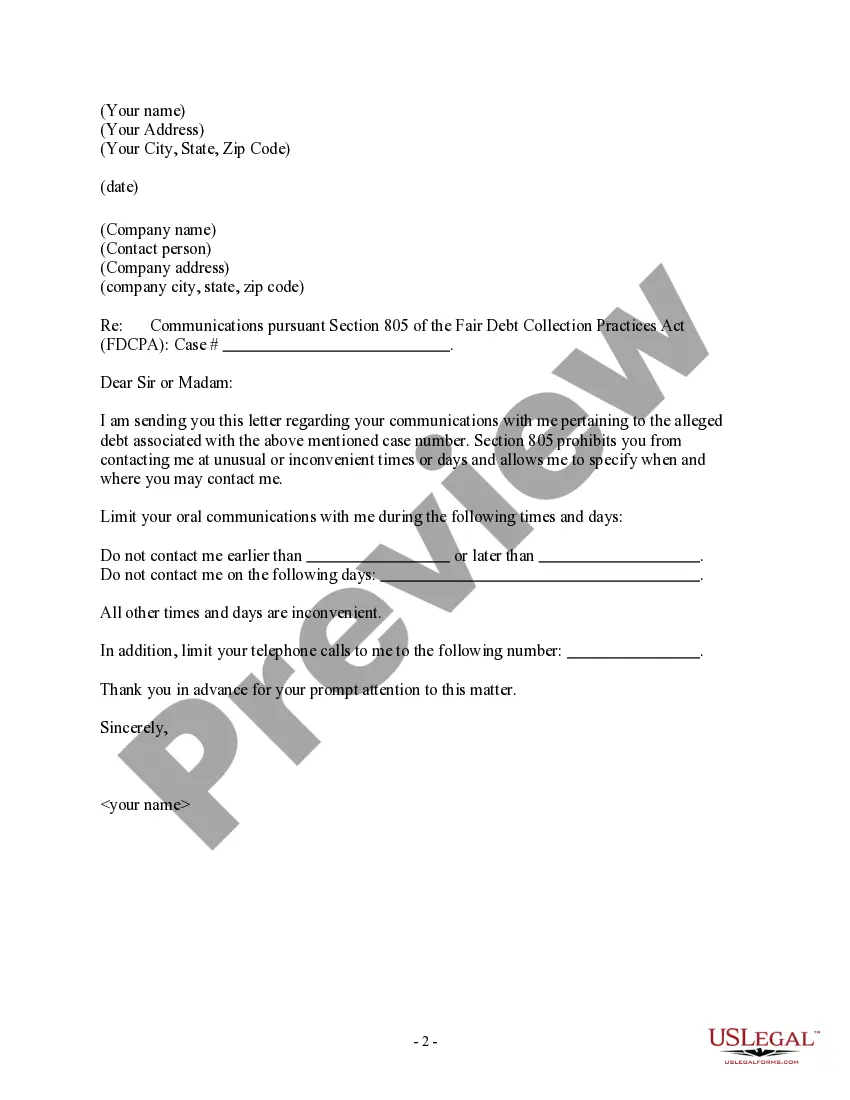

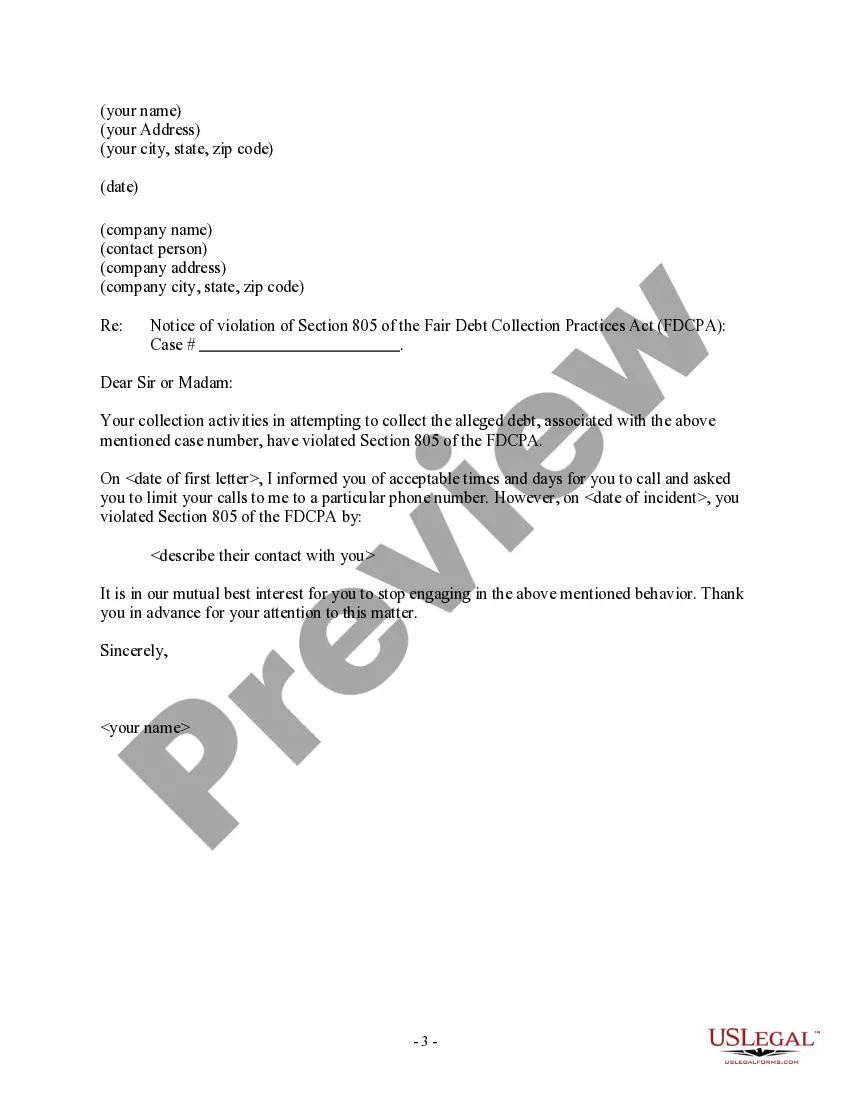

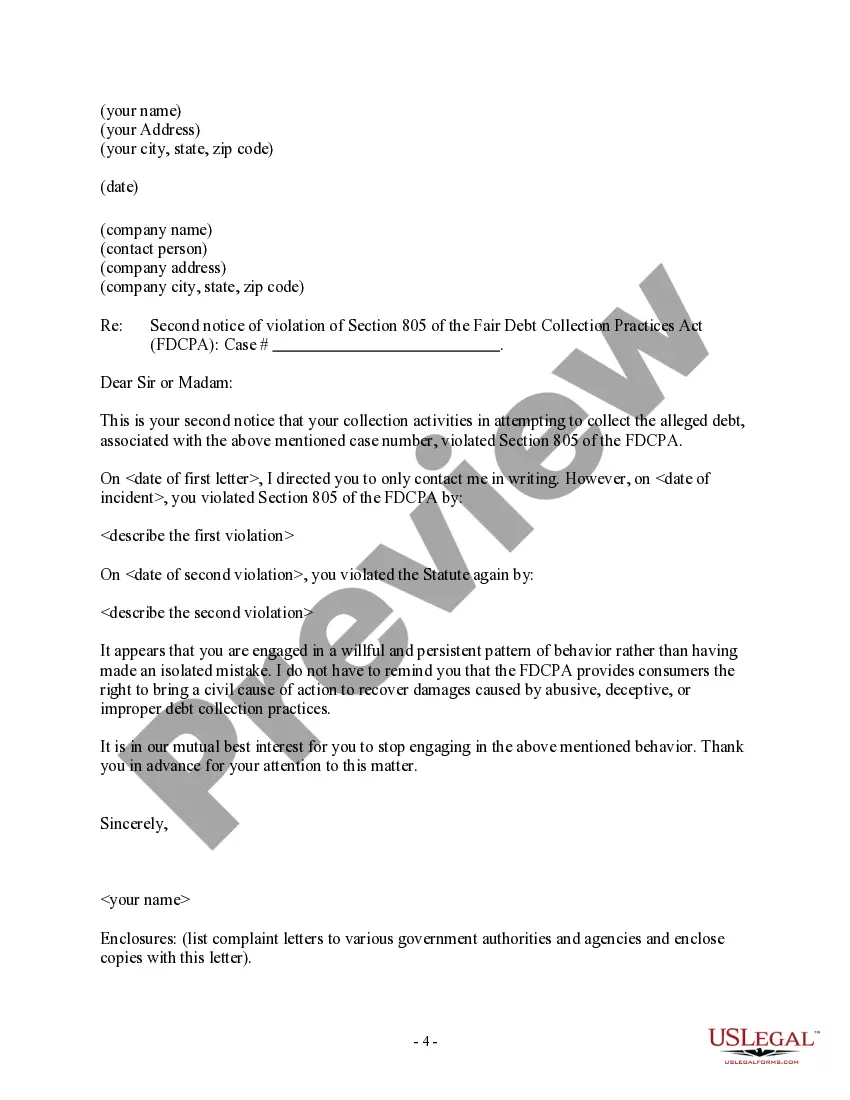

North Dakota Letter to Debt Collector - Only call me on the following days and times

Description

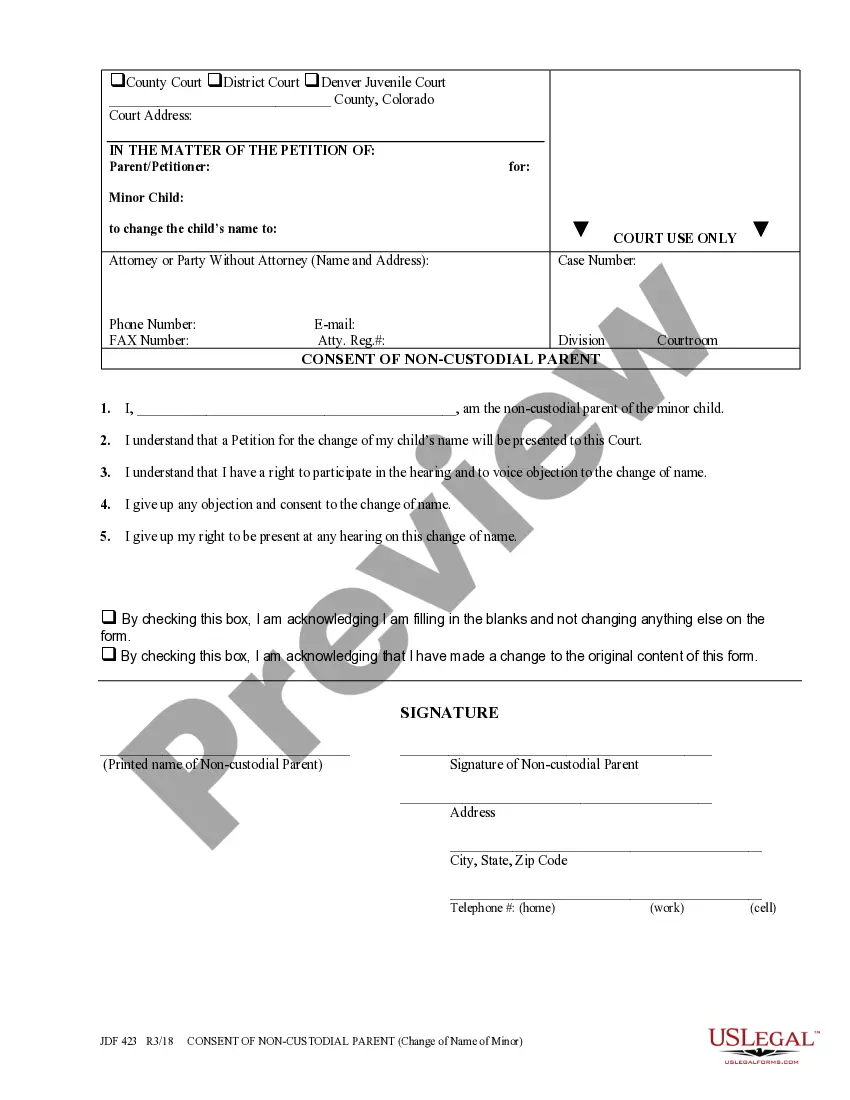

How to fill out North Dakota Letter To Debt Collector - Only Call Me On The Following Days And Times?

US Legal Forms - one of several biggest libraries of authorized types in America - offers a variety of authorized papers themes you can download or printing. Using the web site, you can find a large number of types for enterprise and specific uses, sorted by types, states, or keywords and phrases.You can get the most recent models of types like the North Dakota Letter to Debt Collector - Only call me on the following days and times in seconds.

If you already have a subscription, log in and download North Dakota Letter to Debt Collector - Only call me on the following days and times from your US Legal Forms local library. The Acquire switch can look on every develop you view. You have access to all earlier delivered electronically types within the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, here are straightforward guidelines to help you started out:

- Be sure to have picked the best develop for the city/county. Select the Preview switch to check the form`s content material. Browse the develop description to actually have selected the right develop.

- If the develop doesn`t suit your specifications, take advantage of the Look for discipline towards the top of the display to discover the one which does.

- If you are pleased with the shape, confirm your choice by visiting the Purchase now switch. Then, pick the costs prepare you like and provide your references to register to have an account.

- Process the purchase. Use your charge card or PayPal account to finish the purchase.

- Find the formatting and download the shape on your own system.

- Make changes. Complete, change and printing and sign the delivered electronically North Dakota Letter to Debt Collector - Only call me on the following days and times.

Each format you included in your bank account lacks an expiry time and is your own forever. So, if you want to download or printing yet another duplicate, just proceed to the My Forms portion and then click on the develop you need.

Obtain access to the North Dakota Letter to Debt Collector - Only call me on the following days and times with US Legal Forms, the most considerable local library of authorized papers themes. Use a large number of skilled and condition-specific themes that meet your organization or specific needs and specifications.

Form popularity

FAQ

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. A statement that if you request information about the original creditor within 30 days, the collector must provide it.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L.

You may ask a debt collector to contact you only by mail, or through your attorney, or set other limitations. Make sure you send your request in writing, send it by certified mail with a return receipt, and keep a copy of the letter and receipt.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.