North Dakota Investment-Grade Bond Optional Redemption (without a Par Call) refers to a financial instrument issued by the state of North Dakota with a high credit rating, indicating a low risk of default. This particular type of bond offers investors the flexibility to redeem the bond at any time prior to maturity, without the need for a specified par call. These investment-grade bonds are highly sought after by conservative investors seeking a safe haven for their funds. The absence of a par call means that the bond can be redeemed at its current market value, which provides investors with the advantage of potentially capitalizing on favorable market conditions. There are several types of North Dakota Investment-Grade Bond Optional Redemption (without a Par Call), including: 1. General Obligation Bonds: These bonds are backed by the full faith and credit of the state of North Dakota and are issued to fund various public infrastructure projects, such as schools, roads, and utilities. Investors can enjoy interest payments at regular intervals until the maturity date, at which point the principal amount is repaid. 2. Revenue Bonds: These bonds are secured by the revenue generated from specific projects or facilities, such as toll roads, airports, or water/sewage treatment plants. The income generated from these projects ensures that the bondholders receive regular interest payments and eventual return of the principal. 3. Municipal Bonds: Another variant of North Dakota Investment-Grade Bond Optional Redemption (without a Par Call) is municipal bonds, which are issued by local government entities within the state. These bonds are backed by the entity's ability to collect taxes or user fees, with the interest payments and principal repayment funded through these revenues. Investors interested in these investment-grade bonds should consider factors such as the bond's credit rating, maturity date, interest rate, and potential tax advantages. As with any investment, it is crucial to conduct thorough research and consult with financial professionals before making any decisions. Keywords: North Dakota, Investment-Grade Bond, Optional Redemption, Par Call, General Obligation Bonds, Revenue Bonds, Municipal Bonds.

North Dakota Investment - Grade Bond Optional Redemption (without a Par Call)

Description

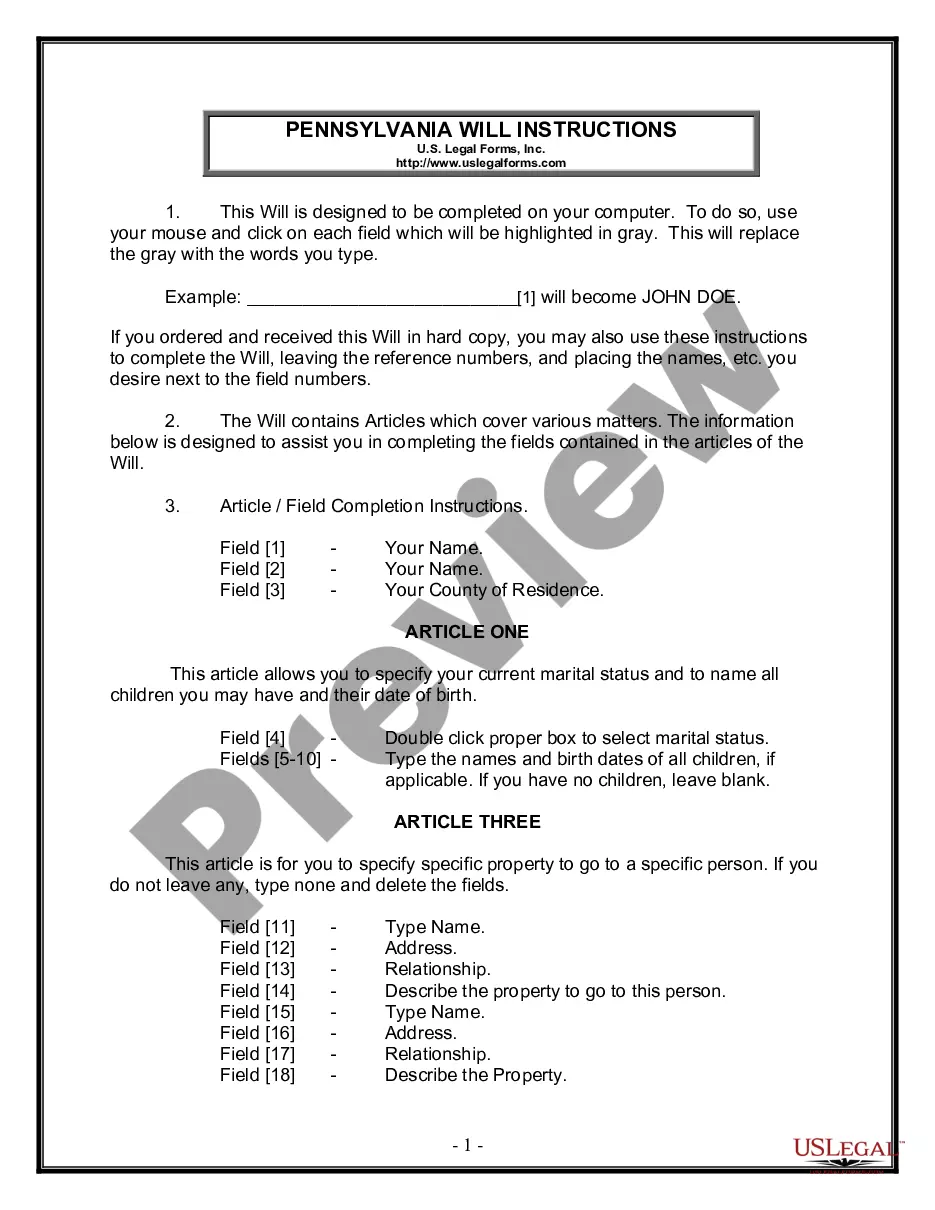

How to fill out North Dakota Investment - Grade Bond Optional Redemption (without A Par Call)?

US Legal Forms - one of many most significant libraries of lawful kinds in America - provides a wide array of lawful papers themes it is possible to acquire or print. Utilizing the site, you will get a large number of kinds for organization and specific functions, categorized by groups, states, or keywords and phrases.You can find the most up-to-date types of kinds such as the North Dakota Investment - Grade Bond Optional Redemption (without a Par Call) in seconds.

If you already have a membership, log in and acquire North Dakota Investment - Grade Bond Optional Redemption (without a Par Call) through the US Legal Forms library. The Obtain option will show up on each and every develop you perspective. You gain access to all previously acquired kinds inside the My Forms tab of your accounts.

If you want to use US Legal Forms the first time, listed below are straightforward directions to obtain started off:

- Be sure to have chosen the proper develop for your city/state. Select the Preview option to analyze the form`s information. Read the develop description to ensure that you have selected the proper develop.

- When the develop does not satisfy your specifications, use the Research area towards the top of the monitor to get the the one that does.

- When you are pleased with the form, verify your choice by simply clicking the Get now option. Then, pick the pricing strategy you want and supply your qualifications to register on an accounts.

- Method the transaction. Use your credit card or PayPal accounts to accomplish the transaction.

- Pick the structure and acquire the form in your product.

- Make modifications. Complete, modify and print and indication the acquired North Dakota Investment - Grade Bond Optional Redemption (without a Par Call).

Each and every template you included with your money lacks an expiration day and it is yours for a long time. So, in order to acquire or print another backup, just check out the My Forms segment and click about the develop you require.

Gain access to the North Dakota Investment - Grade Bond Optional Redemption (without a Par Call) with US Legal Forms, by far the most substantial library of lawful papers themes. Use a large number of skilled and express-particular themes that fulfill your small business or specific demands and specifications.

Form popularity

FAQ

An optional redemption provision allows the issuer to call all or a portion of outstanding bonds on or after a specified date at a specified redemption price plus interest to the redemption date. Refundings and Redemption Provisions - MSRB msrb.org ? sites ? default ? files ? Refundin... msrb.org ? sites ? default ? files ? Refundin...

A bond redemption is the full repayment of the principal amount (the amount you invested) and any interest owed to date. What is bond redemption? - Help Centre - Crowdcube crowdcube.com ? en-us ? articles ? 3600006... crowdcube.com ? en-us ? articles ? 3600006...

Optional Redemption On or after the Par Call Date, the Company may redeem the notes, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount of the notes being redeemed plus accrued and unpaid interest thereon to the redemption date. SIFMA Model Provision?Investment-Grade Bond Optional ... shearman.com ? files ? 2021/11 ? s... shearman.com ? files ? 2021/11 ? s... PDF

Bond Redemption Date means, with respect to any Bond, the date on which such Bond is redeemed pursuant to the applicable Bond Documents. Bond Redemption Date means any date, other than an Interest Payment Date, upon which Bonds shall be redeemed pursuant to the Indenture. Bond Redemption Date Definition | Law Insider lawinsider.com ? dictionary ? bond-redempt... lawinsider.com ? dictionary ? bond-redempt...

Bond redemption is the process by which a bond issuer repays the principal amount of a bond to the bondholder on the bond's maturity date. When a bond is issued, it has a specified term or maturity date, which is the date when the bond issuer is obligated to pay back the principal amount of the bond to the bondholder. Bond Redemption and Types of Bond Redemption | IndiaBonds indiabonds.com ? news-and-insight ? bond-... indiabonds.com ? news-and-insight ? bond-...