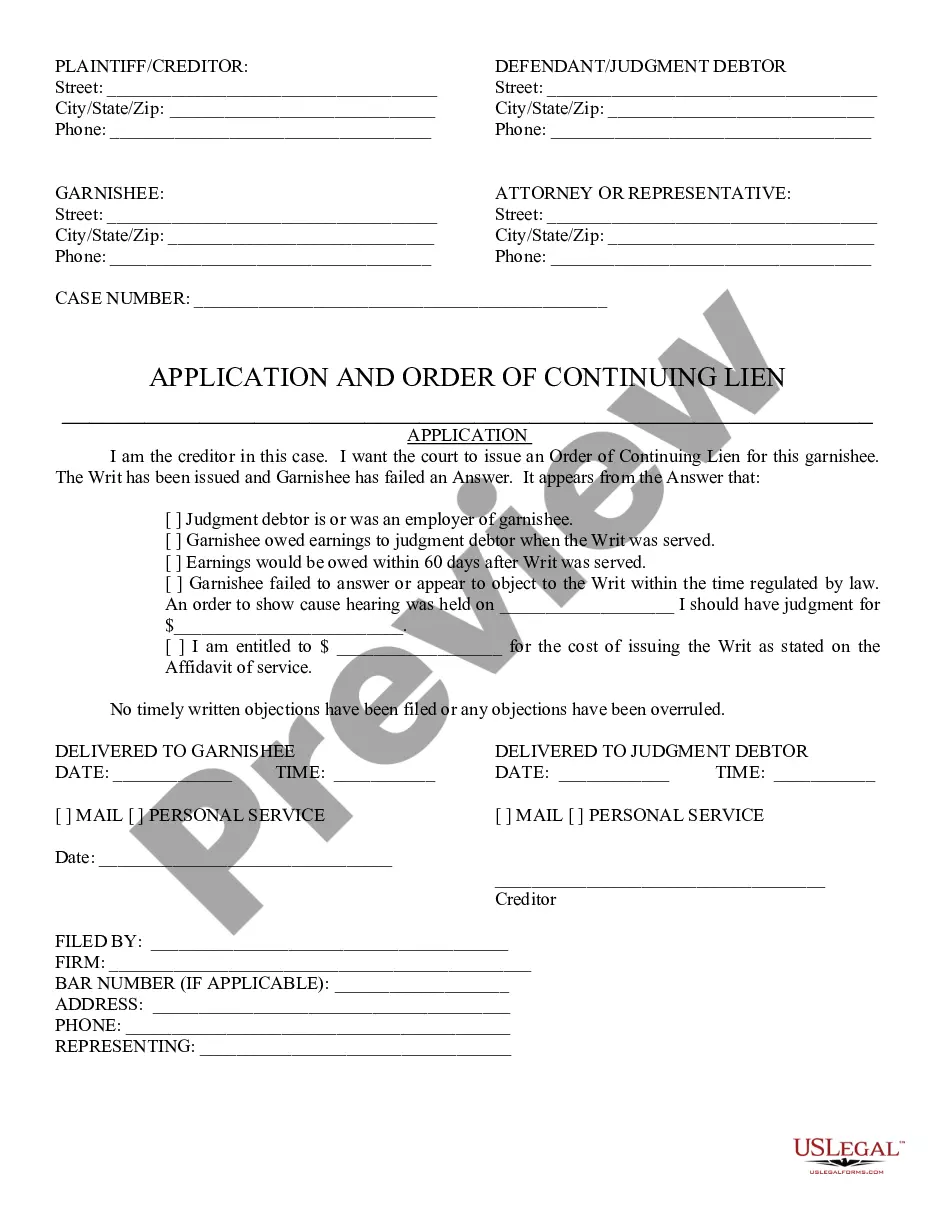

- Ensure you have picked out the correct develop to your area/area. Click the Preview button to review the form`s content material. Look at the develop explanation to actually have chosen the correct develop.

- In case the develop doesn`t match your demands, utilize the Research field near the top of the screen to discover the one that does.

- Should you be pleased with the form, confirm your decision by clicking on the Purchase now button. Then, pick the pricing strategy you like and provide your references to register on an profile.

- Procedure the financial transaction. Use your bank card or PayPal profile to perform the financial transaction.

- Find the formatting and obtain the form in your gadget.

- Make modifications. Complete, change and printing and signal the downloaded North Dakota Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans.

Each and every web template you included in your bank account does not have an expiry day which is the one you have eternally. So, in order to obtain or printing one more version, just proceed to the My Forms section and click in the develop you want.

Obtain access to the North Dakota Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans with US Legal Forms, one of the most considerable catalogue of lawful papers web templates. Use a huge number of professional and express-certain web templates that meet your small business or individual requirements and demands.