The North Dakota Stockholders Agreement between America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. is a legal document that outlines the rights, obligations, and responsibilities of the stockholders of these companies. It governs the relationship between the stockholders and helps ensure smooth operations and decision-making processes. This agreement is specific to North Dakota as it adheres to the state's laws and regulations. It provides a framework for shareholders to protect their interests and establish guidelines for important matters concerning the companies. Here is a detailed description of what this agreement encompasses: 1. Purpose: The agreement lays out the purpose of the stockholders' relationship, which includes promoting cooperation, efficient decision-making, and safeguarding the rights and interests of the stockholders. 2. Stockholder Rights and Obligations: It delineates the rights and obligations of each stockholder, including voting rights, restrictions on stock transfers, and obligations to disclose pertinent information. 3. Governance and Management: The agreement establishes the governance structure of the companies, including the composition of the board of directors and appointment procedures. It may outline specific provisions for decision-making, quorum requirements, and the role and responsibilities of officers. 4. Shareholder Meetings: The agreement defines the procedures for stockholder meetings, including notice requirements, proxies, and voting procedures. It may specify how decisions are made and whether certain decisions require a super majority vote. 5. Capitalization and Stock Issuance: It addresses matters related to the issuance and transfer of stock, including preemptive rights, restrictions on stock issuance, and procedures for stock offerings. 6. Tag-Along and Drag-Along Rights: This clause outlines provisions that allow stockholders to sell their shares in case of a majority of acquisition or merger. Tag-Along rights allow minority stockholders to participate in the sale, while Drag-Along rights compel minority stockholders to sell alongside majority stockholders. 7. Transfer Restrictions: The agreement may include restrictions on stock transfers, such as requiring approval from the board of directors or imposing limitations on transfers to competitors. 8. Dispute Resolution: It lays out the procedures for resolving disputes between stockholders, including mediation, arbitration, or legal action in North Dakota courts. 9. Confidentiality and Non-Compete: The agreement may contain provisions outlining confidentiality obligations and restrictions on stockholders from engaging in competing businesses during their tenure and after leaving the company. 10. Termination and Amendment: The agreement defines the circumstances under which the agreement can be terminated or modified. It may require the consent of a specific percentage of stockholders to make amendments. It is important to note that the North Dakota Stockholders Agreement between America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. can have different variations or types based on the specific needs and circumstances of the companies involved. These variations may include specific provisions, additions, or exclusions to best address the goals and concerns of the stockholders and the companies.

North Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc.

Description

How to fill out Stockholders Agreement Between America Online, Inc., MQ Acquisition, Inc., And Mapquest.Com, Inc.?

Are you presently inside a place in which you need files for sometimes company or person purposes just about every working day? There are plenty of legitimate file themes accessible on the Internet, but getting types you can trust isn`t straightforward. US Legal Forms offers thousands of kind themes, much like the North Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc., which are written to satisfy state and federal demands.

If you are currently knowledgeable about US Legal Forms site and have an account, merely log in. Following that, it is possible to download the North Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc. template.

If you do not have an bank account and wish to start using US Legal Forms, abide by these steps:

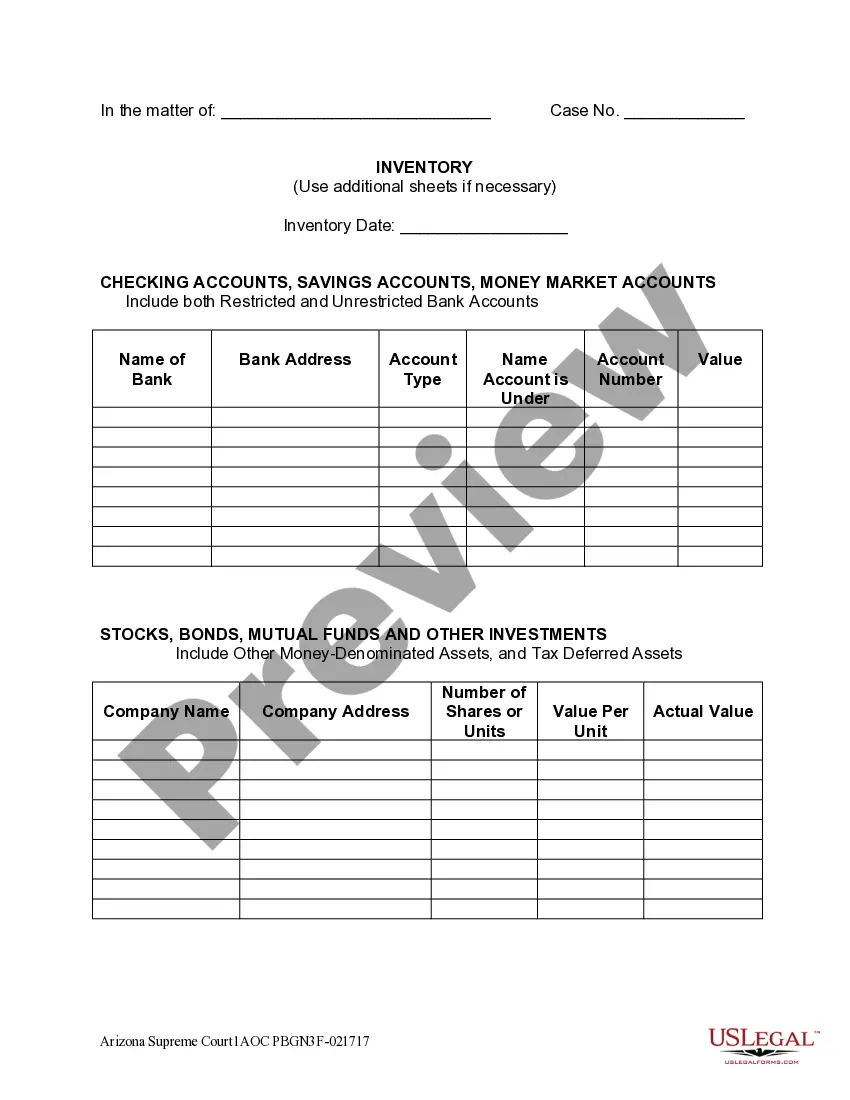

- Discover the kind you require and make sure it is for the correct area/county.

- Utilize the Preview option to review the form.

- Browse the explanation to actually have selected the right kind.

- In case the kind isn`t what you are looking for, utilize the Look for discipline to discover the kind that fits your needs and demands.

- When you find the correct kind, click Buy now.

- Opt for the rates plan you need, fill in the necessary details to produce your bank account, and purchase the order utilizing your PayPal or credit card.

- Decide on a convenient document format and download your copy.

Discover each of the file themes you may have purchased in the My Forms food selection. You can aquire a more copy of North Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc. anytime, if possible. Just select the necessary kind to download or produce the file template.

Use US Legal Forms, one of the most extensive variety of legitimate types, to conserve time as well as steer clear of faults. The service offers expertly made legitimate file themes that can be used for a range of purposes. Produce an account on US Legal Forms and begin creating your daily life easier.