North Dakota Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank

Description

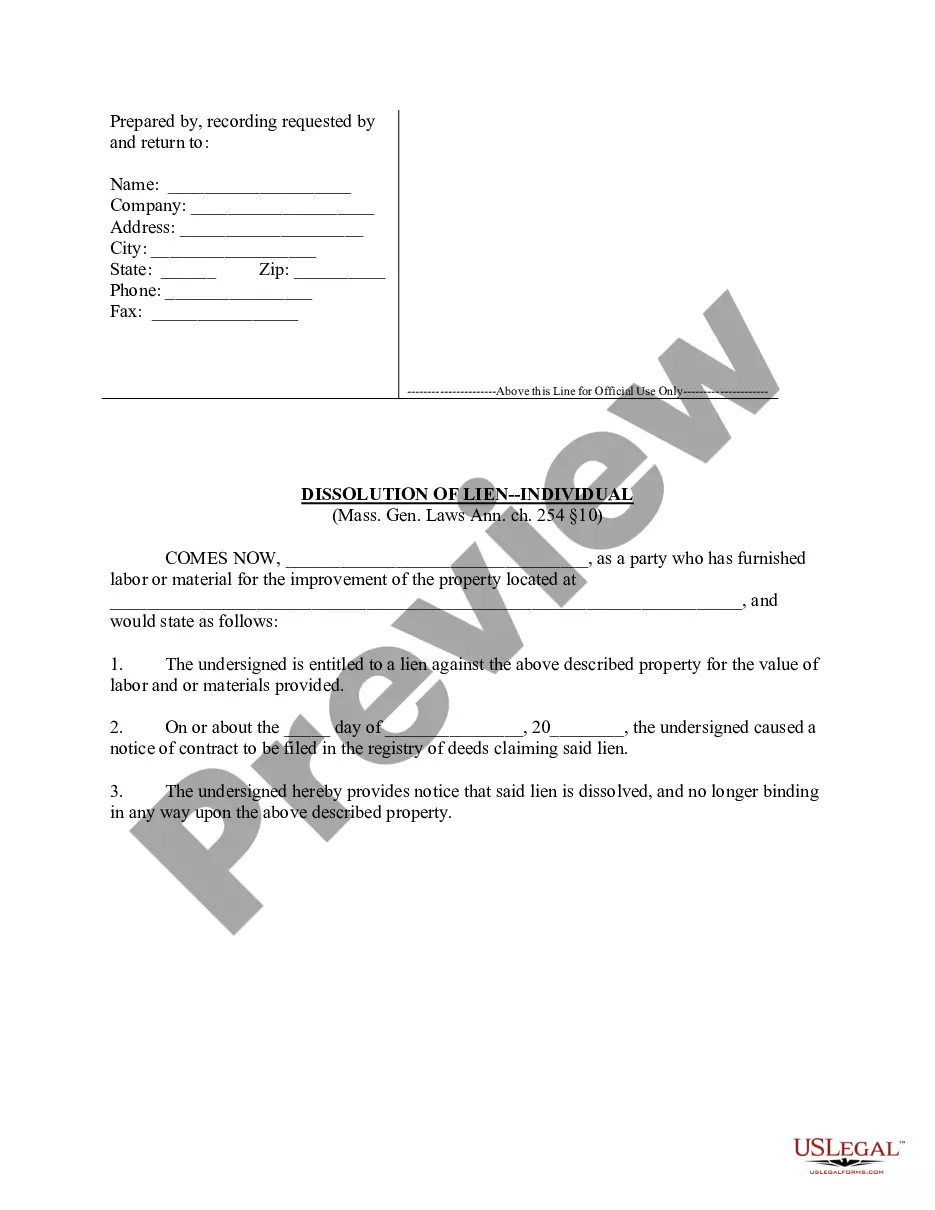

How to fill out Form Of Agreement And Plan Of Merger By Regional Bancorp, Inc., Medford Interim, Inc., And Medford Savings Bank?

US Legal Forms - one of several biggest libraries of lawful kinds in the States - delivers an array of lawful file templates you can down load or printing. While using web site, you may get thousands of kinds for company and person purposes, sorted by classes, claims, or keywords.You will discover the newest versions of kinds such as the North Dakota Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank within minutes.

If you have a registration, log in and down load North Dakota Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank through the US Legal Forms local library. The Obtain key can look on each develop you see. You have access to all formerly acquired kinds in the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, allow me to share simple instructions to help you get started off:

- Be sure to have chosen the correct develop for your personal town/area. Select the Preview key to check the form`s content material. Look at the develop description to ensure that you have chosen the appropriate develop.

- If the develop doesn`t fit your requirements, take advantage of the Search field at the top of the monitor to discover the the one that does.

- When you are content with the shape, validate your choice by clicking on the Buy now key. Then, pick the pricing strategy you want and supply your accreditations to sign up on an account.

- Method the transaction. Make use of bank card or PayPal account to perform the transaction.

- Find the structure and down load the shape on your product.

- Make adjustments. Load, revise and printing and indicator the acquired North Dakota Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank.

Each and every design you included in your bank account does not have an expiration particular date which is the one you have permanently. So, if you wish to down load or printing yet another copy, just proceed to the My Forms section and then click in the develop you will need.

Gain access to the North Dakota Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank with US Legal Forms, one of the most substantial local library of lawful file templates. Use thousands of professional and state-certain templates that fulfill your organization or person needs and requirements.