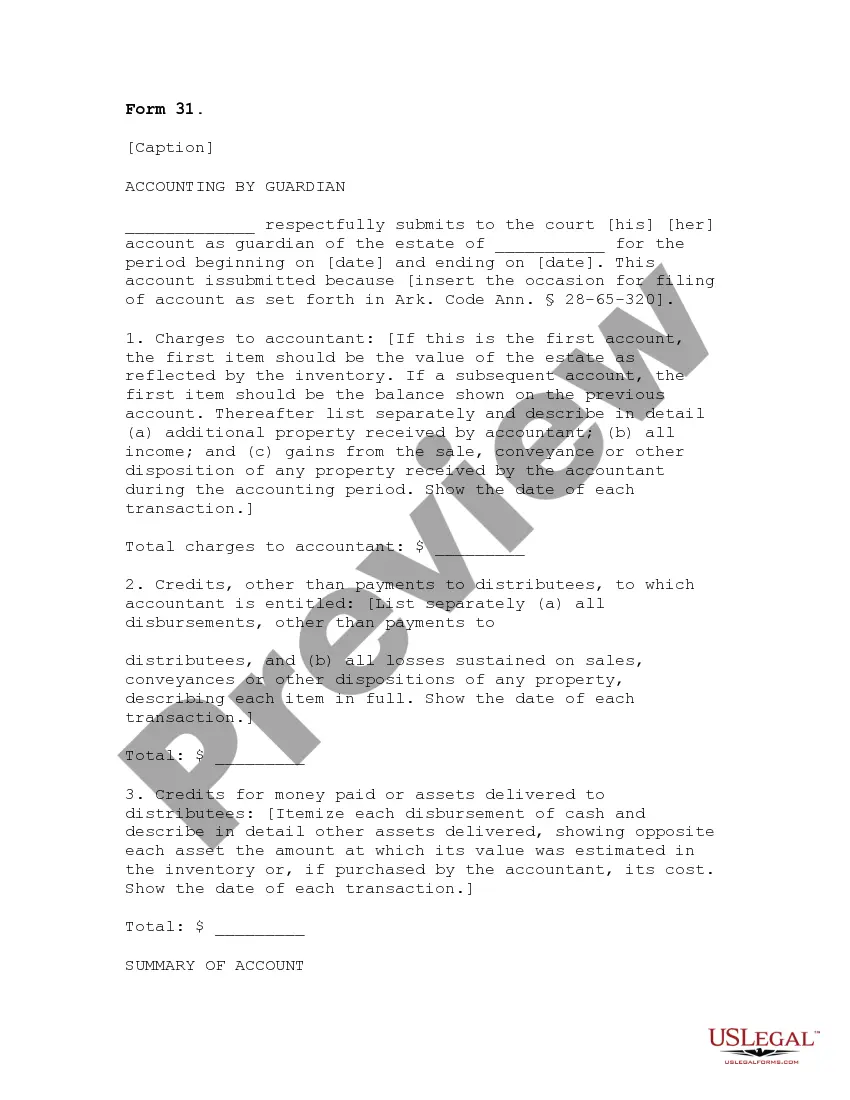

North Dakota Quick start Loan and Security Agreement is a legal document that outlines the terms and conditions of a loan agreement between Silicon Valley Bank (the lender) and print, Inc. (the borrower), based in North Dakota. This agreement is designed to facilitate financial support for print, Inc.'s business operations and growth. The loan agreement consists of several key provisions and conditions to ensure both parties' interests are protected. It establishes the loan amount, interest rate, repayment terms, and any collateral or security required by the lender. In North Dakota, there are different types of Quick start Loan and Security Agreements available between Silicon Valley Bank and print, Inc., tailored to meet specific financing needs: 1. Term Loan Agreement: This type of agreement provides a lump sum loan amount to print, Inc., which is repaid over a predetermined period, usually in regular installments. The interest rate and repayment period are defined within the agreement to ensure clarity for both parties. 2. Line of Credit Agreement: In this agreement, print, Inc. is granted access to a revolving line of credit, up to a maximum pre-approved amount. The borrower can withdraw funds as needed and repay them within an agreed timeframe. Interest is charged only on the amount utilized, providing flexibility for print, Inc. 3. Equipment Financing Agreement: This agreement focuses on financing print, Inc.'s equipment purchases or leasing arrangements. It outlines the loan amount specifically for acquiring equipment and defines the repayment schedule and interest rate associated with this loan. 4. Working Capital Agreement: print, Inc. can opt for a working capital loan agreement to address short-term operational expenses. This type of loan allows the borrower to cover day-to-day costs such as payroll, inventory, and marketing. The agreement sets the loan amount, repayment terms, and interest rate specifically for working capital needs. Throughout the loan agreement, both Silicon Valley Bank and print, Inc. should carefully review the terms and ensure all parties' commitments and obligations are clearly stated. This legally binding agreement protects the rights and responsibilities of both the lender and borrower, ensuring a mutually beneficial partnership in financing print, Inc.'s operations in North Dakota.

North Dakota Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.

Description

How to fill out North Dakota Quickstart Loan And Security Agreement Between Silicon Valley Bank And IPrint, Inc.?

You are able to invest time on the Internet trying to find the authorized record template that fits the state and federal requirements you need. US Legal Forms supplies 1000s of authorized varieties that happen to be examined by specialists. You can easily download or produce the North Dakota Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc. from the service.

If you have a US Legal Forms bank account, you are able to log in and then click the Acquire option. Following that, you are able to comprehensive, edit, produce, or sign the North Dakota Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc.. Every authorized record template you get is the one you have for a long time. To obtain yet another copy for any acquired kind, proceed to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms site the very first time, adhere to the straightforward guidelines under:

- Very first, make certain you have chosen the best record template for the county/metropolis that you pick. See the kind description to ensure you have picked out the right kind. If available, use the Preview option to appear through the record template also.

- If you want to find yet another variation in the kind, use the Lookup discipline to find the template that suits you and requirements.

- Once you have located the template you desire, just click Buy now to carry on.

- Choose the pricing program you desire, key in your references, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal bank account to fund the authorized kind.

- Choose the structure in the record and download it for your product.

- Make modifications for your record if necessary. You are able to comprehensive, edit and sign and produce North Dakota Quickstart Loan and Security Agreement between Silicon Valley Bank and iPrint, Inc..

Acquire and produce 1000s of record themes using the US Legal Forms Internet site, that offers the greatest selection of authorized varieties. Use specialist and status-distinct themes to tackle your small business or individual requirements.