North Dakota Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.

Description

How to fill out Plan Of Merger Between Ichargeit.Com, Inc. And Ichargeit.Com, Inc.?

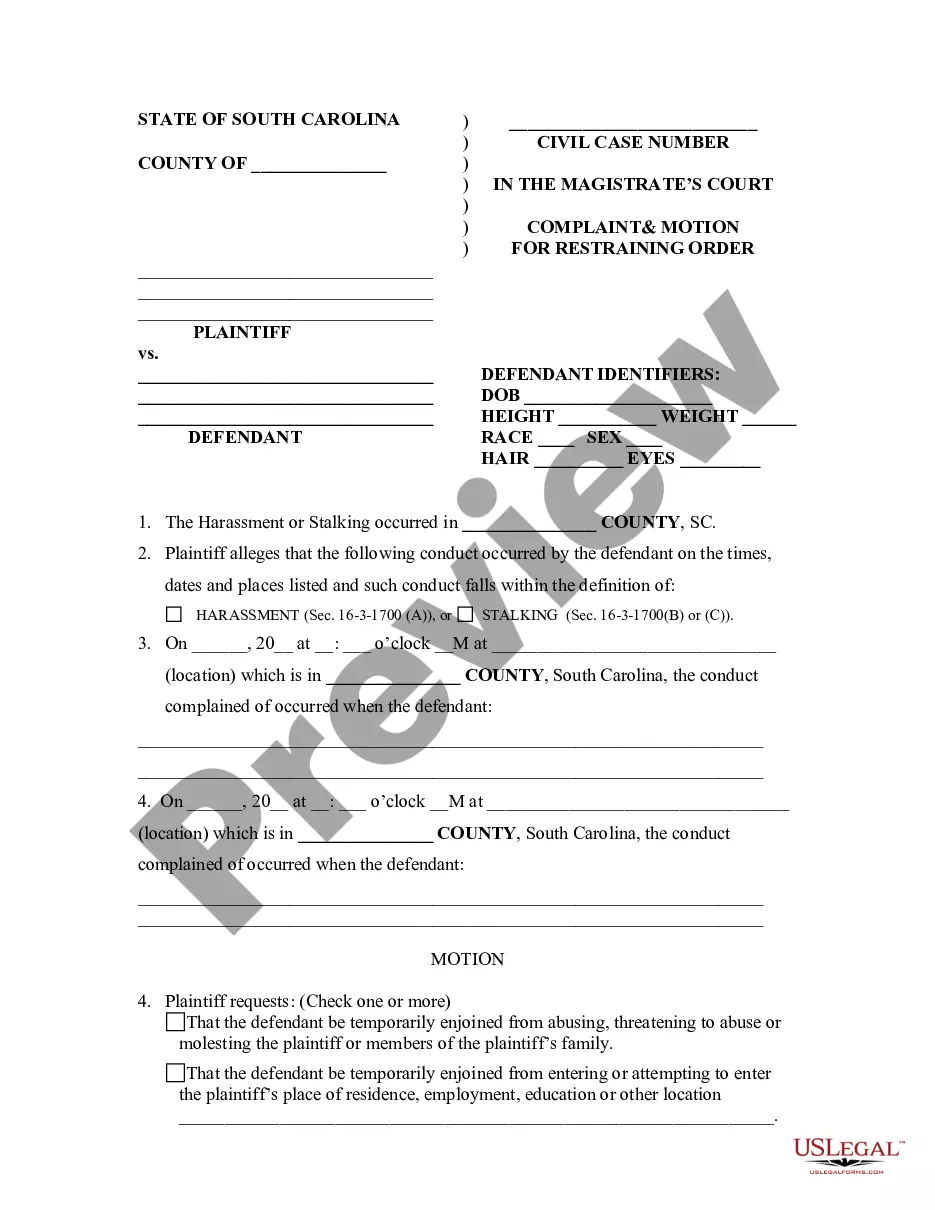

It is possible to invest hrs on the web searching for the authorized file template that fits the federal and state specifications you require. US Legal Forms gives thousands of authorized varieties that happen to be examined by specialists. You can easily acquire or produce the North Dakota Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. from the services.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Down load button. Following that, you are able to full, revise, produce, or indicator the North Dakota Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.. Every authorized file template you purchase is your own for a long time. To get yet another backup associated with a obtained form, proceed to the My Forms tab and then click the related button.

If you use the US Legal Forms site the very first time, follow the straightforward recommendations listed below:

- Initial, ensure that you have chosen the correct file template for that state/area that you pick. Look at the form explanation to make sure you have chosen the right form. If offered, make use of the Preview button to look through the file template too.

- If you wish to locate yet another edition in the form, make use of the Look for industry to find the template that meets your requirements and specifications.

- Once you have identified the template you desire, simply click Get now to continue.

- Pick the pricing program you desire, type your references, and register for a merchant account on US Legal Forms.

- Total the transaction. You can utilize your charge card or PayPal accounts to purchase the authorized form.

- Pick the file format in the file and acquire it to your gadget.

- Make modifications to your file if possible. It is possible to full, revise and indicator and produce North Dakota Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc..

Down load and produce thousands of file layouts while using US Legal Forms web site, which offers the most important collection of authorized varieties. Use expert and state-specific layouts to tackle your company or specific needs.

Form popularity

FAQ

The constituent corporations may merge into a single surviving corporation, which may be any 1 of the constituent corporations, or they may consolidate into a new resulting corporation formed by the consolidation, which may be a corporation of the jurisdiction of organization of any 1 of the constituent corporations, ...

Also known as a parent-subsidiary merger, a short-form merger is a merger between a parent company and its substantially (but not necessarily wholly) owned subsidiary, with either the parent company or the subsidiary surviving the merger.

The effective date of the merger; which must include the month, day and year. The date must be listed as either the date the document is received by the Division or a future date that is within 90 days of the file date.

The Seven-Step Process: Mergers & Acquisition Determine Growth Markets/Services: ... Identify Merger and Acquisition Candidates: ... Assess Strategic Financial Position and Fit: ... Make a Go/No-Go Decision: ... Conduct Valuation. ... Perform Due Diligence, Negotiate a Definitive Agreement, and Execute Transaction:

A Delaware LLC merger is a procedure of combining multiple LLCs to form one entity. It can be used for various reasons, including to simplify operations and consolidate assets or lower expenses.

What Is a Delaware Corporation? A Delaware corporation is a company that is legally registered in the state of Delaware but may conduct business in any state. Delaware first began to adapt its laws in the late 19th century, making changes that would attract businesses away from other states such as New York.