The North Dakota Stock Option Agreement between Northern Bank of Commerce and Cowling Ban corporation is a legally binding contract that outlines the terms and conditions regarding the purchase and sale of stock options. This agreement specifically pertains to the relationship between these two entities in the state of North Dakota. A stock option agreement is a common financial instrument used by companies to incentivize employees or other parties involved in the organization. It grants the holder the right, but not the obligation, to purchase or sell a specific number of shares at a predetermined price within a specified period of time. In the case of the North Dakota Stock Option Agreement between Northern Bank of Commerce and Cowling Ban corporation, it can take various forms depending on the specific terms agreed upon. Some common types of stock option agreements under this arrangement may include: 1. Non-Qualified Stock Option (NO): This type of stock option agreement is usually granted to employees, consultants, or directors of the corporation, allowing them to purchase company shares at a specified price. The exercise price for Nests is typically higher than the current market price. 2. Incentive Stock Option (ISO): SOS are a type of stock option agreement that provides certain tax advantages to employees. They offer the opportunity to purchase company shares at a predetermined price, typically lower than the market value. To qualify for SOS, certain Internal Revenue Service (IRS) criteria must be met. 3. Restricted Stock Units (RSS): RSS are an alternative form of stock option agreement where the recipient is granted a unit that represents a specific number of shares in the company. Unlike traditional stock options, RSS do not grant the right to purchase shares; instead, they entitle the recipient to the actual shares at a future date. Each type of stock option agreement has its own unique features, including vesting schedules, exercise periods, and potential tax implications. The North Dakota Stock Option Agreement between Northern Bank of Commerce and Cowling Ban corporation would specify the type of stock options being granted, the terms of exercise, and any restrictions or conditions associated with the agreement. It is important for both parties involved in the stock option agreement to fully understand the terms and implications before entering into the arrangement. Seeking legal and financial advice is highly recommended ensuring compliance with relevant laws and to protect the rights and interests of all parties concerned.

North Dakota Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation

Description

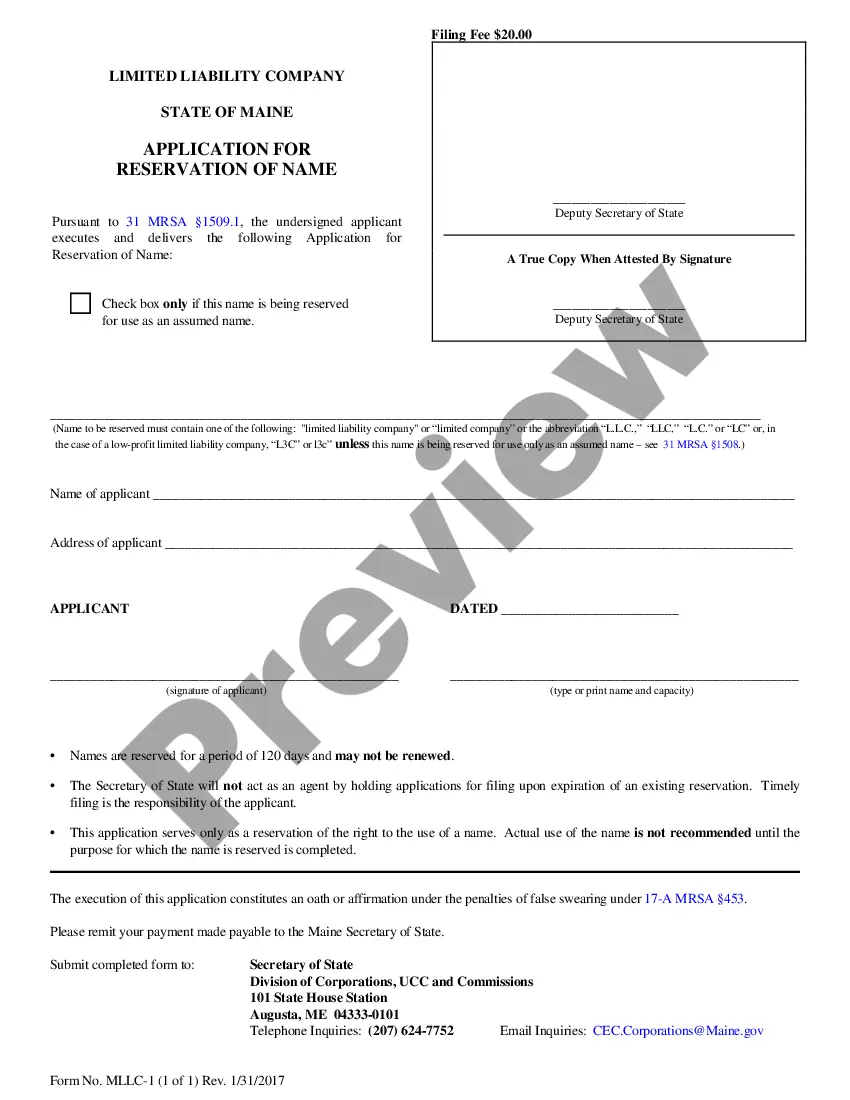

How to fill out North Dakota Stock Option Agreement Between Northern Bank Of Commerce And Cowlitz Bancorporation?

Choosing the best legal papers web template can be a have a problem. Obviously, there are a variety of web templates available on the net, but how will you get the legal type you want? Make use of the US Legal Forms internet site. The services gives thousands of web templates, including the North Dakota Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation, which you can use for business and personal requires. Every one of the varieties are examined by professionals and satisfy federal and state demands.

Should you be already listed, log in in your accounts and click the Acquire key to find the North Dakota Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation. Make use of your accounts to check through the legal varieties you may have acquired formerly. Check out the My Forms tab of your accounts and have yet another duplicate of your papers you want.

Should you be a new consumer of US Legal Forms, listed below are basic directions for you to stick to:

- Very first, make certain you have chosen the appropriate type for the town/region. You are able to look over the shape making use of the Review key and look at the shape information to make certain it is the best for you.

- If the type fails to satisfy your expectations, use the Seach discipline to get the appropriate type.

- Once you are sure that the shape is proper, click on the Acquire now key to find the type.

- Pick the rates program you need and enter in the needed information. Create your accounts and pay for your order utilizing your PayPal accounts or bank card.

- Choose the submit formatting and download the legal papers web template in your system.

- Comprehensive, revise and printing and signal the received North Dakota Stock Option Agreement between Northern Bank of Commerce and Cowlitz Bancorporation.

US Legal Forms is the greatest local library of legal varieties where you will find a variety of papers web templates. Make use of the service to download expertly-produced paperwork that stick to condition demands.