North Dakota Uniform Residential Loan Application

Description

How to fill out Uniform Residential Loan Application?

You are able to spend several hours on-line searching for the authorized papers design that meets the federal and state requirements you will need. US Legal Forms provides a large number of authorized varieties which can be examined by specialists. You can easily obtain or print the North Dakota Uniform Residential Loan Application from our service.

If you have a US Legal Forms bank account, you are able to log in and then click the Acquire option. Next, you are able to total, modify, print, or indicator the North Dakota Uniform Residential Loan Application. Every single authorized papers design you acquire is the one you have for a long time. To obtain yet another duplicate associated with a acquired kind, proceed to the My Forms tab and then click the related option.

If you are using the US Legal Forms website the very first time, adhere to the simple directions under:

- First, make certain you have chosen the correct papers design for that region/town that you pick. Browse the kind explanation to make sure you have picked out the correct kind. If readily available, make use of the Preview option to look throughout the papers design too.

- If you would like find yet another variation of your kind, make use of the Lookup area to discover the design that fits your needs and requirements.

- Once you have identified the design you need, simply click Purchase now to continue.

- Find the pricing strategy you need, enter your references, and sign up for an account on US Legal Forms.

- Total the deal. You can utilize your bank card or PayPal bank account to fund the authorized kind.

- Find the file format of your papers and obtain it in your device.

- Make changes in your papers if possible. You are able to total, modify and indicator and print North Dakota Uniform Residential Loan Application.

Acquire and print a large number of papers templates utilizing the US Legal Forms site, which offers the biggest assortment of authorized varieties. Use skilled and status-particular templates to handle your small business or person requirements.

Form popularity

FAQ

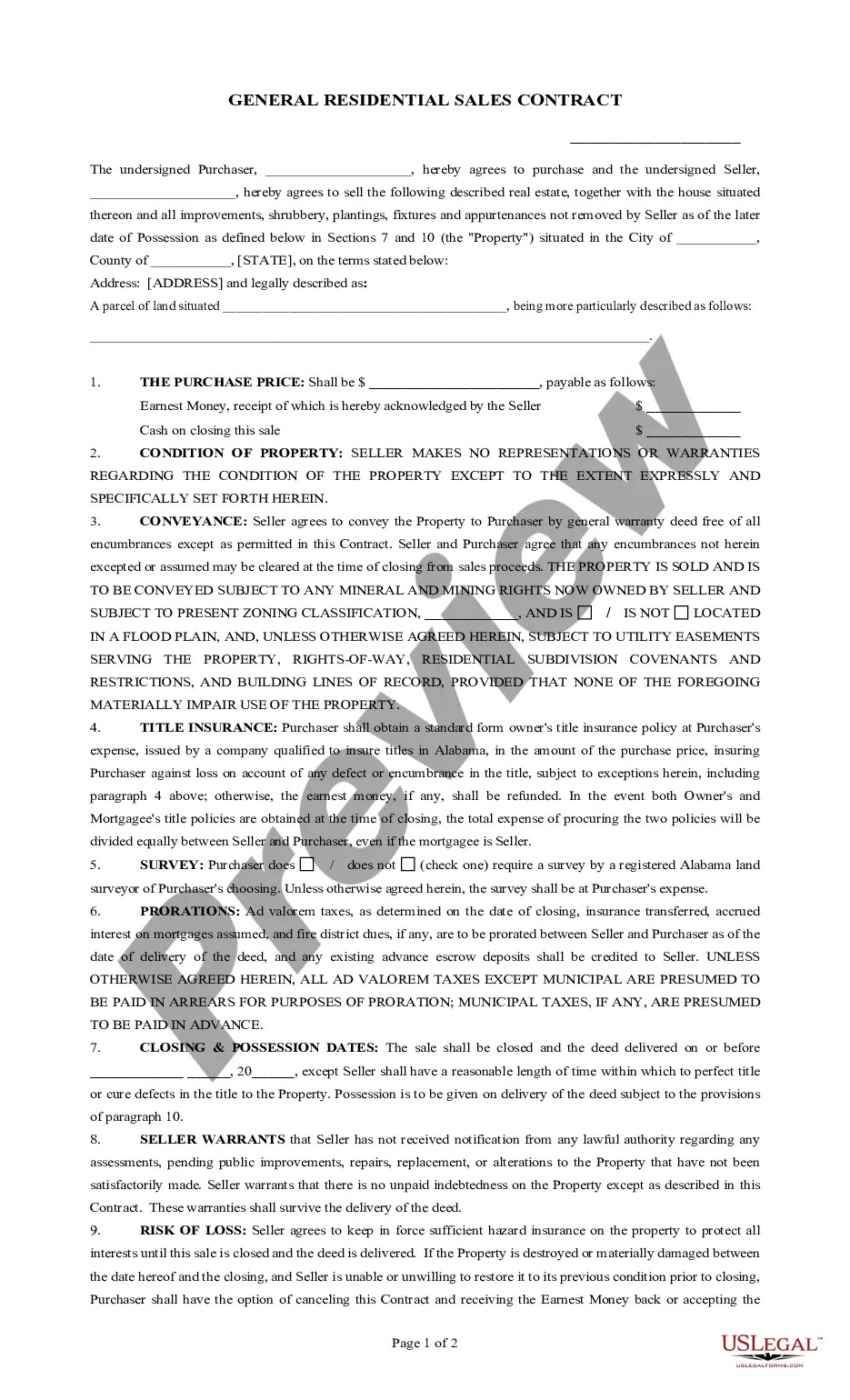

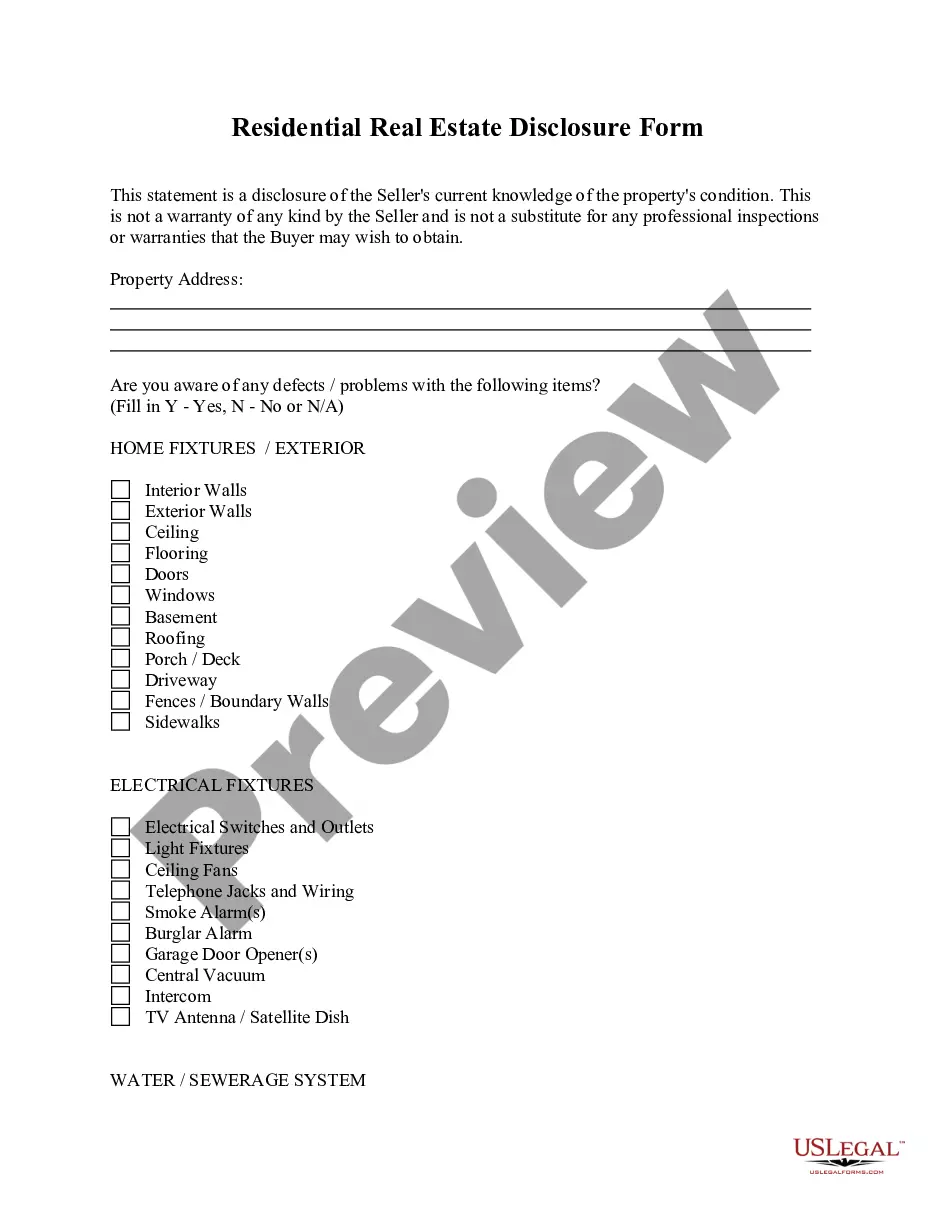

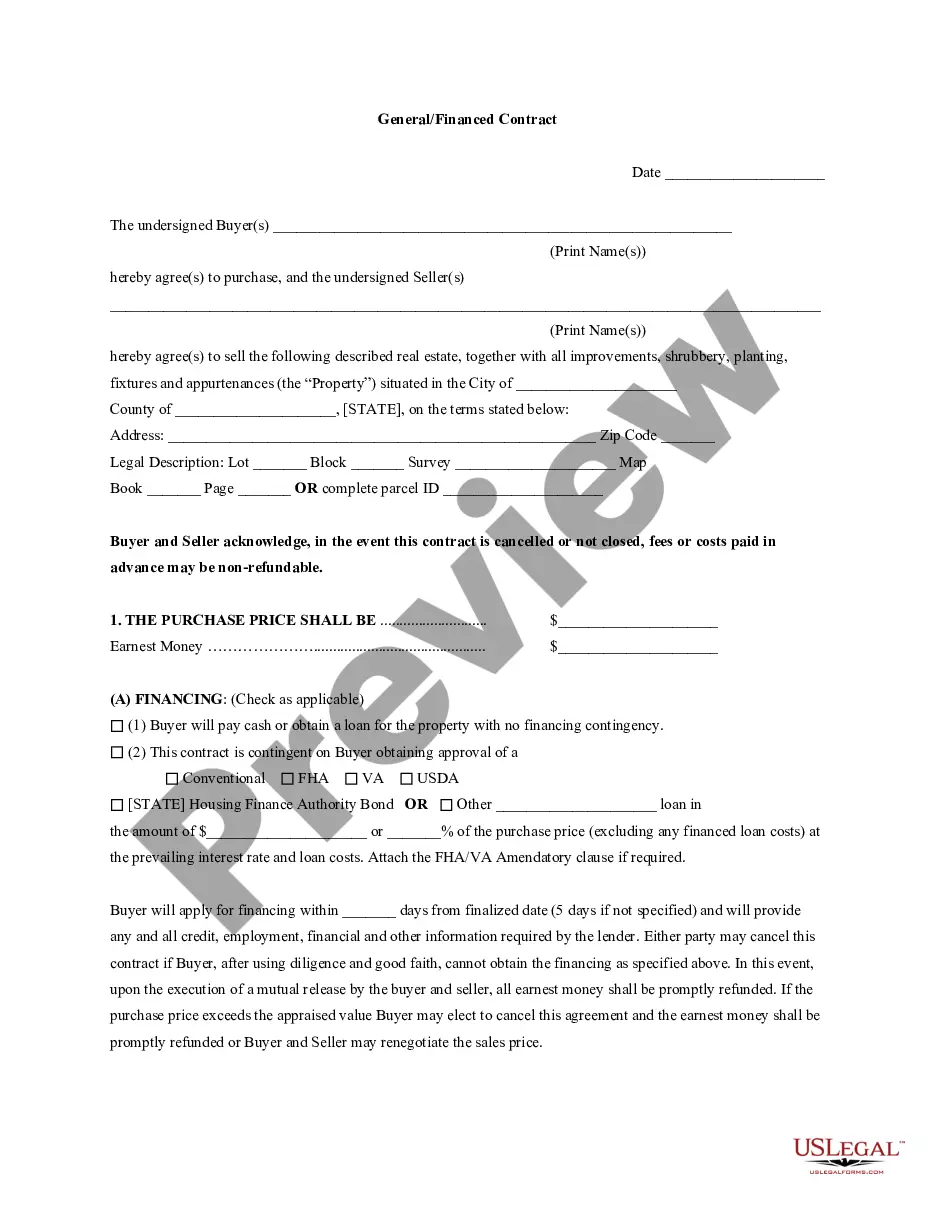

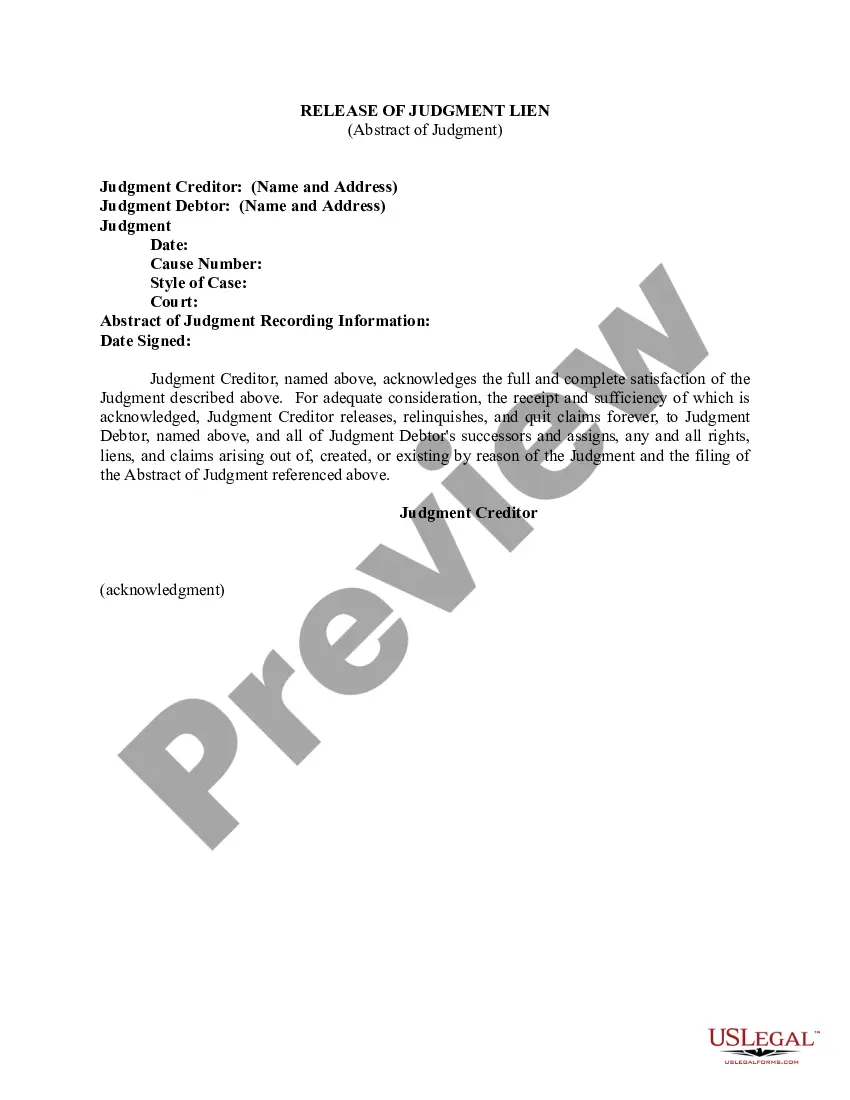

What Is a Mortgage Application? A mortgage application is a document submitted to a lender when you apply for a mortgage to purchase real estate. The application is extensive and contains information about the property being considered for purchase, the borrower's financial situation and employment history, and more.

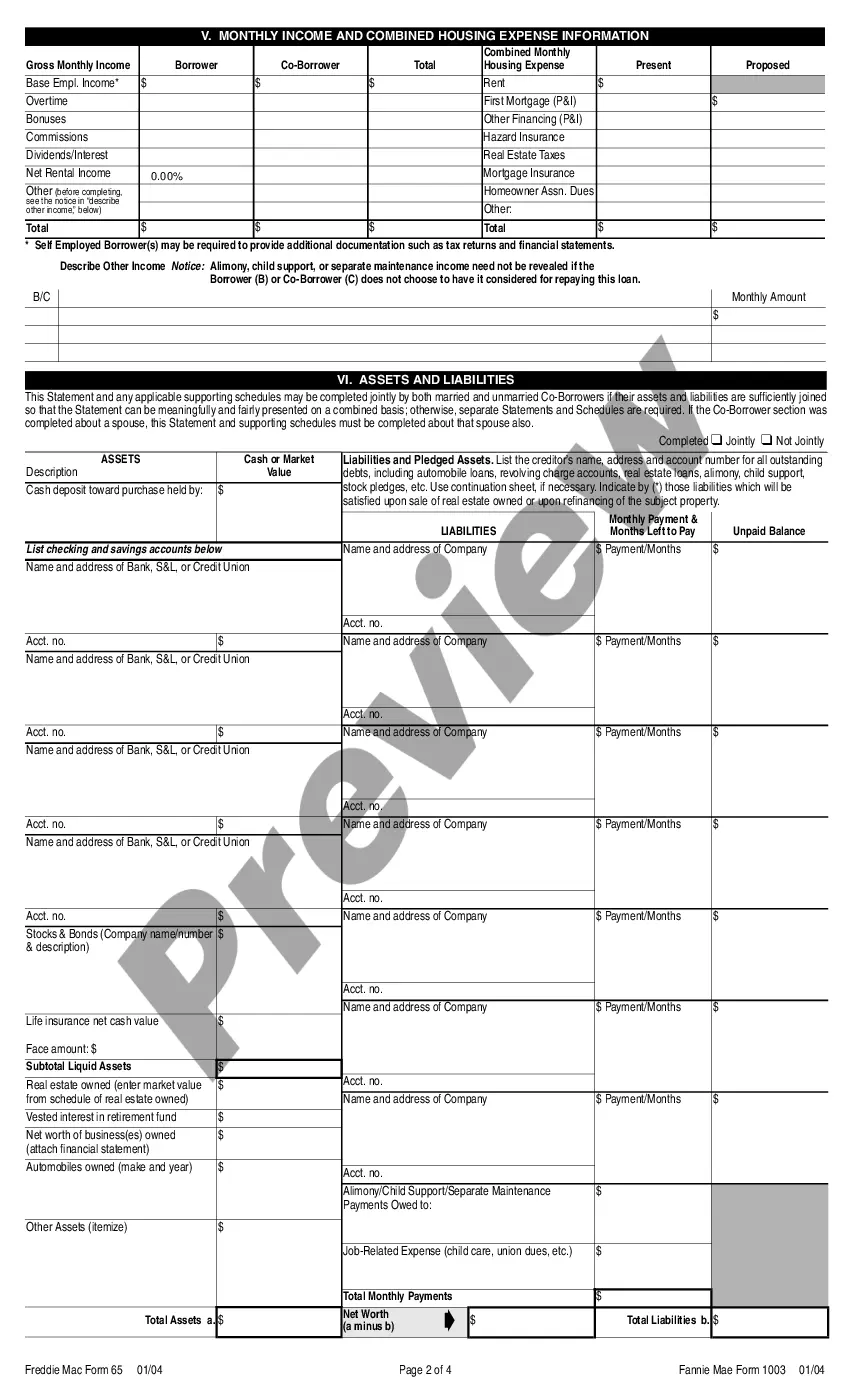

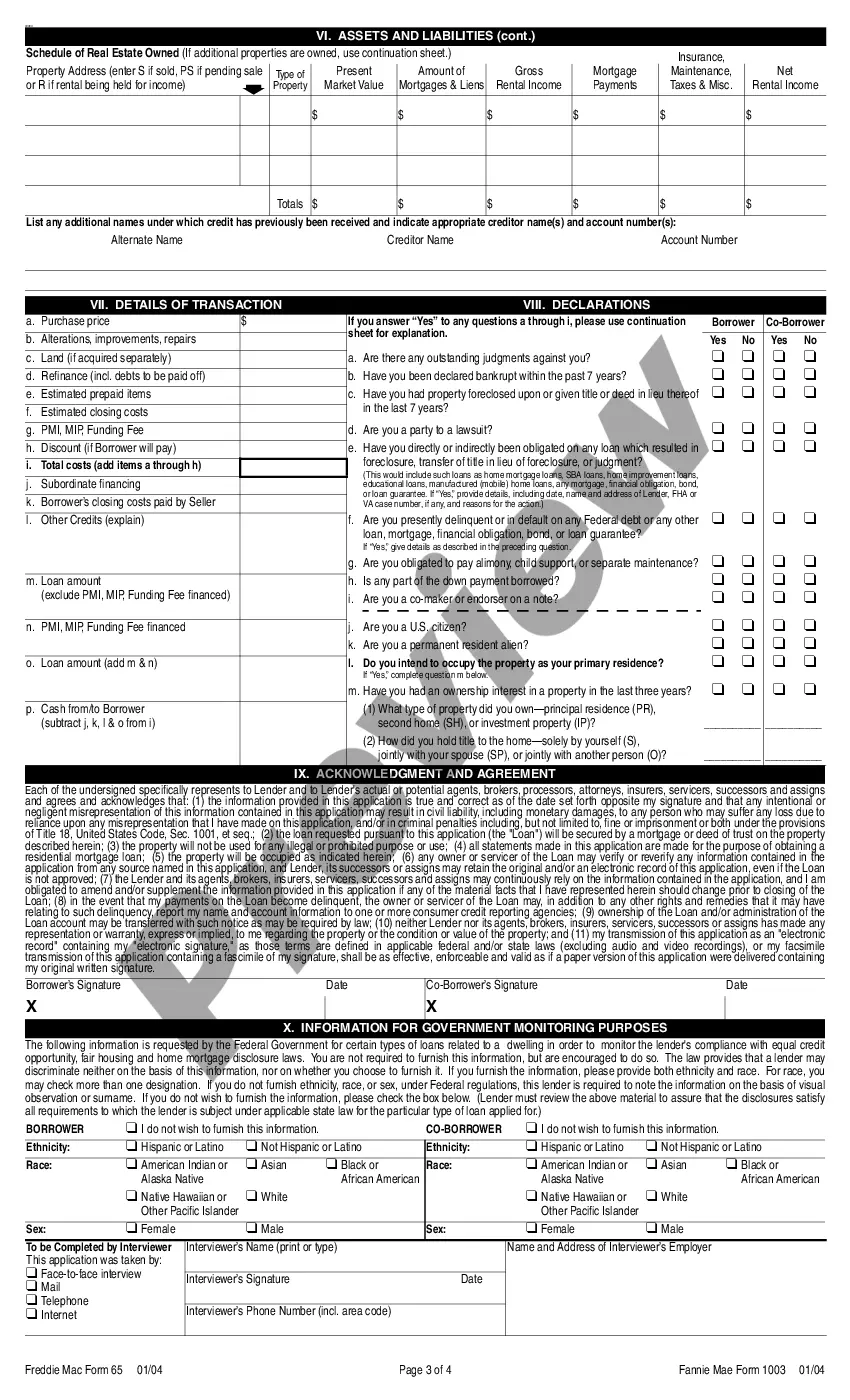

The URLA consists of two main forms, the Borrower Information Form and the Lender Information Form, which together make up the complete loan application. However, depending on certain situations, additional forms may be required. These are the Additional Borrower form, Unmarried Addendum, and Continuation Sheet.

Known as the Uniform Residential Loan Application (or the 1003, after its Fannie Mae form number), this five-page document provides a lender with the basic information needed to approve a buyer.

The uniform residential loan application is a form designed by Fannie Mae and Freddie Mac, government-sponsored enterprises (GSE) that support the mortgage market. The form was created to collect the information lenders need to assess your creditworthiness for a mortgage loan.

After years of delays, including a year-long delay due to COVID-19, the release of the new Uniform Residential Loan Application (URLA) is about to happen. Starting March 1, 2021, all lenders who intend to sell closed residential mortgage loans to Fannie Mae or Freddie Mac will be required to use the new URLA.

Typically, unmarried persons cannot apply for joint credit, and as such, much individually submit separate loan apps (1003). They should NOT sign the top of the 1003, nor each other's 1003 in this case.

Uniform Residential Loan Application (URLA/Form 1003)

The home loan application will ask borrowers for information regarding their financial situation, including income and assets, as well as personal information like their Social Security number. You will also be required to provide documentation corroborating the information you provide.