North Dakota Approval of executive director loan plan

Description

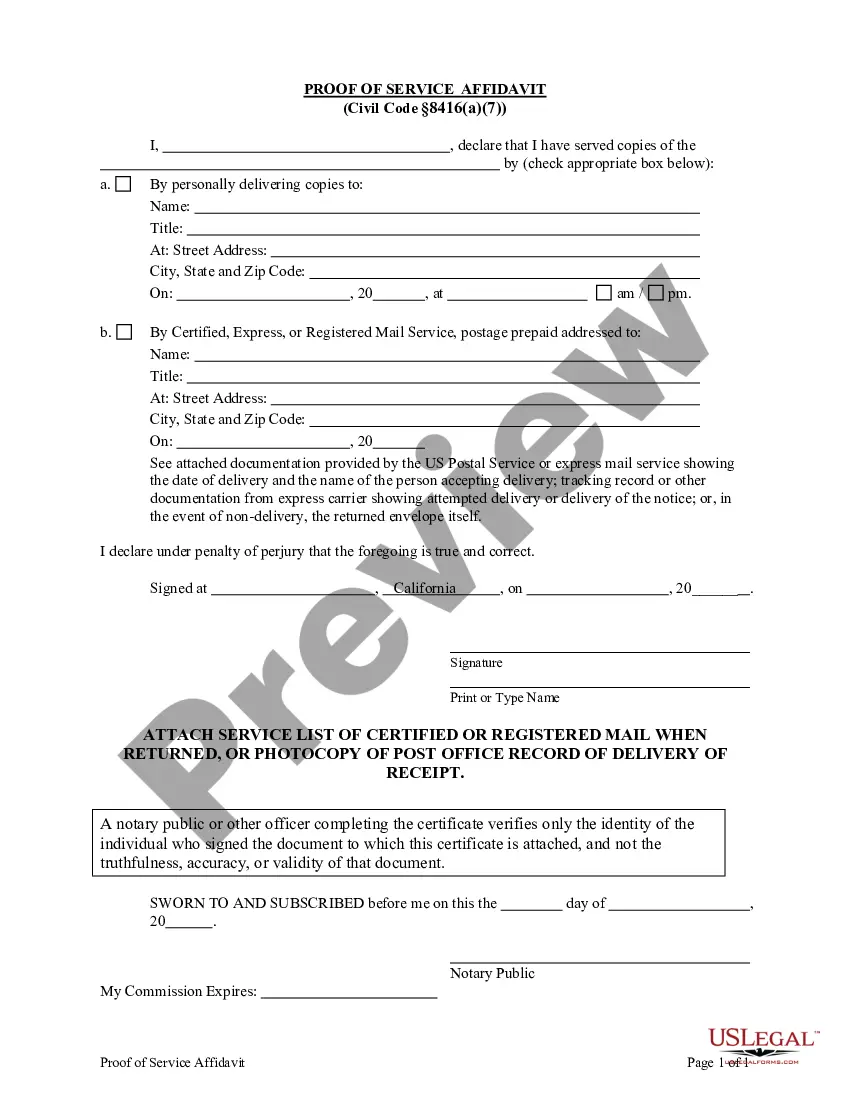

How to fill out Approval Of Executive Director Loan Plan?

US Legal Forms - one of the largest libraries of lawful forms in America - offers a variety of lawful papers layouts it is possible to acquire or print out. Making use of the web site, you can find 1000s of forms for company and person functions, sorted by types, suggests, or key phrases.You will discover the most up-to-date types of forms like the North Dakota Approval of executive director loan plan within minutes.

If you currently have a subscription, log in and acquire North Dakota Approval of executive director loan plan in the US Legal Forms catalogue. The Acquire switch will appear on each and every form you see. You have access to all previously saved forms inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, listed here are simple recommendations to help you started off:

- Be sure to have selected the proper form for your personal metropolis/area. Select the Preview switch to check the form`s content material. See the form explanation to actually have chosen the right form.

- When the form doesn`t match your needs, use the Look for area near the top of the display screen to discover the one who does.

- Should you be satisfied with the shape, verify your option by simply clicking the Acquire now switch. Then, select the pricing prepare you want and give your accreditations to register for the bank account.

- Process the purchase. Utilize your bank card or PayPal bank account to finish the purchase.

- Find the file format and acquire the shape on the gadget.

- Make modifications. Fill out, revise and print out and indication the saved North Dakota Approval of executive director loan plan.

Each and every design you added to your bank account does not have an expiration day which is your own property for a long time. So, if you would like acquire or print out one more backup, just check out the My Forms area and then click about the form you need.

Get access to the North Dakota Approval of executive director loan plan with US Legal Forms, one of the most extensive catalogue of lawful papers layouts. Use 1000s of expert and condition-particular layouts that meet up with your company or person demands and needs.

Form popularity

FAQ

Contributions to the fund must include "[t]hirty percent of total revenue derived from taxes on oil and gas production or extraction." The fund was established by ballot initiative in 2010. The fund is modeled after the Norwegian Sovereign Wealth Fund. As of June 30, 2023, the fund is valued at $8.999 billion.

The major difference between a traditional corporation and PC is that a PC is designed to protect licensed professionals and their personal assets. Licensed professionals may incorporate as a PC, as long as they meet the entity's specific requirements.

The North Dakota Industrial Commission is the body that oversees the management of several separate programs and resources, including the Bank of North Dakota, North Dakota Mill and Elevator, and the Department of Mineral Resources.

One of the key differences between a corporation and a professional corporation is that the shareholders of a professional corporation must be licensed professionals who are authorized to provide professional services in their respective fields. This requirement does not apply to a regular corporation.

The Industrial Commission Administrative Office as of June 30, 2021 has three full-time employees?the Executive Director and Secretary, Karlene Fine, the Deputy Executive Director, Reice Haase, and Administrative Assistant II, Andrea Rebsom.

The professional corporation or PLLC's sole purpose must be to provide the services of the licensed professionals, such as providing legal or medical services. In addition to the standard state-naming requirements, the name must clearly indicate that it is a professional corporation or PLLC.

The difference between LLC and PC is straightforward. A limited liability company (LLC) combines the tax benefits of a partnership and the limited liability protection of a corporation. A professional corporation (PC) is organized ing to the laws of the state where the professional is licensed to practice.

A professional corporation may render: One specific type of professional service and services ancillary thereto; or. Two or more kinds of professional services that are specifically authorized to be practiced in combination under North Dakota's licensing laws of each of the professional services to be rendered.