North Dakota Independent Sales Representative Agreement

Description

How to fill out Independent Sales Representative Agreement?

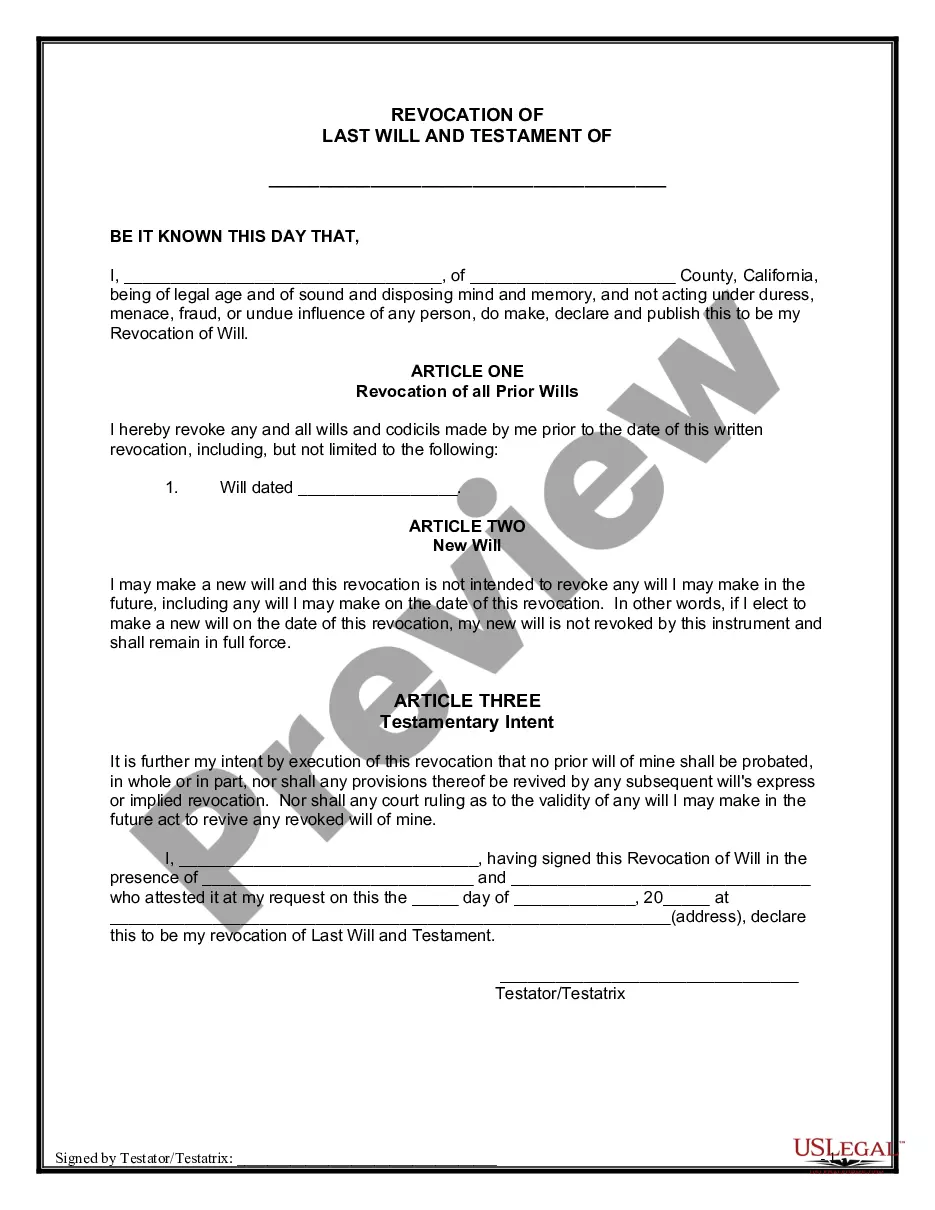

Choosing the best legitimate file design might be a struggle. Needless to say, there are plenty of themes accessible on the Internet, but how can you obtain the legitimate kind you need? Utilize the US Legal Forms site. The services provides thousands of themes, such as the North Dakota Independent Sales Representative Agreement, that you can use for company and private needs. Each of the varieties are checked by experts and fulfill state and federal needs.

Should you be previously authorized, log in to the profile and then click the Acquire key to get the North Dakota Independent Sales Representative Agreement. Utilize your profile to appear with the legitimate varieties you might have acquired formerly. Proceed to the My Forms tab of your own profile and obtain one more duplicate in the file you need.

Should you be a whole new end user of US Legal Forms, here are basic guidelines that you can adhere to:

- Very first, make certain you have chosen the right kind for the town/region. It is possible to look through the form using the Preview key and study the form information to ensure this is basically the best for you.

- When the kind fails to fulfill your expectations, utilize the Seach industry to find the proper kind.

- Once you are certain the form is suitable, click the Get now key to get the kind.

- Select the costs program you want and enter in the required information and facts. Build your profile and buy your order making use of your PayPal profile or charge card.

- Pick the file formatting and acquire the legitimate file design to the gadget.

- Total, revise and produce and sign the acquired North Dakota Independent Sales Representative Agreement.

US Legal Forms is definitely the greatest library of legitimate varieties that you can discover different file themes. Utilize the service to acquire expertly-created files that adhere to condition needs.

Form popularity

FAQ

(a) You shall be entitled to receive a sales commission from the Fund in an amount equal to 1.00% of the gross sales price per Share, of which 0.80% will be re-allowed to the sub-sales agent. Sales Commission Sample Clauses - Law Insider lawinsider.com ? clause ? sales-commission lawinsider.com ? clause ? sales-commission

Advice When Drafting and Signing a Commission Agreement Use a Commission Agreement Template. ... Define Worker Type and Commission Structure. ... List All Activities That Will Provide Commission Pay. ... Define the Commission Rate. ... Identify Any Potential Bonuses Above And Beyond Commission. ... Explain Termination Procedures. Commission Agreement Template for Your Business - Nitro PDF gonitro.com ? pdf-templates ? commission-a... gonitro.com ? pdf-templates ? commission-a...

What is an independent sales rep? An independent sales representative is a professional who works as a contractor for a company, selling a service or product on their behalf. They may work contractually, only earning income when they make a sale. How To Become an Independent Sales Rep From Home | Indeed.com indeed.com ? career-advice ? finding-a-job indeed.com ? career-advice ? finding-a-job

The document should state that the sales rep is a contractor and spell out what he or she does, how often and how much he or she is paid, and provide a definition of how commission is paid out, such as getting 15 percent of each sale. 1099 Sales Rep Agreement: Everything You Need to Know upcounsel.com ? 1099-sales-rep-agreement upcounsel.com ? 1099-sales-rep-agreement

The Sales Commission Contract is a type of agreement by which a company entrusts the sale (exclusive or non-exclusive) of products and services to a person, self-employed professional or company (the agent) in exchange for fees which are established solely as a percentage of the amount of sales made. Sales Commission Contract Template - Global Negotiator Globalnegotiator ? files ? sales-c... Globalnegotiator ? files ? sales-c... PDF

Advice When Drafting and Signing a Commission Agreement Use a Commission Agreement Template. ... Define Worker Type and Commission Structure. ... List All Activities That Will Provide Commission Pay. ... Define the Commission Rate. ... Identify Any Potential Bonuses Above And Beyond Commission. ... Explain Termination Procedures. Commission Agreement Template for Your Business - Nitro PDF Nitro ? pdf-templates ? commissio... Nitro ? pdf-templates ? commissio...

5 to 15 percent ing to the folks at ZenBusiness, independent sales reps ?typically [earn] 5 to 15 percent of net sales. However, in some businesses, independent representatives are paid on a ledger basis? ? earn a commission on every sale made in their territory, regardless of direct communication. Average B2B Commission Rates - CaptivateIQ captivateiq.com ? blog ? b2b-sales-commissi... captivateiq.com ? blog ? b2b-sales-commissi...

The standard salary to commission ratio is with 60% being the base rate and 40% being commission-driven. The plan best serves as an incentive or motivation for increased sales performance. Example: A salesperson earns $500 a month in salary with 10% commission, or $500, for $5,000 worth in sales. 9 Sales Commission Structures (With Formulas and Examples) - Indeed indeed.com ? commission-structure-for-sales indeed.com ? commission-structure-for-sales