North Dakota Letter of Transmittal

Description

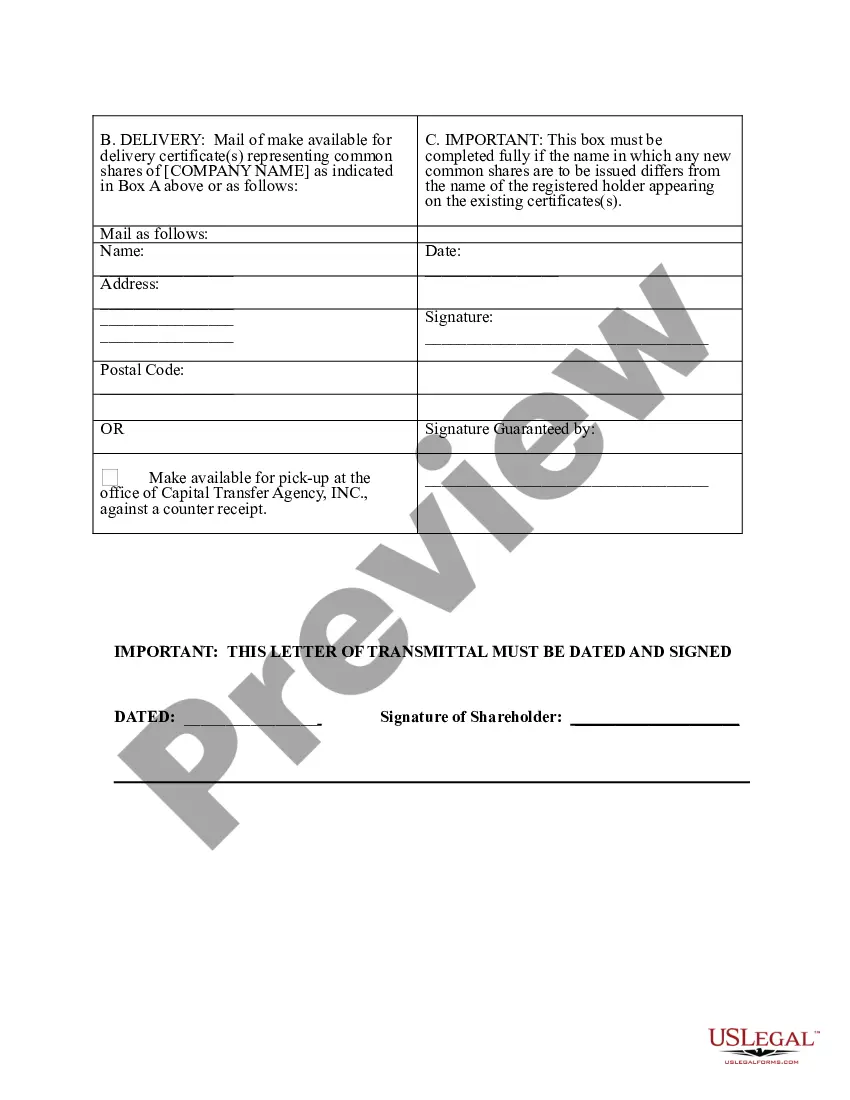

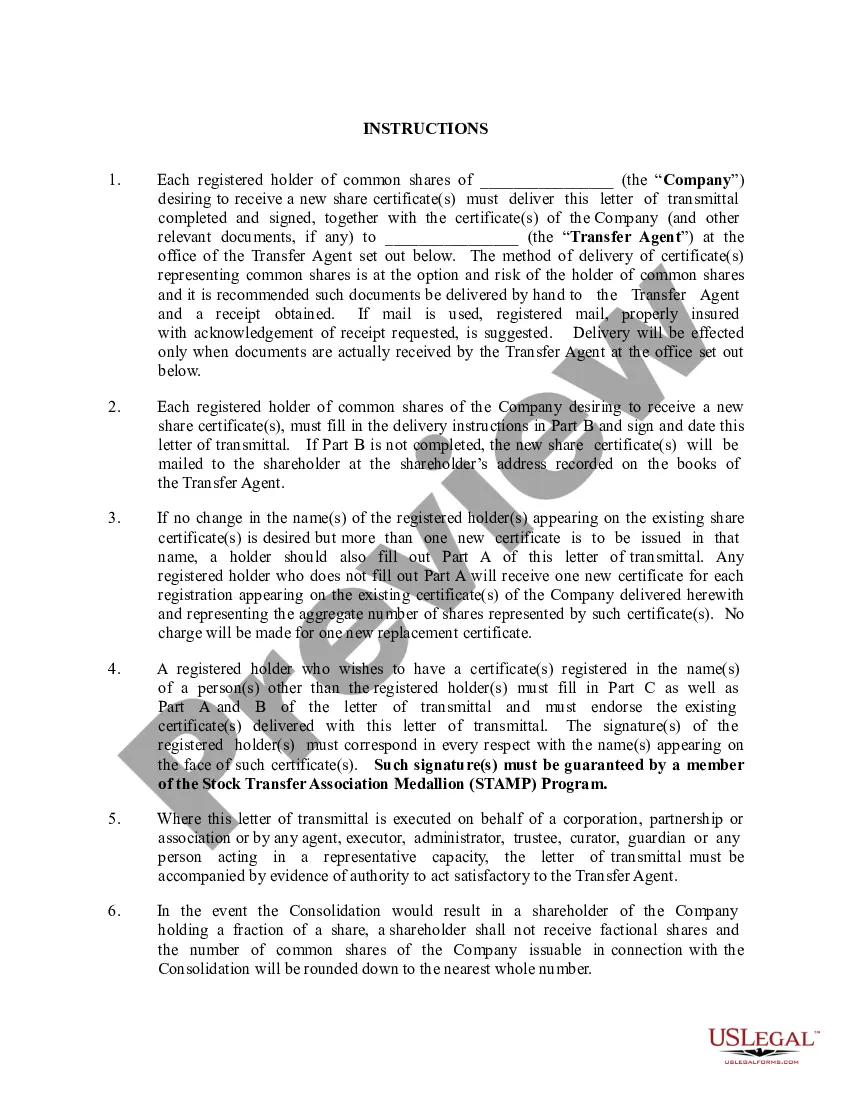

How to fill out Letter Of Transmittal?

Are you currently in the placement in which you need documents for both enterprise or individual reasons virtually every time? There are plenty of legitimate papers themes accessible on the Internet, but locating ones you can rely is not simple. US Legal Forms delivers 1000s of form themes, much like the North Dakota Letter of Transmittal, which can be composed to satisfy federal and state needs.

If you are previously acquainted with US Legal Forms internet site and possess a merchant account, merely log in. After that, you may acquire the North Dakota Letter of Transmittal web template.

Unless you provide an account and wish to start using US Legal Forms, adopt these measures:

- Find the form you will need and make sure it is for the appropriate metropolis/region.

- Use the Review button to examine the form.

- Read the information to ensure that you have chosen the right form.

- In case the form is not what you`re trying to find, use the Lookup area to get the form that meets your requirements and needs.

- When you get the appropriate form, click on Buy now.

- Pick the prices program you desire, fill in the specified info to produce your bank account, and pay money for an order utilizing your PayPal or charge card.

- Select a convenient file structure and acquire your backup.

Get all the papers themes you possess bought in the My Forms menus. You can get a additional backup of North Dakota Letter of Transmittal any time, if required. Just select the essential form to acquire or print the papers web template.

Use US Legal Forms, probably the most extensive variety of legitimate kinds, to conserve efforts and prevent faults. The service delivers professionally made legitimate papers themes which you can use for a variety of reasons. Create a merchant account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

North Dakota Transmittal Of Wage And Tax Statement. Form 307 - North Dakota Transmittal of Wage and Tax Statement nd.gov ? forms ? it-withholding nd.gov ? forms ? it-withholding PDF

North Dakota has a graduated individual income tax, with rates ranging from 1.10 percent to 2.90 percent. North Dakota also has a 1.41 percent to 4.31 percent corporate income tax rate.

Form 500 may be used by a taxpayer to do one of the following: Authorize the North Dakota Office of State Tax Commissioner to disclose the taxpayer's confidential tax information to another individual or firm not otherwise entitled to the information. Form 500 - Authorization To Disclose Tax Information & Designation Of ... nd.gov ? documents ? forms ? misc-forms nd.gov ? documents ? forms ? misc-forms

The North Dakota Office of State Tax Commissioner mandates the filing of Form 1099. If the payee is a resident or non-residence of North Dakota. In case the payee is a non-resident of North Dakota, Form 1099 should be filed only if the income is sourced in North Dakota. North Dakota 1099 filing requirements | ND Form 1099-NEC, MISC, INT ... taxbandits.com ? form-1099-series ? north-... taxbandits.com ? form-1099-series ? north-...

North Dakota Transmittal Of Wage And Tax Statement.

The Form 306, North Dakota Income Tax Withholding return must be filed by every employer, even if compensation was not paid during the period covered by this return. Form 306 and the tax due on it must be submitted electronically if the amount withheld during the previous calendar year was $1,000 or more.

If you elect to file and pay your Income Tax Withholding electronically, you must use the E-File Application to register for Withholding E-File (Form 301-EF). This form can be filled in on-line. Print and sign the application and mail to the address shown in the instructions.

Employers must electronically file Form 306 ? Income Tax Withholding Return and remit the amount of North Dakota income tax withheld if one of the following applies: The amount required to be withheld from wages paid during the previous calendar year is $1,000 or more. Income Tax Withholding in North Dakota nd.gov ? business ? income-tax-withh... nd.gov ? business ? income-tax-withh...

The North Dakota Voluntary Disclosure Program (Program) allows a taxpayer that has been conducting business activities in North Dakota or has been collecting but not remitting North Dakota sales tax to voluntarily come forward and resolve potential tax liabilities.