North Dakota Accredited Investor Certification is a specialized recognition that verifies an individual's eligibility to participate in certain investment opportunities that are only available to accredited investors. Accredited investors are individuals or entities that satisfy specific financial criteria, which makes them eligible for higher-risk investments with potentially higher returns. To become North Dakota Accredited Investor certified, individuals must meet certain requirements outlined by the North Dakota Securities Department. These requirements are designed to ensure that investors have sufficient financial knowledge and resources to bear the potential risks associated with certain investment opportunities. The North Dakota Accredited Investor Certification requires individuals to have a net worth exceeding $1 million, either individually or jointly with their spouse, excluding the value of their primary residence. Alternatively, individuals can qualify based on having an annual income of at least $200,000 for the previous two years, or $300,000 for joint income with their spouse, with an expectation of maintaining the same level of income in the current year. By obtaining the North Dakota Accredited Investor Certification, individuals gain access to certain private placements, venture capital investments, hedge funds, and other investment opportunities that are typically not available to non-accredited investors. This certification allows investors to diversify their portfolios, potentially benefiting from unique and high-growth investments that may not be available in traditional investment markets. It is essential to note that the North Dakota Accredited Investor Certification is valid only within the state of North Dakota. Other states may have their own criteria and certification processes for accredited investors. Hence, to participate in investment opportunities in other states, individuals may need to comply with their specific requirements. To ensure compliance with securities laws and regulations, it is crucial for individuals to maintain accurate records of their financial information and certifications. This includes maintaining detailed documentation of their net worth, tax returns, and any other financial statements required for proving eligibility as an accredited investor. In conclusion, the North Dakota Accredited Investor Certification enables individuals to engage in specialized investment opportunities that are generally not accessible to non-accredited investors. By meeting specific financial criteria, individuals can expand their investment portfolios and potentially access higher-risk investments with the expectation of higher returns. However, it is essential to understand that this certification is valid only within North Dakota, and individuals must comply with other states' requirements if they wish to invest in opportunities outside of North Dakota. Keywords: North Dakota, Accredited Investor Certification, investment opportunities, financial criteria, high-risk investments, potential returns, net worth, primary residence, annual income, private placements, venture capital investments, hedge funds, diversify portfolios, compliance, securities laws, regulations, eligibility, documentation, non-accredited investors, specialized investments.

North Dakota Accredited Investor Certification

Description

How to fill out North Dakota Accredited Investor Certification?

Finding the right legal document web template can be a have difficulties. Of course, there are plenty of themes available online, but how do you discover the legal form you need? Take advantage of the US Legal Forms internet site. The support offers 1000s of themes, including the North Dakota Accredited Investor Certification, which you can use for enterprise and personal needs. All the forms are checked by experts and meet state and federal needs.

If you are already signed up, log in for your profile and click the Acquire button to get the North Dakota Accredited Investor Certification. Make use of profile to appear with the legal forms you might have purchased previously. Check out the My Forms tab of your profile and have one more duplicate from the document you need.

If you are a fresh consumer of US Legal Forms, allow me to share basic recommendations so that you can stick to:

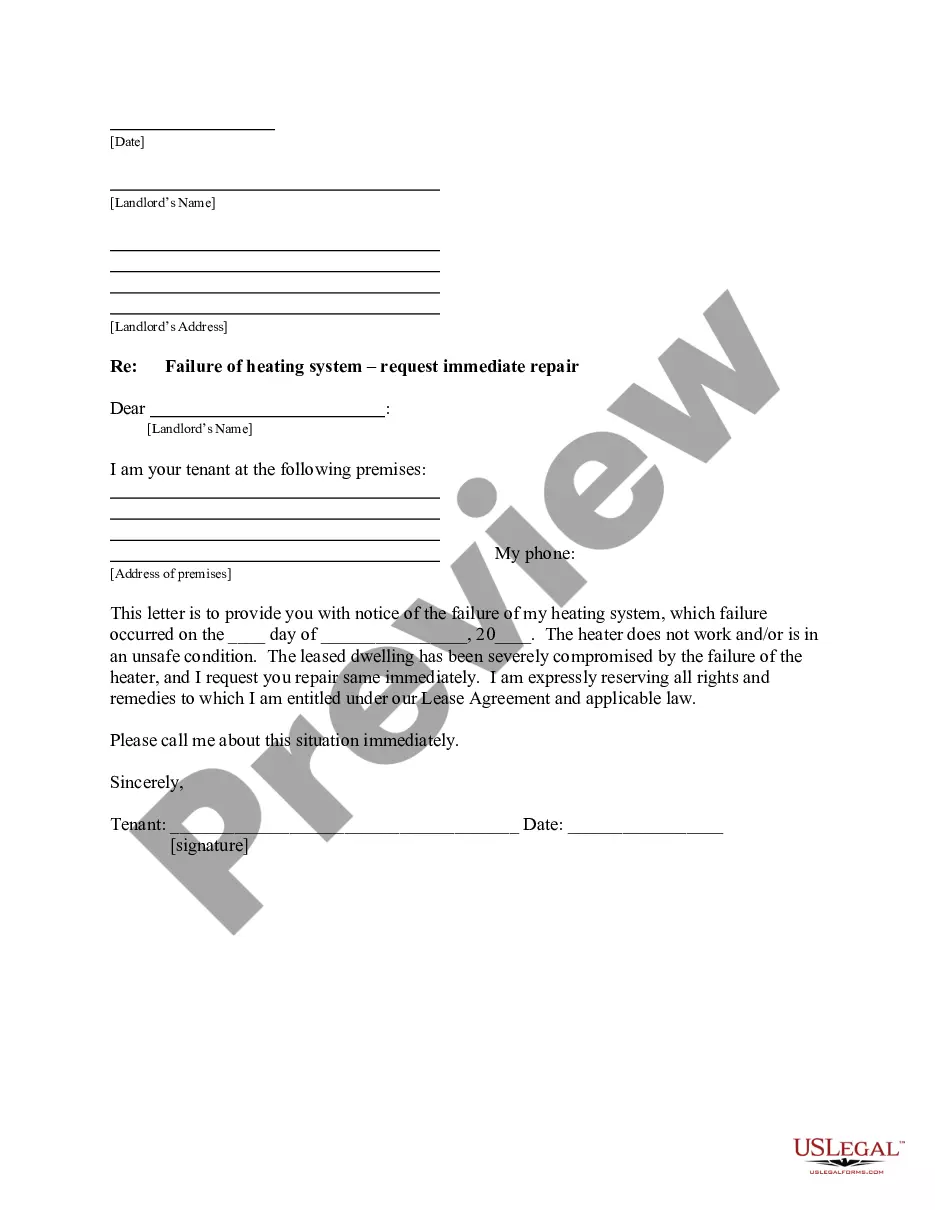

- Initially, make sure you have chosen the proper form for your area/region. You can examine the form while using Preview button and browse the form description to make sure this is basically the right one for you.

- In the event the form does not meet your expectations, utilize the Seach discipline to discover the correct form.

- When you are certain that the form would work, click the Buy now button to get the form.

- Choose the rates strategy you need and type in the needed info. Design your profile and buy your order utilizing your PayPal profile or charge card.

- Opt for the file structure and download the legal document web template for your device.

- Comprehensive, change and printing and indication the received North Dakota Accredited Investor Certification.

US Legal Forms may be the biggest library of legal forms where you will find a variety of document themes. Take advantage of the service to download skillfully-made files that stick to state needs.