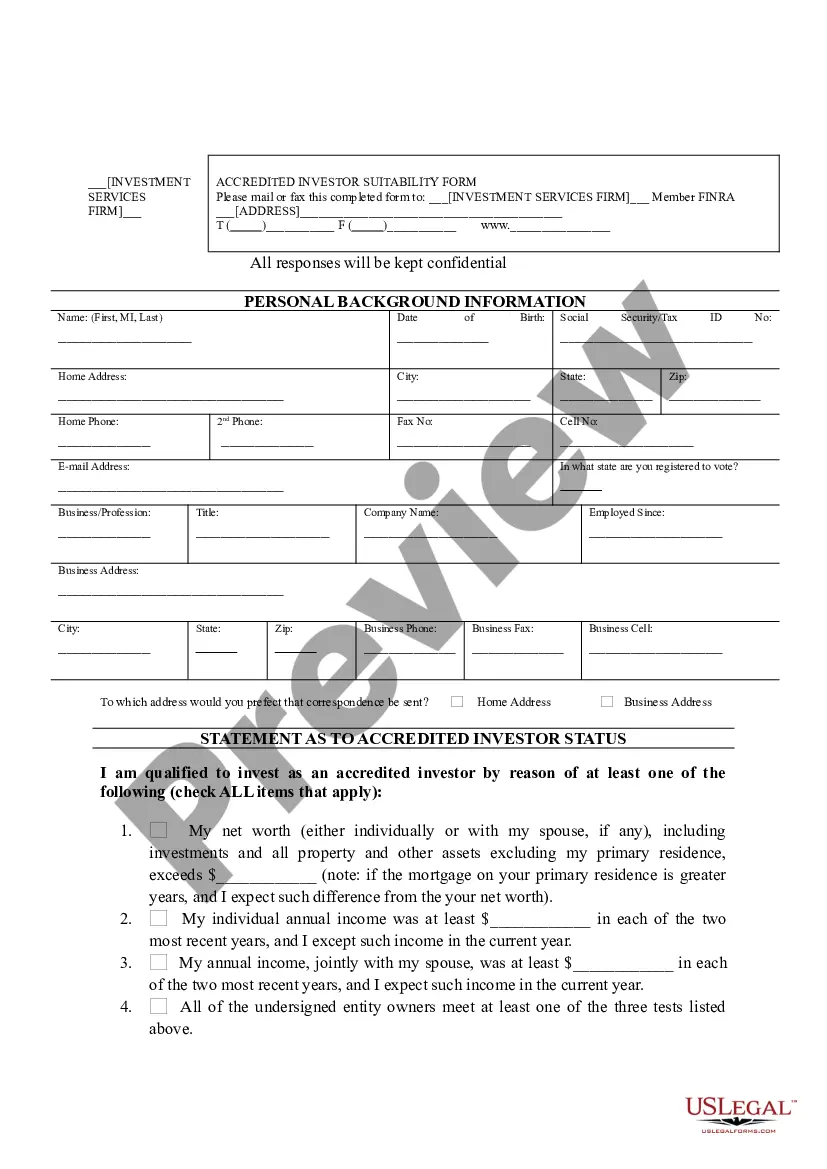

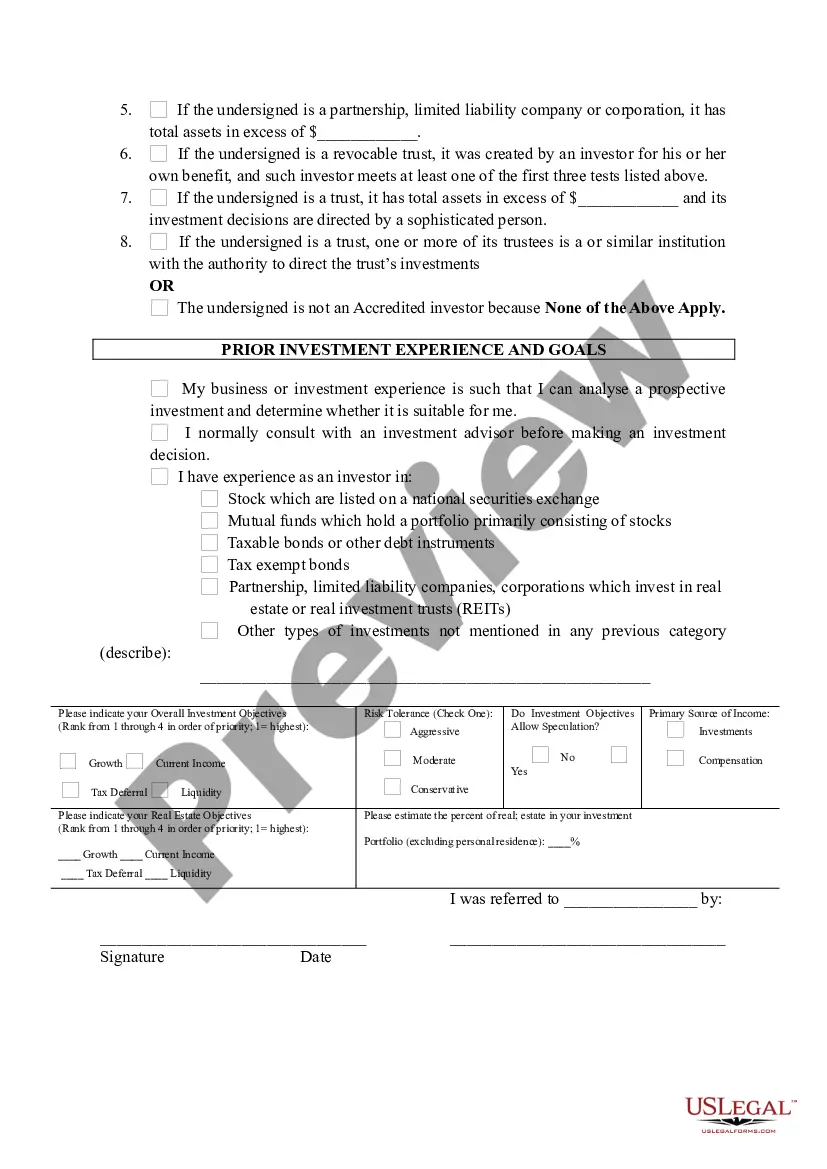

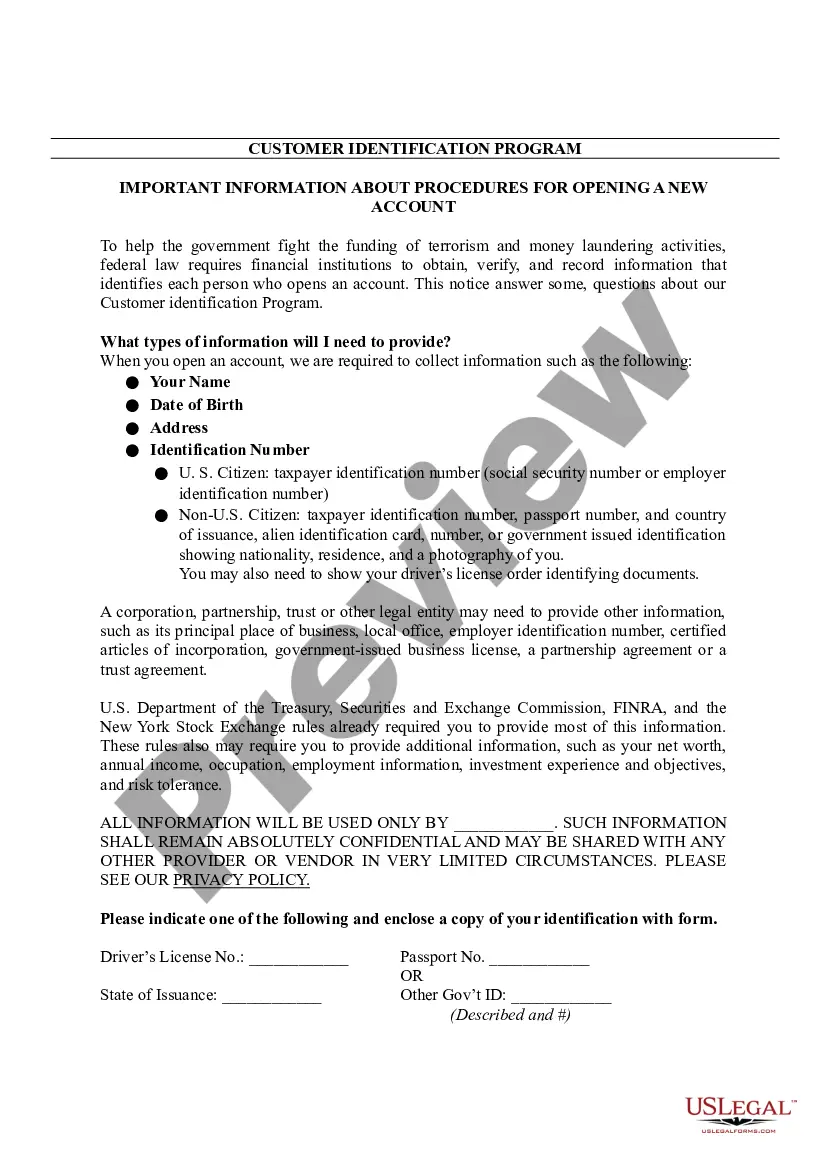

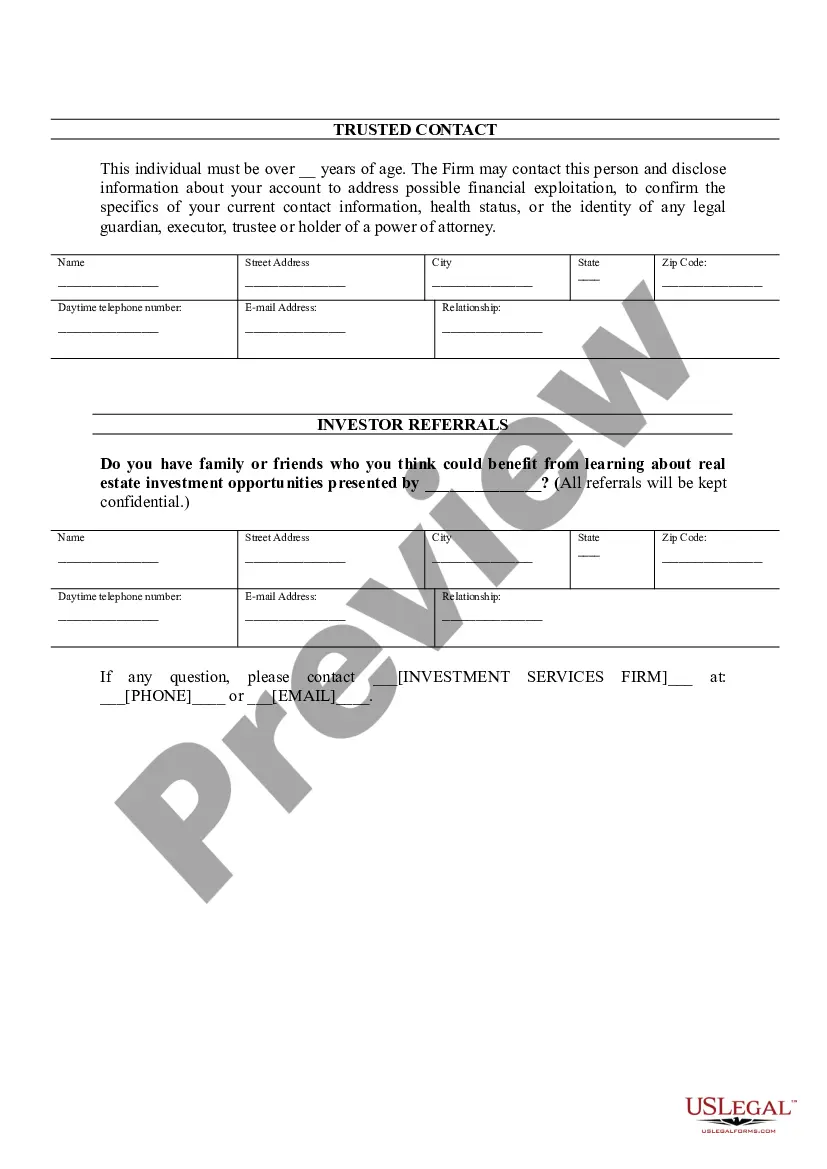

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

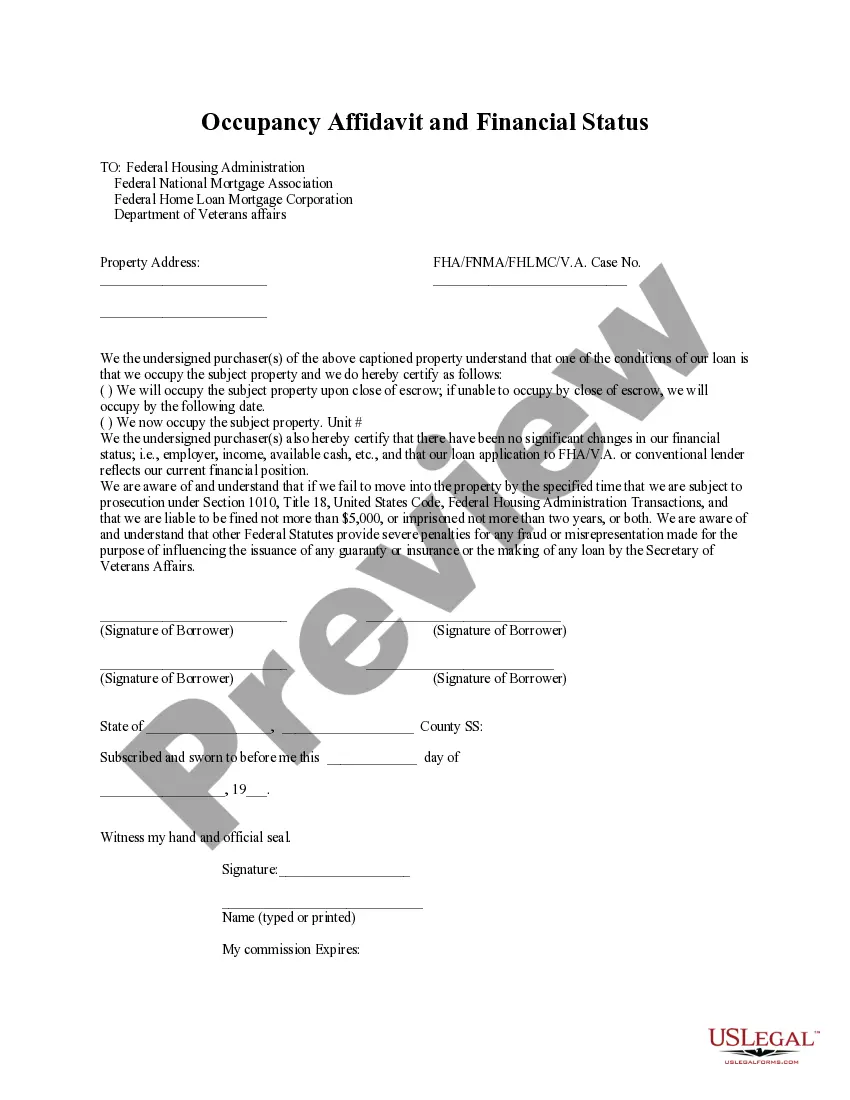

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

North Dakota Accredited Investor Suitability refers to the set of rules and regulations in North Dakota that determine who can qualify as an accredited investor and participate in certain investment opportunities. The term "accredited investor" pertains to individuals or entities who meet specific criteria related to their income, net worth, or professional experience. This designation grants them access to investment opportunities that may not be available to non-accredited investors. North Dakota has its own specific guidelines for determining accredited investor suitability, closely aligned with the standards set by the Securities and Exchange Commission (SEC). Individuals or entities must meet certain criteria to be considered accredited investors in North Dakota. These criteria include: 1. Income Requirements: An individual must have a certain level of income to qualify as an accredited investor. For example, they need to have an annual income exceeding a specific threshold, such as $200,000 for an individual or $300,000 for a married couple, for the past two years. 2. Net Worth Requirements: Individuals can also qualify as accredited investors if their net worth exceeds a certain threshold. North Dakota, in line with the SEC, considers individuals with a net worth of over $1 million as accredited investors. However, there are certain exclusions, such as the primary residence not being included in the net worth calculation. 3. Professional Experience: Certain professionals, such as executives, officers, or general partners of an issuer, can qualify as accredited investors due to their experience and expertise in managing investments. It is important to note that North Dakota Accredited Investor Suitability aligns with the SEC's definition of the accredited investor, ensuring consistency across multiple jurisdictions. This designation provides individuals and entities increased access to investment opportunities that may involve higher risks or are not publicly available. By meeting the criteria for North Dakota Accredited Investor Suitability, investors gain the opportunity to participate in various investment offerings, including private equity, venture capital funds, hedge funds, and other alternative investments. This designation allows them to diversify their portfolios and potentially access higher returns. Different types or categories of North Dakota Accredited Investor Suitability generally do not exist, as the state follows the SEC's definition. However, there may be variations in the specific requirements and thresholds within the broader accredited investor framework, depending on individual state regulations. North Dakota's specific rules ensure that investors within the state can participate in relevant investment opportunities while maintaining transparency and safeguarding against fraudulent activities.