North Dakota Convertible Secured Promissory Note

Description

How to fill out Convertible Secured Promissory Note?

Discovering the right legal record design might be a have a problem. Obviously, there are tons of templates available on the Internet, but how would you discover the legal develop you require? Make use of the US Legal Forms web site. The services provides a huge number of templates, for example the North Dakota Convertible Secured Promissory Note, that can be used for business and private demands. All of the forms are inspected by experts and satisfy federal and state needs.

Should you be already signed up, log in to your bank account and then click the Acquire button to get the North Dakota Convertible Secured Promissory Note. Make use of your bank account to search with the legal forms you have bought previously. Go to the My Forms tab of your own bank account and obtain one more copy of your record you require.

Should you be a brand new user of US Legal Forms, allow me to share easy guidelines that you should adhere to:

- Initial, make certain you have chosen the right develop to your metropolis/area. You are able to examine the shape while using Review button and read the shape explanation to guarantee it will be the best for you.

- In the event the develop will not satisfy your preferences, take advantage of the Seach discipline to get the proper develop.

- When you are certain the shape is suitable, select the Acquire now button to get the develop.

- Opt for the costs strategy you need and enter the essential info. Design your bank account and purchase your order with your PayPal bank account or bank card.

- Choose the submit format and obtain the legal record design to your device.

- Full, change and print out and indication the received North Dakota Convertible Secured Promissory Note.

US Legal Forms will be the most significant library of legal forms in which you can discover numerous record templates. Make use of the company to obtain professionally-produced files that adhere to condition needs.

Form popularity

FAQ

Secured promissory notes have collateral behind them to secure the loan. Unsecured notes might have a personal guarantee but no valuable collateral, which carries a higher degree of risk of financial loss. Promissory notes are only as sound as the companies or projects there are financing.

One of the disadvantages of promissory notes for lenders is that they are more risky than traditional loans. If the borrower defaults on the note it could cause not only legal problems but also problems between friends or relatives if they are a party to the transaction.

There are two major types of promissory notes, secured and unsecured. Secured promissory notes have collateral behind them to secure the loan. Unsecured notes might have a personal guarantee but no valuable collateral, which carries a higher degree of risk of financial loss.

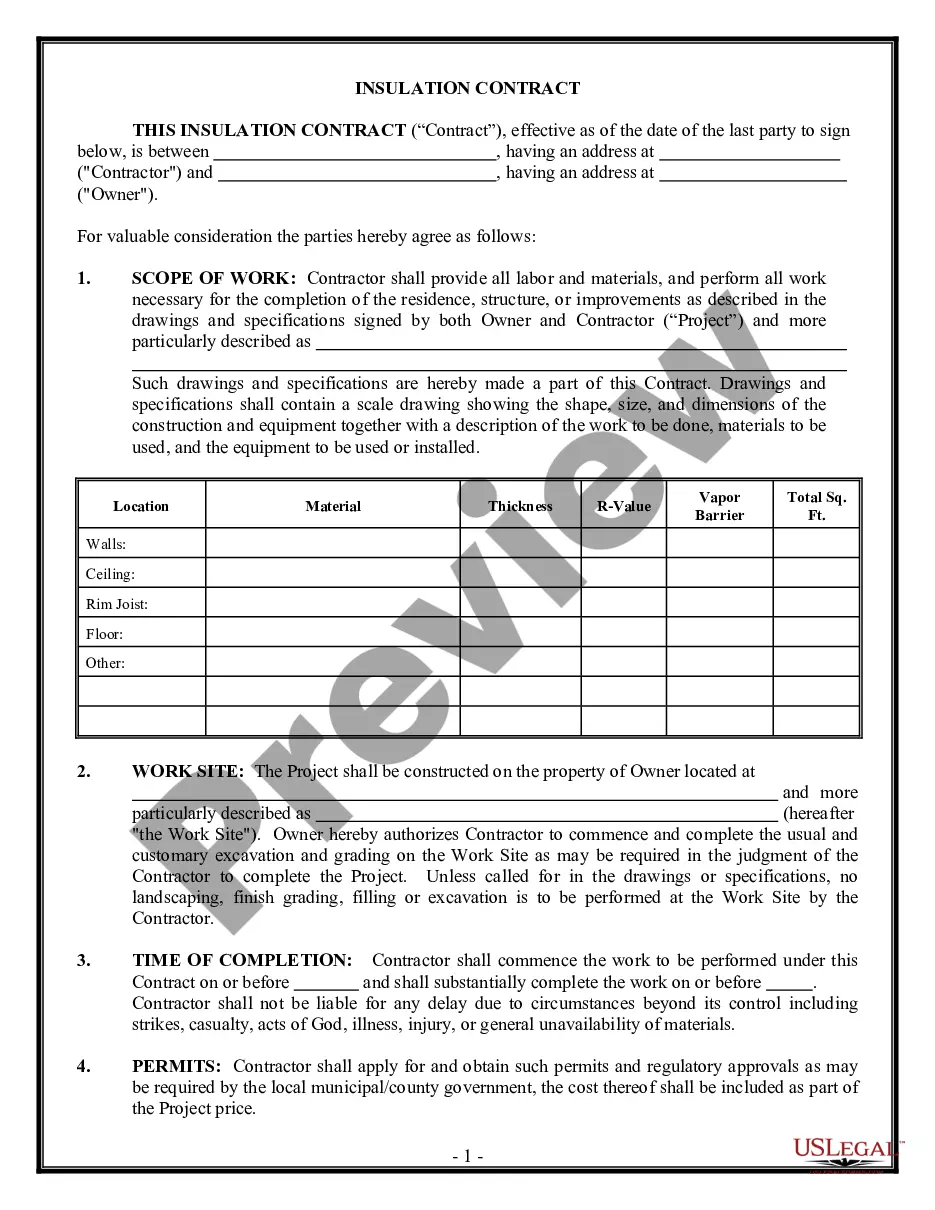

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved. However, its terms - which can include a specific date of repayment, interest rate and repayment schedule - are more certain than those of an IOU.

The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

What should be included in a Secured Promissory Note? The amount of the loan and how that money may be transferred. All parties involved and their contact information. ... Repayment schedule. ... Any interest on the loan. ... The details of the collateral.

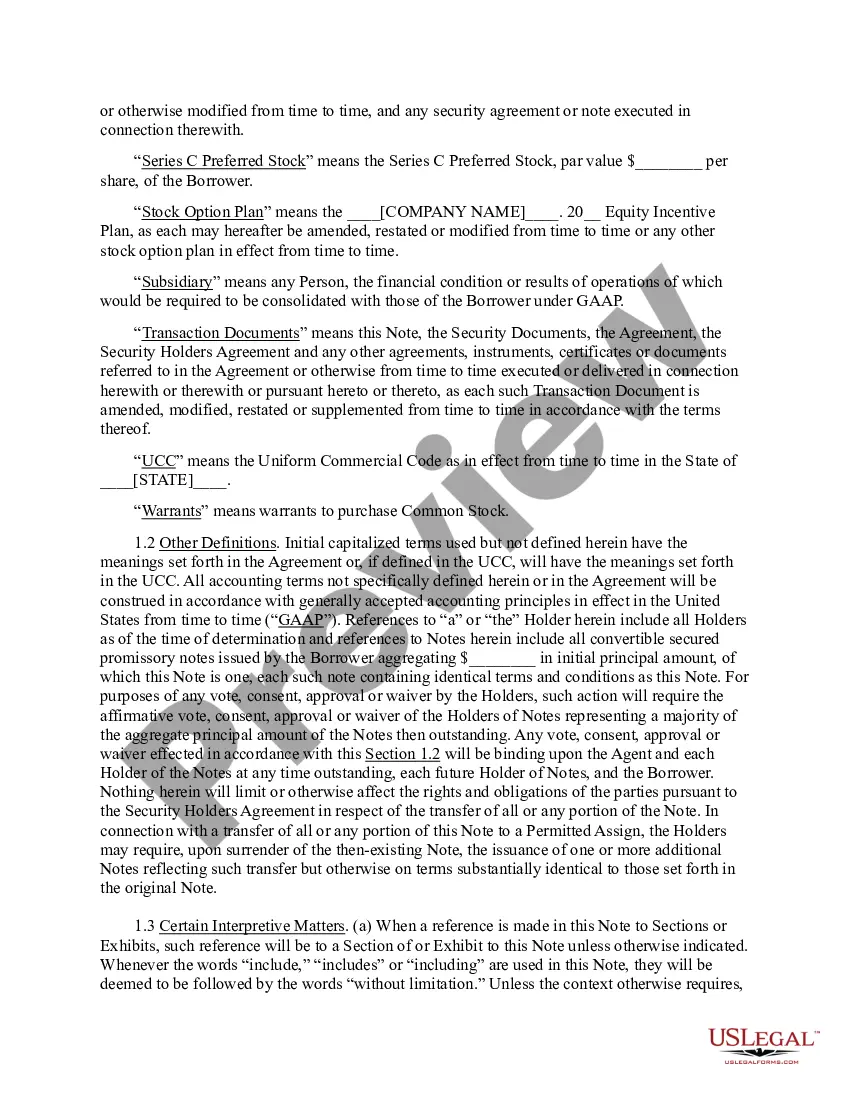

A secured convertible promissory note, or SCP for short, is a type of security instrument that gives the holder the right to convert their debt into equity in the issuer company. Typically, an SCP will convert at a discount to the market value of the company's shares at the time of conversion.