North Dakota Utilization by a REIT of partnership structures in financing five development projects

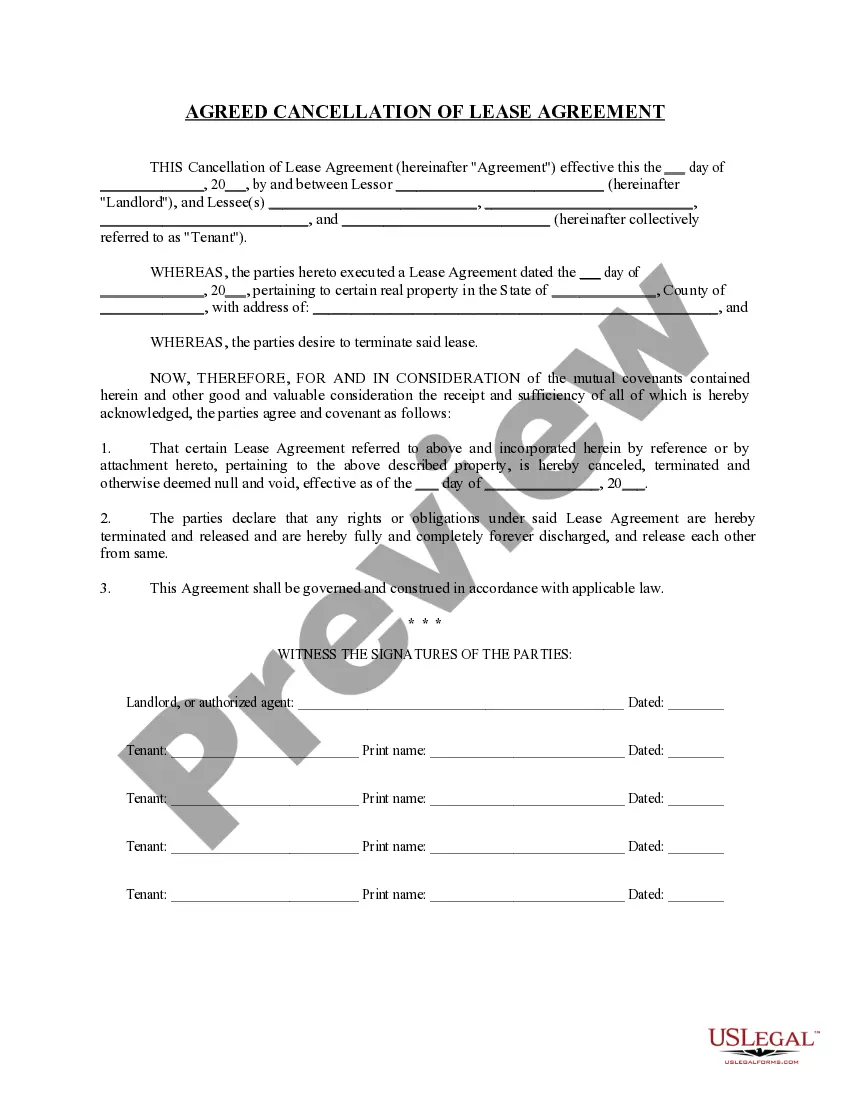

Description

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

If you have to complete, acquire, or printing authorized papers layouts, use US Legal Forms, the largest variety of authorized types, that can be found on the web. Use the site`s easy and practical research to get the papers you require. Different layouts for organization and person uses are categorized by categories and suggests, or search phrases. Use US Legal Forms to get the North Dakota Utilization by a REIT of partnership structures in financing five development projects in a few mouse clicks.

If you are previously a US Legal Forms consumer, log in for your bank account and click on the Acquire key to find the North Dakota Utilization by a REIT of partnership structures in financing five development projects. You can also access types you formerly delivered electronically from the My Forms tab of your own bank account.

Should you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for the proper city/land.

- Step 2. Take advantage of the Review choice to examine the form`s information. Don`t forget to read through the explanation.

- Step 3. If you are not happy with the kind, take advantage of the Lookup discipline at the top of the display to get other variations of the authorized kind design.

- Step 4. After you have found the shape you require, click on the Purchase now key. Choose the prices plan you prefer and include your references to sign up for the bank account.

- Step 5. Approach the deal. You can use your bank card or PayPal bank account to complete the deal.

- Step 6. Select the structure of the authorized kind and acquire it on the system.

- Step 7. Comprehensive, change and printing or indication the North Dakota Utilization by a REIT of partnership structures in financing five development projects.

Each and every authorized papers design you acquire is yours eternally. You may have acces to every kind you delivered electronically inside your acccount. Click on the My Forms portion and pick a kind to printing or acquire once more.

Contend and acquire, and printing the North Dakota Utilization by a REIT of partnership structures in financing five development projects with US Legal Forms. There are millions of professional and express-certain types you may use for your personal organization or person requirements.

Form popularity

FAQ

To qualify as a REIT, at least 80% of investments must be in income-generating commercial properties, and 90% of rental income must be distributed as dividends. As per the SEBI guidelines, REITs must be listed on the stock exchange. What are Real Estate Investment Trusts, Types & List of REITs etmoney.com ? learn ? personal-finance ? e... etmoney.com ? learn ? personal-finance ? e...

Lenders to a REIT have several different collateral structures available to them to meet their underwriting needs and the needs of the REIT. Loans may be unsecured or may be secured by mortgages, by a pledge of equity owned by the REIT, or by any combination of collateral. REIT Financing: Collateral Structures - Chapman and Cutler LLP Chapman and Cutler LLP ? publication-reit-financing... Chapman and Cutler LLP ? publication-reit-financing...

Most REITs have a straightforward business model: The REIT leases space and collects rents on the properties, then distributes that income as dividends to shareholders. Mortgage REITs don't own real estate, but finance real estate, instead. Real Estate Investment Trust (REIT): How They Work and How to Invest investopedia.com ? terms ? reit investopedia.com ? terms ? reit

REITs historically have delivered competitive total returns, based on high, steady dividend income and long-term capital appreciation. Their comparatively low correlation with other assets also makes them an excellent portfolio diversifier that can help reduce overall portfolio risk and increase returns. What's a REIT (Real Estate Investment Trust)? reit.com ? what-reit reit.com ? what-reit

Ing to the Federal Reserve Bank of Chicago, the typical pattern for REIT financing is to purchase real property assets with unsecured credit and then refinance this debt by issuing common/preferred stock or senior notes. How Do REITs Raise Capital? - Realized 1031 realized1031.com ? blog ? how-do-reits-rais... realized1031.com ? blog ? how-do-reits-rais...

What is the Minimum Investment Amount for Private REITs? Typically $1,000 - $25,000; private REITs that are designed for institutional or accredited investors generally require a much higher minimum investment. A Complete Guide to Private REIT Investing with Nareit reit.com ? what-reit ? types-reits ? guide-pri... reit.com ? what-reit ? types-reits ? guide-pri...

The ongoing requirements for a REIT are: Pay 90% of the REIT's taxable income to investors in dividends. At least 75% of the REIT's assets must be in real estate, or real estate mortgages, quarterly. At least 75% of the REIT's gross income must come from rental income or mortgage interest. How to Start a REIT | The Motley Fool fool.com ? investing ? real-estate-investing fool.com ? investing ? real-estate-investing

REITs generate income for investors either through interest payments on the property's underlying mortgage or rental income once the development is completed. What Is A REIT? | Rocket Mortgage rocketmortgage.com ? learn ? reit rocketmortgage.com ? learn ? reit