North Dakota Proposal to amend the restated articles of incorporation to create a second class of common stock

Description

How to fill out Proposal To Amend The Restated Articles Of Incorporation To Create A Second Class Of Common Stock?

US Legal Forms - among the greatest libraries of lawful kinds in the United States - offers an array of lawful file templates it is possible to download or print out. Using the website, you can find a large number of kinds for organization and individual functions, sorted by categories, says, or keywords and phrases.You will find the newest versions of kinds such as the North Dakota Proposal to amend the restated articles of incorporation to create a second class of common stock in seconds.

If you currently have a monthly subscription, log in and download North Dakota Proposal to amend the restated articles of incorporation to create a second class of common stock from the US Legal Forms collection. The Down load switch will show up on each develop you see. You have accessibility to all in the past delivered electronically kinds within the My Forms tab of your profile.

If you wish to use US Legal Forms the first time, listed here are easy instructions to get you started out:

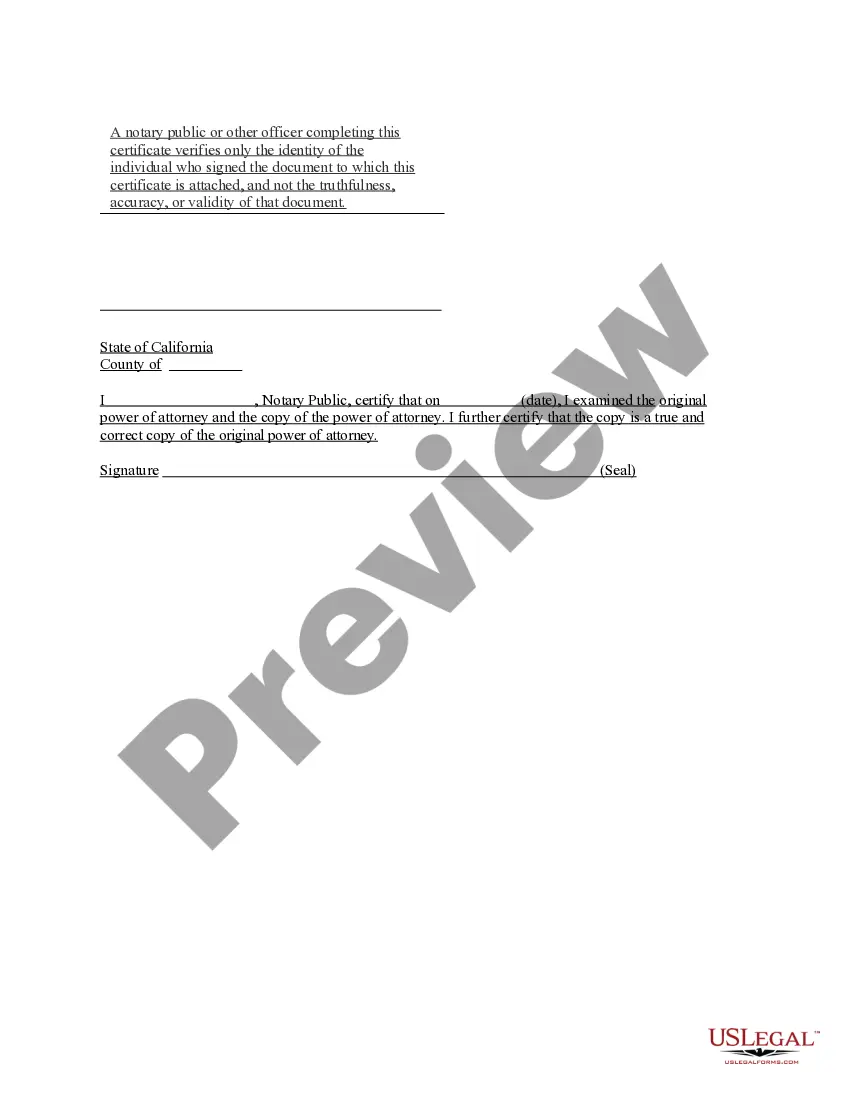

- Ensure you have selected the best develop for the area/state. Click the Review switch to analyze the form`s information. Read the develop explanation to ensure that you have selected the proper develop.

- If the develop doesn`t suit your specifications, utilize the Research discipline towards the top of the monitor to discover the one who does.

- If you are pleased with the shape, confirm your option by clicking on the Get now switch. Then, opt for the rates program you favor and provide your credentials to sign up to have an profile.

- Method the financial transaction. Utilize your credit card or PayPal profile to complete the financial transaction.

- Find the structure and download the shape on your own device.

- Make changes. Fill out, modify and print out and indicator the delivered electronically North Dakota Proposal to amend the restated articles of incorporation to create a second class of common stock.

Each and every format you included with your account lacks an expiry time and is the one you have eternally. So, if you want to download or print out yet another duplicate, just go to the My Forms segment and click in the develop you require.

Get access to the North Dakota Proposal to amend the restated articles of incorporation to create a second class of common stock with US Legal Forms, by far the most substantial collection of lawful file templates. Use a large number of expert and status-specific templates that meet up with your business or individual demands and specifications.

Form popularity

FAQ

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

What should Articles of Incorporation amendments include? Corporation name and state. Date of amendment. Article number being amended. Statement that the article cited is being amended. The actual amendment. Statement that other sections of the articles remain in full force and effect. Director names and signatures.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, email, phone or in person, but we recommend calling. Normal processing takes up to 2 days, plus additional time for mailing, and costs approximately $20 plus .

Not only is it required by state law to update your California Articles of Incorporation, but there are many other reasons why it's imperative that you do so. For example, properly amending your Articles of Incorporation can ensure that your corporation continues to: Receive the benefits of being a registered entity.

Changes to the number of stocks or how the stocks are valued would also necessitate a change to the articles of incorporation. The most common reason that businesses need to change their articles of incorporation, however, is that there has been a change in personnel for the business.