North Dakota Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.

Description

How to fill out Underwriting Agreement Of ABFS Mortgage Loan Trust 1999-4 And Prudential Securities, Inc.?

US Legal Forms - one of many biggest libraries of lawful kinds in the United States - offers a wide range of lawful record templates you may download or print. Using the website, you can get 1000s of kinds for business and personal purposes, categorized by groups, claims, or keywords and phrases.You will discover the most up-to-date types of kinds just like the North Dakota Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. in seconds.

If you already possess a membership, log in and download North Dakota Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. in the US Legal Forms local library. The Acquire button can look on each kind you see. You get access to all earlier downloaded kinds within the My Forms tab of your own profile.

If you would like use US Legal Forms initially, allow me to share basic guidelines to help you started:

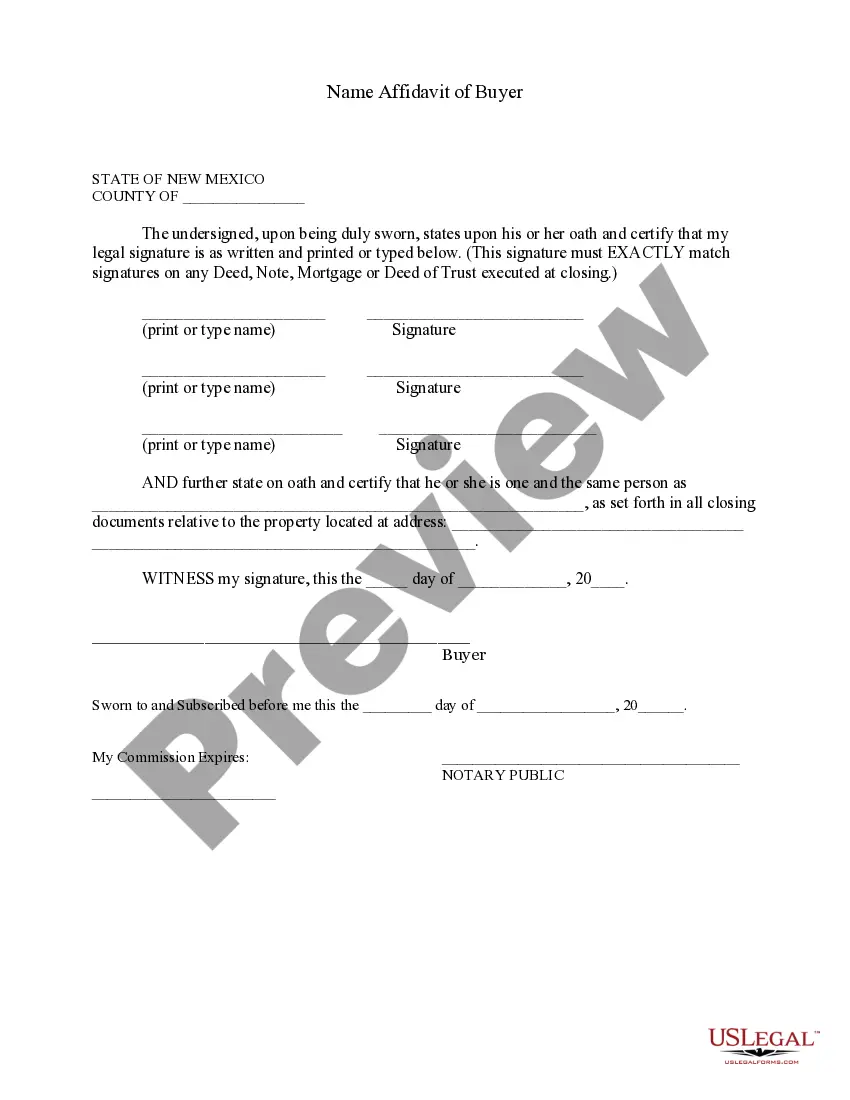

- Make sure you have chosen the proper kind for your town/state. Select the Review button to examine the form`s content. See the kind description to actually have chosen the correct kind.

- When the kind does not suit your specifications, utilize the Lookup area at the top of the display screen to discover the the one that does.

- If you are happy with the shape, verify your selection by simply clicking the Buy now button. Then, choose the rates program you prefer and provide your references to register for an profile.

- Procedure the purchase. Utilize your bank card or PayPal profile to complete the purchase.

- Find the formatting and download the shape in your product.

- Make alterations. Fill up, revise and print and sign the downloaded North Dakota Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc..

Every format you included in your account does not have an expiry time and is also yours for a long time. So, if you want to download or print another duplicate, just proceed to the My Forms area and click on in the kind you want.

Gain access to the North Dakota Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. with US Legal Forms, one of the most extensive local library of lawful record templates. Use 1000s of professional and state-certain templates that fulfill your business or personal demands and specifications.