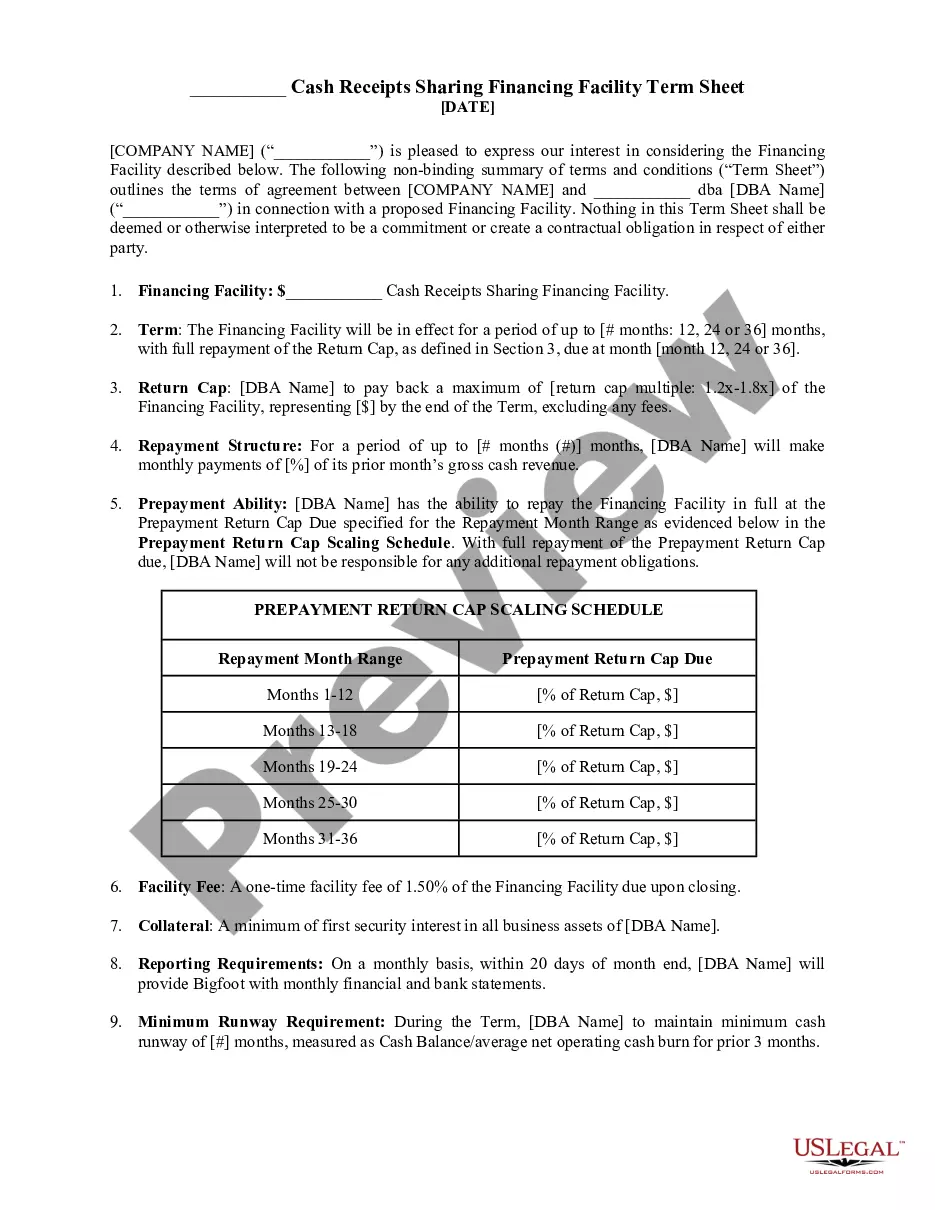

North Dakota Cash Receipts Sharing Financing Facility Term Sheet

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth."

How to fill out Cash Receipts Sharing Financing Facility Term Sheet?

You are able to commit hours on the Internet attempting to find the authorized record format that suits the federal and state needs you want. US Legal Forms offers thousands of authorized varieties which can be reviewed by professionals. You can easily acquire or print the North Dakota Cash Receipts Sharing Financing Facility Term Sheet from your service.

If you have a US Legal Forms accounts, you may log in and then click the Acquire switch. Afterward, you may total, change, print, or indication the North Dakota Cash Receipts Sharing Financing Facility Term Sheet. Every single authorized record format you acquire is the one you have for a long time. To have an additional backup of any bought type, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms web site the very first time, adhere to the easy guidelines under:

- Very first, make certain you have selected the right record format to the area/city of your choosing. See the type outline to ensure you have selected the proper type. If available, make use of the Preview switch to check from the record format also.

- If you want to locate an additional variation in the type, make use of the Research field to get the format that meets your requirements and needs.

- Once you have found the format you want, click on Acquire now to continue.

- Select the prices plan you want, key in your qualifications, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You should use your bank card or PayPal accounts to fund the authorized type.

- Select the file format in the record and acquire it to your gadget.

- Make modifications to your record if possible. You are able to total, change and indication and print North Dakota Cash Receipts Sharing Financing Facility Term Sheet.

Acquire and print thousands of record layouts utilizing the US Legal Forms website, that offers the most important collection of authorized varieties. Use professional and status-distinct layouts to deal with your small business or individual needs.