North Dakota Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services

Description

How to fill out Sub-Advisory Agreement Between Prudential Investments Fund Management, LLC And The Prudential Investment Corp. Regarding Provision Of Investment Advisory Services?

If you want to full, obtain, or printing authorized papers templates, use US Legal Forms, the biggest assortment of authorized types, which can be found on-line. Utilize the site`s simple and practical lookup to get the documents you need. Different templates for business and specific functions are categorized by types and claims, or search phrases. Use US Legal Forms to get the North Dakota Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services within a handful of mouse clicks.

Should you be currently a US Legal Forms consumer, log in to the accounts and then click the Down load key to have the North Dakota Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services. Also you can accessibility types you formerly saved from the My Forms tab of your own accounts.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have selected the shape for that proper town/nation.

- Step 2. Use the Review choice to look over the form`s articles. Never forget to read through the outline.

- Step 3. Should you be not satisfied with all the develop, use the Look for area near the top of the display screen to get other models of your authorized develop web template.

- Step 4. Once you have located the shape you need, go through the Purchase now key. Select the prices plan you like and add your accreditations to register for an accounts.

- Step 5. Process the transaction. You can utilize your bank card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the formatting of your authorized develop and obtain it on your device.

- Step 7. Complete, revise and printing or indication the North Dakota Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services.

Each and every authorized papers web template you purchase is your own permanently. You may have acces to each and every develop you saved within your acccount. Click on the My Forms area and select a develop to printing or obtain again.

Be competitive and obtain, and printing the North Dakota Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services with US Legal Forms. There are thousands of skilled and status-distinct types you can use for your personal business or specific needs.

Form popularity

FAQ

PRU boasts a sturdy balance sheet strength that includes highly liquid assets of $4.3 billion at the end of the third quarter and a capital position that continues to support an AA financial strength rating. The company continues to balance investments in the growth of businesses with returning capital to shareholders.

Best index funds to invest in SPDR S&P 500 ETF Trust. iShares Core S&P 500 ETF. Schwab S&P 500 Index Fund. Shelton NASDAQ-100 Index Direct. Invesco QQQ Trust ETF. Vanguard Russell 2000 ETF. Vanguard Total Stock Market ETF. SPDR Dow Jones Industrial Average ETF Trust.

Best-performing U.S. equity mutual funds TickerName5-year return (%)STSEXBlackRock Exchange BlackRock13.41%CORRXColumbia Contrarian Core Adv13.40%SRFMXSarofim Equity13.29%FGRTXFidelity® Mega Cap Stock13.28%3 more rows

The company's solid financial position provides it with the flexibility to execute its transformation and invest in the long-term growth of businesses. Prudential Financial has been increasing its dividend for the past 15 years. Its dividend yield of 6.4% compares favorably with the industry's figure of 2.9%.

The Prudential Investment Plan is an investment bond where you can invest your money in a range of different funds that aim to increase the value of your investment over the medium- to long-term, so 5 to 10 years or more.

The top performer was Pru Discretionary S3, a large-cap UK-biased strategy that made 84.9% and is managed by the former Prudential Portfolio Management Group, now M&G Treasury & Investment Office.

On the low-risk side of the spectrum, Prudential offers two funds, one passively managed (the Prudential Risk Managed Passive fund) and one active ? LF Prudential Risk Managed Active. Both have outperformed the average peer from the ABI Mixed Investment 0-35% Share sector and returned more than 23.6% since 2013.

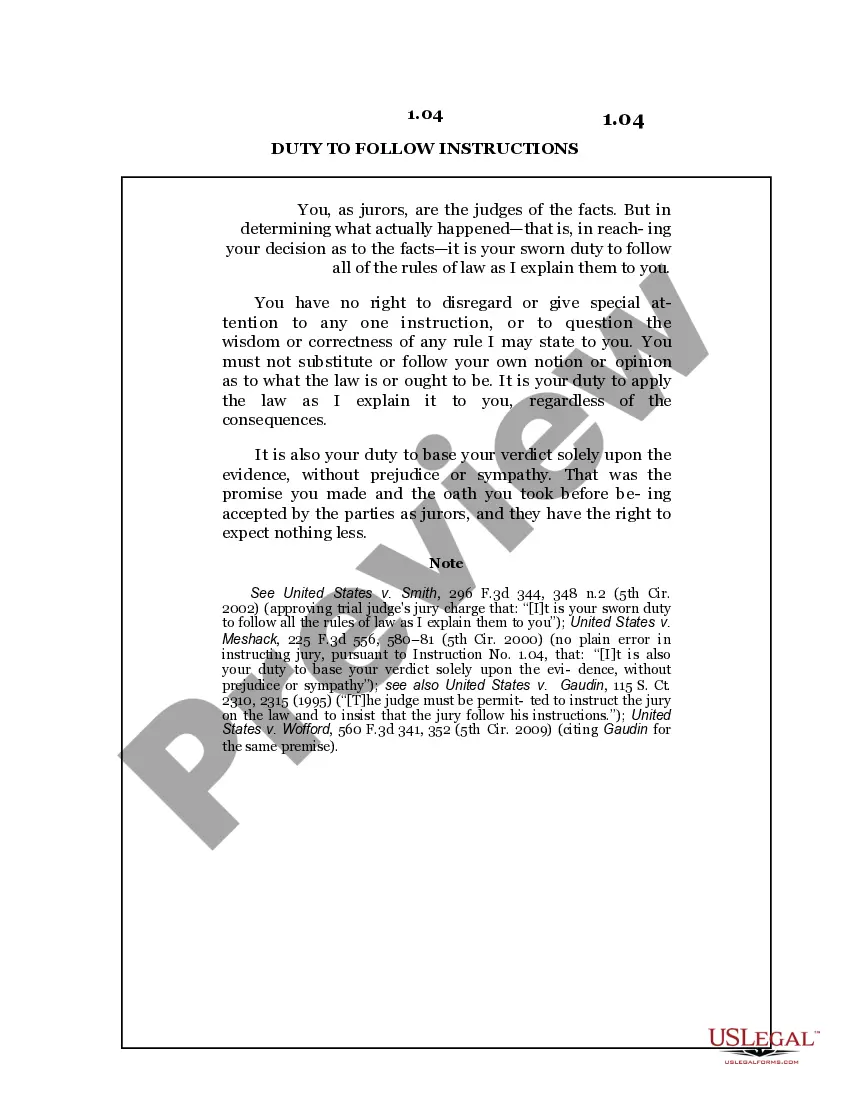

A subadvisory agreement is a legally binding agreement between a mutual fund and an advisor. These agreements outline the terms and conditions of the relationship between the fund and the advisor and what rights and responsibilities are expected of each party.